Reading Time: 12 minutes

Since the attempted shooting of DJT, talks of the Trump Trade have been re-invigorated. Markets now predict a Trump Presidency as all but certain.

I agree that the Donald will be elected too, but I don’t blindly believe in linear ways of predicting markets in the manner of:

“What happened last time DJT was president?”

And then deducing from that the things that are bound to happen again…If you want an edge from markets, you need a big picture way of looking at things.

I mapped out the main processes I think are shaping the market setup — and I uncovered two main boom/bust processes.

—» The Techno-AI cycle

—» Biden’s Techno-Imperial Cycle (or Techno-Expansion Cycle)

Let’s start with the Techno-AI Cycle…

The Techno-AI Cycle

It’s no secret that the US and its Big Tech companies dominate the global technology markets, the US was always on the cusp of this trade. The Chinese know this and have been trying to close the gap, either by trying to catch up or by closing up their own markets to US competition.

For example, Google isn’t allowed in China and so Baidu is the leader in search.

US dominance in internet and technology has been a great boon for the economy for more than two decades now — allowing US equity markets to not only over-perform but also consistently attract foreign capital.

Rising equity prices propelled US household wealth, boosting purchase power and resulting in wealth effects.

This accelerated post-Covid…

While the rest of the world was reeling from Covid lockdowns and fears of a steeper economic recession, the US economy was benefiting from massive stimulus.

On March 27th 2020, Trump signed the biggest stimulus package in US history — $2 trillion. The super fast response from the US was the reason US equities bounced back fast and strong.

Confidence in the US economy was reinforced and the S&P 500 is now 150% higher than the Covid bottom of March 2020.

Biden is inaugurated…

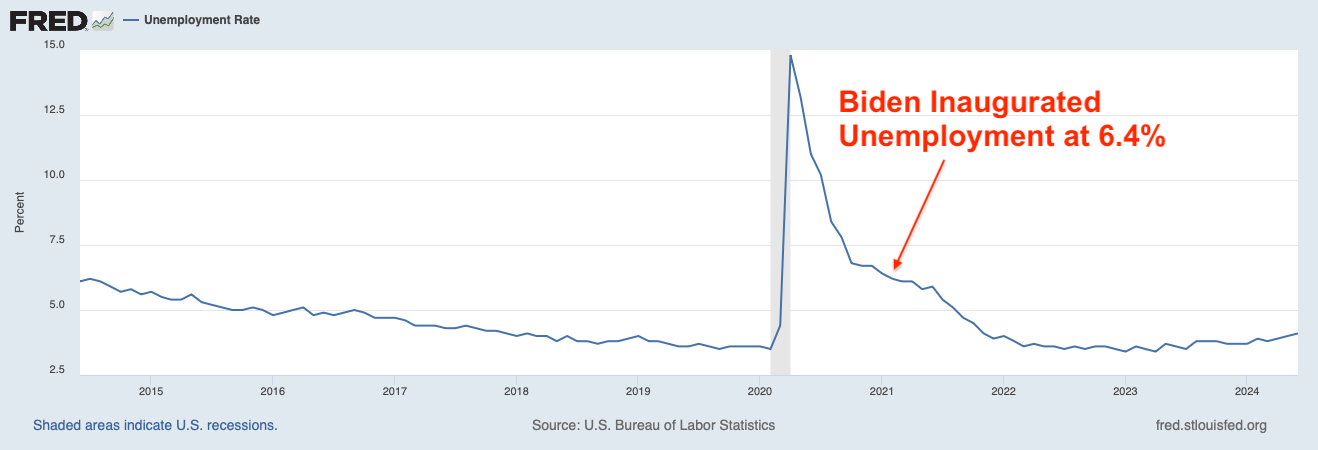

By January of 2021, Biden was inaugurated as POTUS. The economy was already recovering and unemployment was dropping fast.

But Biden knew not to miss a great massive fiscal stimulus opportunity — to shore up his chances of being re-elected. INCENTIVES!

We will get back to Bidenomics later in the piece, but for now I should note that the massive fiscal expansion with the war in Ukraine on top resulted in spiking inflation.

The Fed was then forced to act by hiking rates fast — scaring investors and spooking stocks. The broad-market sell off started in January 2022 and went on until October 2022, right about the time Chat GPT was launched.

Chat GPT is Launched!

