Coursera is the world’s leading online learning platform. It was founded in 2011 and floated in March 2021. Coursera is a platform type business, making it difficult to assess from the investor’s perspective.

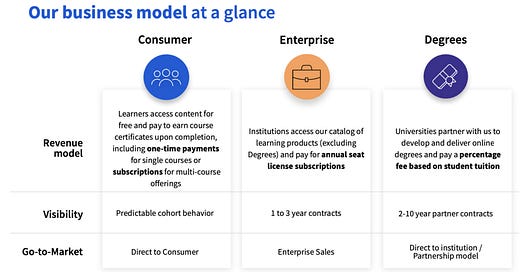

The Coursera business model is based on three separate offerings; Consumer, Enterprise and Degrees.

Consumer is a type of freemium model where registered learners can access the course for free but must pay to get the course completion certificate. Some courses are not freely accessible and must be purchased.

Enterprise is exactly what its name describes. The Coursera learning products catalog is offered under a subscription model. The annual licence fee is not fixed, but is relative to the needs of each enterprise client. Enterprise has three offerings, Coursera for Business, for Government and for Campus.

In Degrees, universities partner with Coursera to develop and offer their degrees on the platform. Coursera receives a percentage share of the tuition cost of each degree.

Coursera enables a global ecosystem of learners, educators and institutions. The company offers stackable content (i.e. smaller modules of study can count as progress towards larger credentials) and credentials to their 87 million registered learners, ranging from $10 guided learning projects to full fledged university degrees.

Technological trends like automation and the rapid ascent of the internet is transforming all areas of business and driving low-skilled jobs extinct, forcing companies and individuals to invest in more up to date education.

Only a small percentage (~5%) of total registered learners (87 million) have actually paid for a course, but the biggest source of paid learners is from free learners.

The company’s large and growing pool of free learners as well as the huge amount of free content online is one of its biggest competitive advantages against the competition.

First, paid content learners are mined to a large extent from the pool of free learners for virtually no cost; while competitors need to pay for customer acquisition. Second, free content is a massive driver of traffic to Coursera as individuals searching online are directed to the Coursera website, converting to registered learners from that point onwards.

Disruptor or Enabler?

Coursera management repeatedly says that they are not a disruptor, but an enabler; and that is true. Coursera does not compete with universities or other education institutions. It works with them to reinforce and strengthen their offering. Educators (universities etc.) leverage Coursera’s platform to build and offer their content online as well as offer their enrolled students job relevant education.

Coursera has disrupted one thing however, and that is the classroom. With the ascent of EdTech, the classroom has lost its monopoly as facilitator of teaching and learning. Online learning platforms have advantages relative to classrooms, like removing geographical and physical barriers to attending a course.

Educators use the Coursera platform as a distribution channel for their content, the same way a seller uses platforms like eBay, Amazon or Farfetch to sell their goods online to a wider audience. In fact, with the tsunami of the technological revolution upon us; educators suffer from serious existential risks if they do not move online, fast.

Coursera benefits from network effects. As more users (learners and educators) join the platform, platform value increases, attracting more of them in a virtuous cycle.

This network effect is a competitive advantage as it makes very hard for others to compete with Coursera.

The Technology

Disregarding network effects and the sheer size of the Coursera platform for a second; the company attracts educators (i.e. universities) for another reason. It is very difficult, time consuming and costly to develop your own online infrastructure for distributing content to learners.

Many universities choose to use Coursera technology and go online almost seamlessly, without the worry and hassle of having to develop and maintain their own infrastructure.

More on Enterprise – Business / Government / Campus

Coursera for Business

Coursera offers two separate lines for their institutional clients, Team and Enterprise. Team is for smaller organization that want to empower their employees to master new skills with unlimited access to the Coursera catalog.

Institutional clients sign up to Coursera for Business to upskill and reskill their staff and prepare their organization for the future.

“Employers can use Coursera for Business to help employees develop new skills in order to better acquire and serve customers, lower costs, reduce risk, and remain competitive in today’s economy. The launch of our Enterprise business in 2016 has enabled customers to choose Coursera to upskill their teams with critical skills in business, technology, data science, and other disciplines. As of December 31, 2020, over 2,000 organizations, including over 25% of Fortune 500 companies, were paying customers of Coursera for Business.”

Excerpt from Coursera Registration Statement S-1, March 2021

2. Coursera for Government

Governments started using Enterprise to upskill government staff at first, but now some are launching programs to upskill whole populations.

Governments, facing unprecedented levels of unemployment, can use Coursera for Government to build a competitive workforce that drives sustainable economic growth by upskilling employees for public sector success and reskilling citizens for career advancement.

Which nation doesn’t have a problem with unemployment and underskilled citizens?

Through the Coursera Workforce Recovery Initiative, government agencies launched more than 340 online learning programs that ran for free through December 2020. During that time, more than 1 million learners joined and logged more than 8 million course enrollments. Governments participating in the Workforce Recovery Initiative included the federal governments of Colombia and Kazakhstan, as well as the State of Illinois and the State of New York.

As of December 31, 2020, over 100 government agencies and organizations were paying customers of Coursera for Government. These customers represent national, state, and local government agencies and organizations from 33 countries and states including the United Arab Emirates, Saudi Arabia, Uruguay, and the State of New York.

