Antero Resources (AR)

LNG export play. Generating cash, paying down debt, rewarding shareholders. 20% FCF Yield.

Foreword

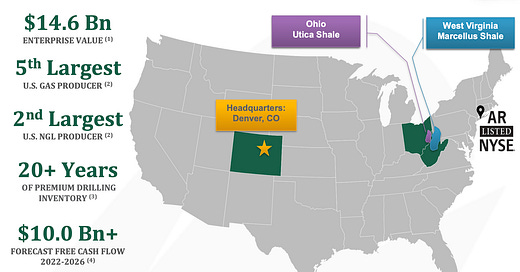

Antero Resources is an energy producer based in Denver, Colorado. It is the 5th biggest natural gas and 2nd largest NGL (natural gas liquids) producer in the U.S. The company is trading on the NYSE and is currently selling for a 2022E, 20% FCF yield to EV (Enterprise Value).

The company is a shale gas producer. Shale gas is natural gas that is trapped in shale formations. In order to extract this gas a non-conventional type of drilling is required, called hydraulic fracturing (or fracking). Read more about fracking and its risks and concerns here.

The company is selling for $9.4 billion, and has debt outstanding of ~$1.6 billion.

What happened?

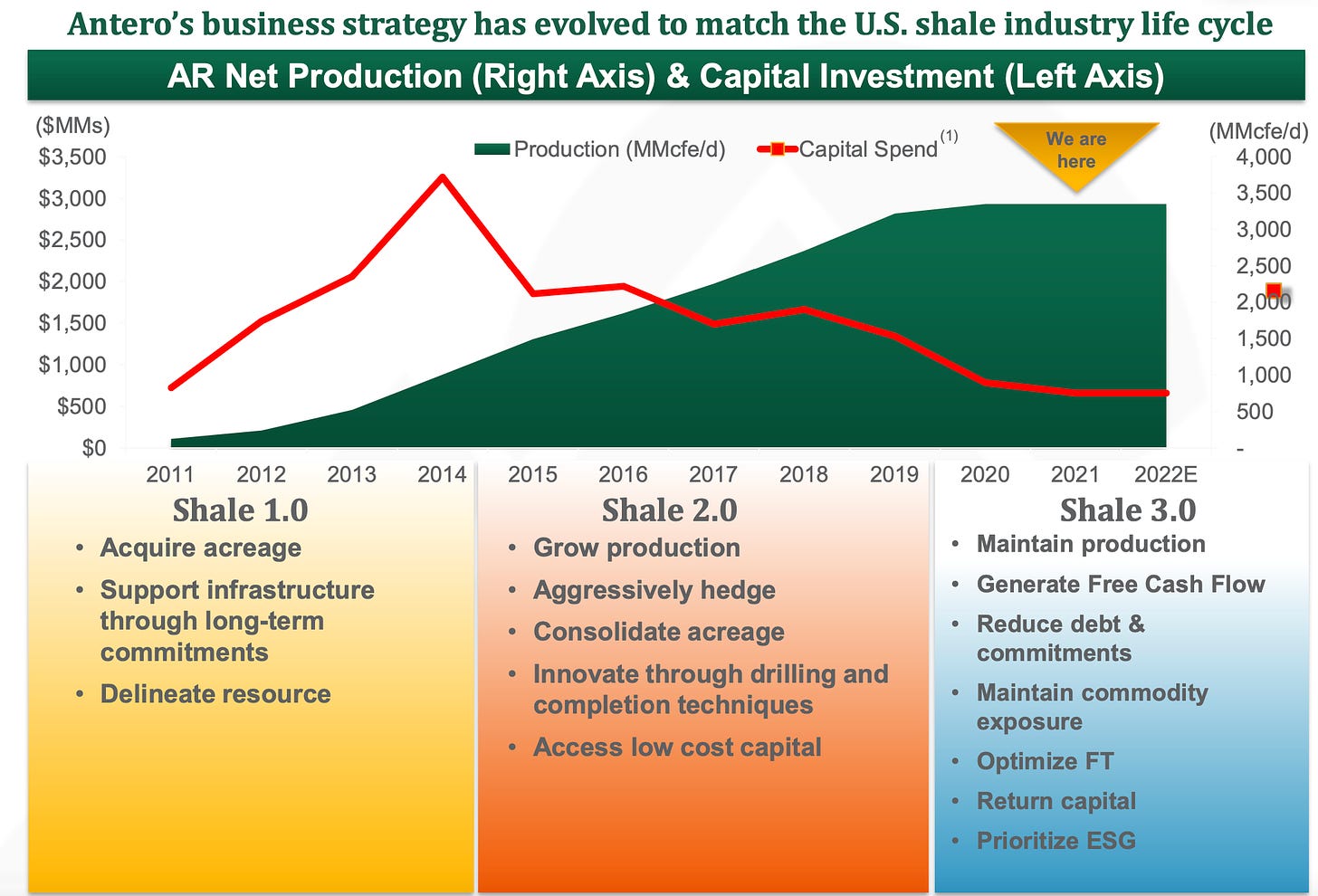

The shale industry in the U.S has gone through difficult times, resulting in considerable business volatility and bankruptcies across the board. The slide below from the AR presentation tells the story.

Shale industry capital spend ramped up massively in the early 2010s until 2014 where producers were forced to aggressively cut back on spending. That was a consequence of the sliding prices in energy commodities, caused by price competition from Saudi Arabia and OPEC.

Saudi Arabia should not be underestimated. They started a price war in 2014 that drove oil prices into the $20s. No other single entity could have done that. The strategy temporarily stalled U.S. oil production, and although they did bankrupt a few shale oil producers, the industry proved resilient. So Saudi Arabia switched back to cutting production to prop up prices in 2016, and until recently they had maintained that strategy.

How did OPEC price production affect energy prices?

From peak 2014 to trough 2016:

Henry Hub (Natural Gas) futures slid from $5 to $1.5 / MMBTu, a 70% drop.

WTI Crude Oil slid from above $100 to ~$30, a 70% drop.

We can see from the chart above how cash flows and capital expenditure both tanked, putting a lot of stress on the industry. The ones with the lowest staying power filed for bankruptcy as their heavy debt loads proved unsustainable in the face of tanking prices. But this stress transformed the industry, setting the stage for the recovery we are experiencing now - aided of course by high energy prices.