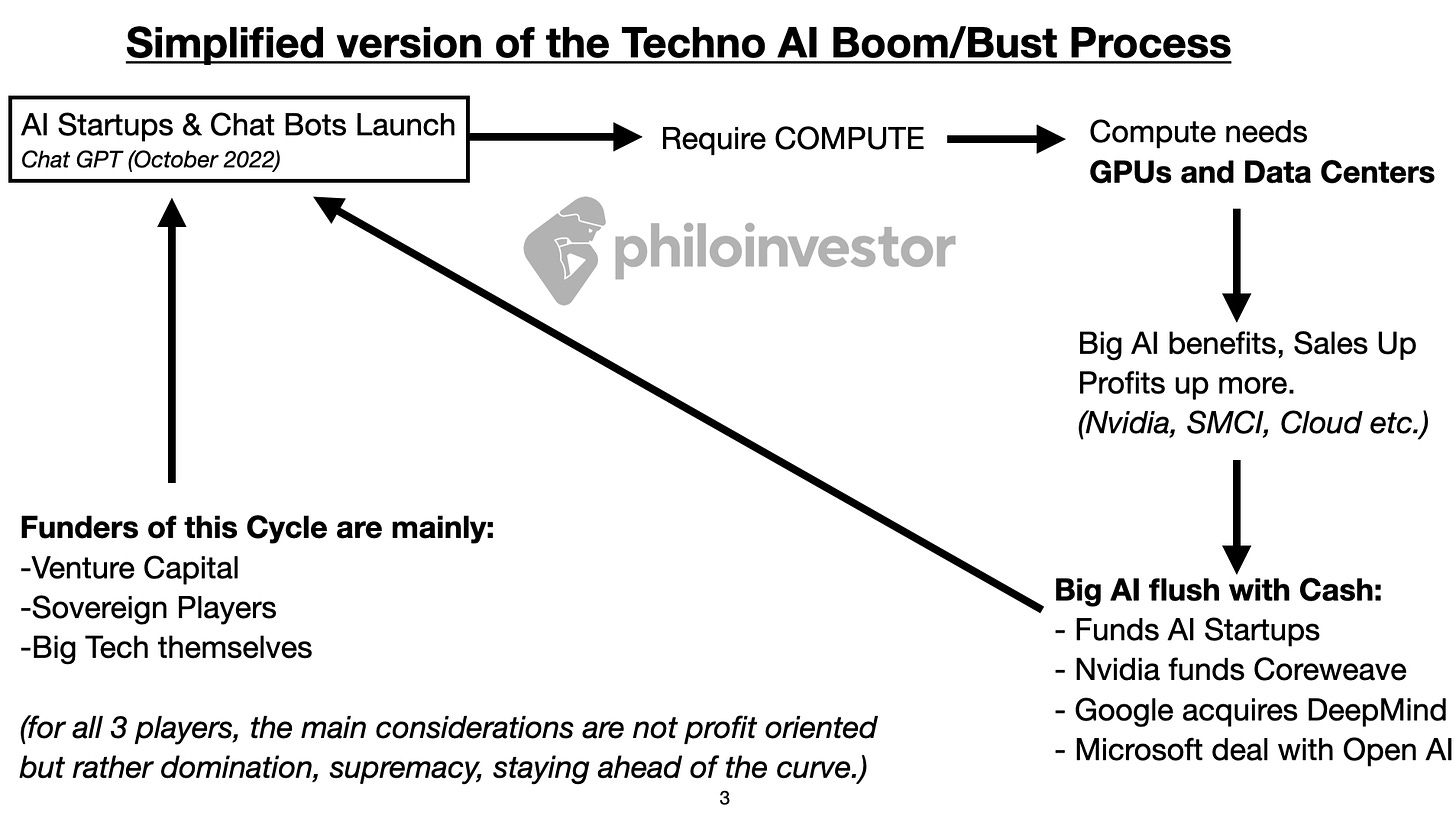

And this is where, strictly speaking, the process of the Techno-AI Boom/Bust process starts.

Start with the white box on the upper left and move clockwise following the arrows.

Fallibility & Reflexivity

Our understanding of reality is always flawed, that’s the fallibility part —the reflexivity part is when our understanding of reality alters reality itself.

We are in far-from-equilibrium conditions when there is a clear reflexive connection happening between the fundamentals and our perceptions of the fundamentals.

Boom/Bust

The reflexive connections range from the big and obvious to the small and insignificant — but all together they unite to create extreme fluctuations not only in security prices but in the underlying fundamentals as well.

Let’s uncover the connections and incentives shaping the whole setup…

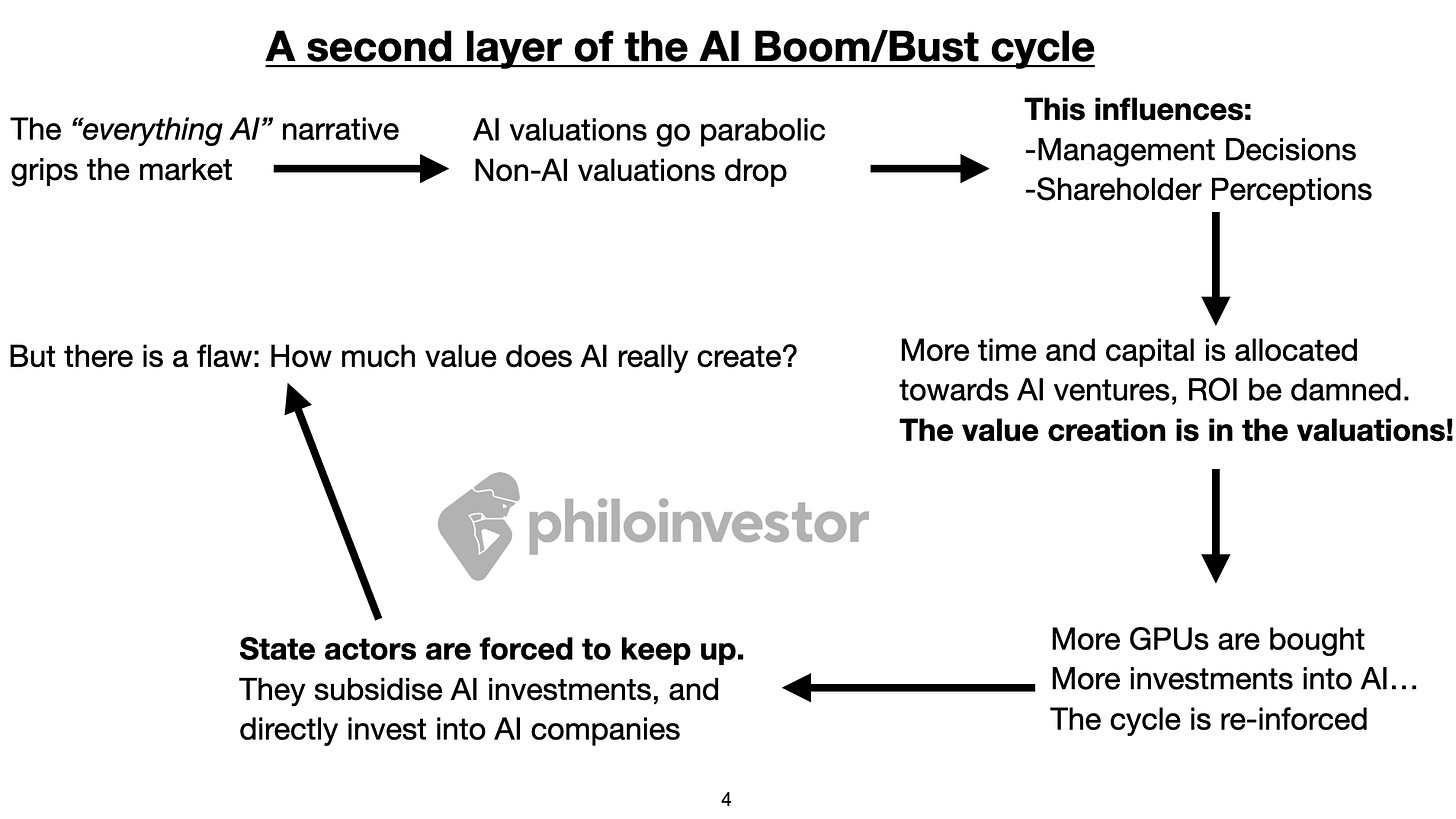

Valuations as Truth

There is much discussion about the actual ROI on AI-related capex. Just how much ROI will all this capex achieve?

Well, at this stage in their life cycle — Big Tech may be more interested in domination and supremacy rather than profitability. This is a serious layer to consider in all this.

The incentives behind this path are multiple:

Maybe the capex is ultimately negative in ROI, but capex-ing more (rather than less) secures company survival from being outcompeted by others who invest more aggressively in AI…

In which case, if the company is outcompeted, management will be ousted. Uncovering an obvious incentive-caused bias: The more management invests in AI, the more it optimises its existence within the company — at least for the shorter term.

Further to this again, maybe the capex is ultimately negative in ROI, but capex-ing more (rather than less) allows a company’s share price to benefit from the good graces of market forces. Remember Google shares before the market was pleased with their AI plans? Remember Apple shares before they released their AI? (Apple Intelligence). Remember Tesla before Elon came out with his stupid AI plans and what have you? 🤦🏻♂️

Whether big or small, Tech companies can buy time and valuations simply by announcing AI and spending some capital on AI-related capex. It doesn’t matter if it’s 100 million or 1 billion — the leverage in value creation will come in multiples! (i.e. 1 billon in spend equals 10 or 20 billion in “value” created)

In the short term, managements are incentivised to spend MORE, rather than less.

And so, in typical financial market fashion — the price sets the narrative and everything is accepted as obvious.

The Flaw

“The fact that a thesis is flawed does not mean that we should not invest in it as long as other people believe in it and there is a large group of people left to be convinced. The point was made by John Maynard Keynes when he compared the stock market to a beauty contest where the winner is not the most beautiful contestant but the one whom the greatest number of people consider beautiful. Where I have something significant to add is in pointing out that it pays to look for the flaws; if we find them, we are ahead of the game because we can limit our losses when the market also discovers what we already know. It is when we are unaware of what could go wrong that we have to worry.” - George Soros

What is the flaw here?

The flaw is that fundamentals in AI —> which directly affect Sales and EPS in the Semis/AI complex (and beyond) are not independent of our views about the future of AI.

Is that easy to comprehend?

The more we believe that AI is the future (look at slide 4 above, upper left, everything AI) —> the more we act towards it —> and the more we act towards it, the more AI fundamentals are ALTERED.

This self-reinforcing loop cannot go on forever, there is a point where the process is taken too far, and it starts to fall on its own weight. One needs to remain fluid to identify this — it could come in the form of a stock market drop out of nowhere, a piece of news that makes the market realise things aren’t so great, or something of this nature.

The Bust

An obvious potential issue in the whole process, is when companies that invest heavily in AI don’t get the returns they expect. Take Hyperscalers (i.e. Big Cloud), they are the main investors into the AI cycle — as they extend AI-related capex, they directly affect the Sales and Profits of AI/Semis companies —> and they create the narrative themselves.

In May,

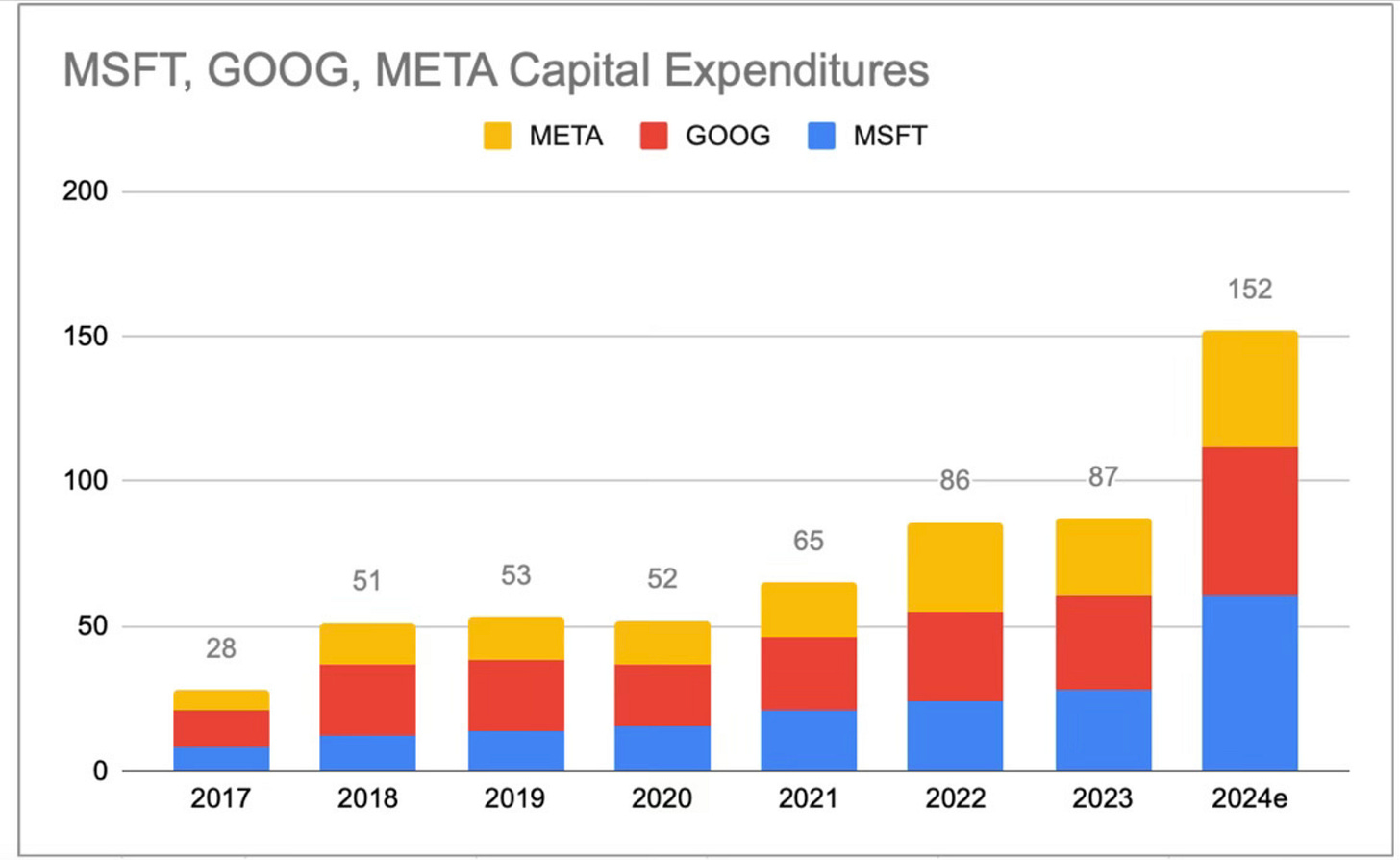

presented his piece Big Tech Capex and Earnings Quality, making the same point I made in my piece Downside at Microsoft.That the capital intensity in this previously very capital-light businesses is increasing heavily. They used to make money practically out of thin air, now the 3 of them plan to capex ~$152bln for 2024, most of the increase is AI-related.

But that’s not all…

The point is that they are now competing between themselves fiercely, AI services are getting commoditised, everything is getting commoditised! Will they make the returns they expect? Or the returns they signal? Nobody knows.

And so, as we have seen in Slide 3 above👆, once the funders of the cycle pull back just a little bit (for any reason), the capex cycle will go in reverse and the Techno-AI cycle will go into Bust.

The question now remains, how much return on capital can Microsoft achieve on all that Capex spend?

Will AI and Cloud solutions become commoditised with time, and if so, how will margins change for Hyperscalers going forward? How much are Hyperscalers growing profitably Vs cannibalising each other?

And considering these unknowns through the prism of Microsoft’s current valuation — is there sufficient margin of safety here?

(Excerpt from Downside at Microsoft)

Venture Capital and Sovereigns will pull back the same time as well — because they don’t invest independently from everyone else, in fact they take their CUES from everyone else… Talk about intellectual independence!

Biden’s Techno-Imperial Cycle

The slide below provides a revisionary explanation of how I understand the cycle.

The Center and the Periphery

We can understand the US as the CENTER and everyone else as the PERIPHERY.

Not only did the US benefit from a strong Covid re-opening with Trump’s $2 trillion in stimulus, and then from Bidenomics (i.e. massive fiscal expansion) — but also subsequently benefited from geopolitical conflict blowing up with the Russian invasion into Ukraine.

Why?

Europe, being next door to Ukraine, immediately became the most fragile of the Western blocs especially with the energy insecurity that was unleashed within the EU. The euro/usd was crashing, and naturally the dollar was going up.

European stock markets have been suffering for years and so the easy choice was to allocate more to the US while the markets were going up and up.

A Bifurcation

But the inflation that was unleashed and the subsequent super-fast Fed rate hike cycle did not end up in a fast and deep recession, simply because of a bifurcation between rate sensitives and rate IN-sensitives.

The rate in-sensitive players are 1) the US Government which spends no matter the deficit and the interest expense they have to pay on the debt (as long as someone is funding that deficit!) and 2) the Big Tech expansion that was underpinned by the AI race and the fact that their massive net cash balances immediately resulted in massive interest income, due to the rate hike cycle!

In simpler terms…

The top 50% is benefiting from interest income and a strong stock market — and manages to keep up with the cost of living explosion.

And the bottom 50% is suffering from the cost of living crisis, real wage contraction and isn’t managing to keep up. This second category has been forced to spend less, which is starting to show across the economy.

Central Planning

Scott Bessent’s piece on Bidenomics says that this economy policy is Central Planning (and social engineering!) — and that it chokes the private sector while spurring inflation.

Government intervention (except at specific times) is extremely destructive. The US will take years to bounce back from Bidenomics — and so the proper way to view a Trump presidency is:

1) The process of healing from Bidenomics and 2) to observe said process within the prism of Trump/Vance policies. 🤯

Some excerpts from the Bessent piece (by the way, he was a Soros CIO, and an economic historian)

But like all prior attempts at central planning, it failed to deliver prosperity, and instead generated a substantial upward price-level shock, accompanied by an insidiously persistent inflationary environment that has eroded standards of living in the United States. Continual economic anxiety has replaced abundance and prosperity.

….

In justifying its blowout spending, the Biden administration corrupted classic Keynesian economic theory. This theory holds that deficit spending can help restore growth and lift employment in a particularly deep recession not responding to monetary stimulus. Such a policy mix can, in fact, assist in promoting economic recovery, provided that there are productive resources in the economy lying idle that could be brought back online with demand stimulus. The Federal Reserve accommodated the fiscal stimulus with ultra-loose monetary policy and large-scale asset purchases. But Covid was a fundamentally different situation from a classic recession caused by the normal fluctuations of the business cycle. There was no output gap, and few unused resources as the pandemic had restricted supply and demand in concert. As a result, the Biden administration’s demand stimulus set the conditions for significant upheaval when it collided with the supply side of the economy.

…

Inflation was the natural result of regulatory restraints on the supply side of the economy interacting with the demand stimulus provided by the Biden administration’s unprecedented spending binge. Inflation peaked in June 2022 at a 9.1% annual rate, as measured by the consumer price index, the highest rate in 40 years. As a result, real wages significantly declined through 2021 and 2022, and are now approximately 5% below their pre-pandemic trend.

The Flaw & Trump’s Problem

What is the flaw in Biden’s Techno-Imperial Cycle?

The cycle only works in conditions of massive fiscal stimulus. But at some point, even with very high deficits, the economy starts to turn south — and the whole process goes into bust.

The recessionary climate will (probably) act as a dampener to inflation, lowering it month by month. The wildcard is that if Bidenomics takes time to unwind, inflation will remain sticky — setting the stage for a stagflationary environment.

Note that when past excesses are unwinding is when risk is highest. An economy relying on Covid stimulus cheques and massive government intervention doesn’t just switch to running on its own forces the next day.

I remain unconvinced about Trumponomics and how much of that agenda DJT will actually execute. My main working hypothesis is that the US is in a very slippery slope and the possibility of mistakes is very steep.

I will look for clues for a reversal of Biden’s Techno-Imperial cycle in a continuing weakening economy — which would pave the way for a turn from Boom to Bust. The Bust will bring the following moves.

Crashing Fed Funds rate

Crashing Dollar

Crashing Stock Market

Crashing Economy

Do not read the above list in sequential order. This is just my thesis for the moment and will probably change as we go along and gather more clues.

How the future plays out will depend on the decisions made by important actors going forward. e.g. Will the Fed lower rates fast in conditions of a recessionary pivot, or will they lower slowly to keep inflation down? All these things will matter.

Will the government realise they have to reign in the deficit — bringing about a fiscal contraction? Will Big Tech be pressured from the markets to reign in their capex spending too and start to focus on profitability?

All these are big questions for how the cycle will progress, and we will answer them as we go along.

Sincerely,

Philo 🦉