3. Coursera for Campus

Colleges and universities can use Coursera for Campus to deliver branded online learning at low cost in a new era of financial challenges for higher education and evolving student preferences for hybrid learning. Coursera for Campus enables universities to leverage our global online learning platform to provide job-relevant, credit-ready, high-quality learning at higher scale and lower cost than in-classroom learning alone. Accelerated by the pandemic, thousands of higher education institutions launched Coursera for Campus over the past year, making it one of our fastest growing offerings. As of December 31, 2020, over 130 colleges and universities were paying customers of Coursera for Campus.

A small note on competition

We face competition from established companies as well as other emerging companies, which could divert partners to our competitors, result in pricing pressure, impact our market share, and significantly reduce our revenue.

The market for global adult online learning is highly fragmented and rapidly evolving. We expect alternative modes of learning to continue to accelerate as players in this industry introduce new and more competitive products, enhancements, and bundles.

The EdTech (Educational Technology) space is the area of technology focusing on teaching and education. Of course it is fragmented and rapidly evolving as it is in the early innings of its progression.

There is great venture capital interest into funding EdTech companies, and that is driving a lot of the new entrants into the space. Many will enter the space, and many will fail. One thing is for sure, most do not have the 87 million registered learners that Coursera has.

Inverting the whole “fragmented space” question on its head – it’s more efficient to focus on the company at hand, to assess it cash generation capabilities and its business staying power rather than simply scratching a potential investment because of competition.

It’s a Platform Business

Coursera is a platform-type business. The financial and business economics implications of this is that the bulk of the profits are backloaded, while the bulk of the investment required to create and ramp up the platform is frontloaded. I try to show below what I mean by this using a visual depiction.

The numbers used above are for illustrative purposes only. They are used to show that in the early days costs are very high relative to revenue and thus profits are near zero. As the platform ramps up and grows, revenues increase asymmetrically to costs resulting in a spike in profit margins.

Investors tend to focus too much on free cash flow generation. In platform businesses such as Coursera, cash flow progression is not linear over the life of the business.

Forget about the cash flow generation for the time being and focus on the value creation. Let’s just say that Coursera is generating a lot of value for its business as 1) more users join the platform, either as learners or as educators and 2) more institutions adopt the Coursera offering and 3) new products and the overall platform are being built, all contributing the Coursera platform flywheel.

The money will come as the company’s fixed cost base (general & administrative, research & development, technology costs etc.) is levered as revenues increase over time.

What does the company look like financially? (as of Q2 2021)

The company has ~137 million shares outstanding after floating in March 2021, and $750 million cash on its books.

At this phase of its growth cycle, the company is loss making as it has to spend a lot on sales & marketing, R&D and general & administrative to develop products and grow the business.

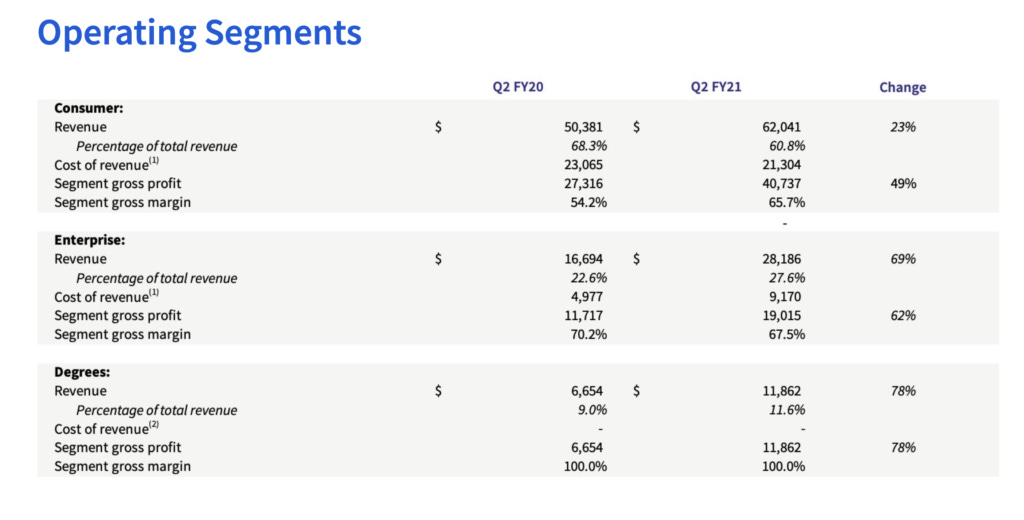

It makes more sense however to look at the company’s cash earning ability at the segment level, rather than the company level.

Operating Leverage #1 (Below the Line)

We can see that gross margins for all three segments are very high (>50%), while net margins at the company-level are very low, indicating the potential for significant operating leverage going forward. Let’s call it below the line operating leverage because it is the overheads that are being levered to result in a higher net margin percentage.

Cost of revenue consists of content costs in the form of fees paid to educator partners and expenses associated with the operation of our platform. These expenses include the cost of servicing both paid learner and educator partner support requests, hosting and bandwidth costs, amortization of acquired technology, internal-use software and content assets, customer payment processing fees, and allocated depreciation and facilities costs.

Content costs only apply to Consumer and Enterprise offerings; there is no content cost attributable to our Degrees offering. Content costs as a percentage of revenue are lower for our Enterprise offerings, due to a lower effective percentage payable to educator partners compared with sales to Consumer customers. We expect Enterprise and Degrees to become a larger portion of the overall business, and as our mix changes, content costs will decrease as a percentage of total revenue.

Operating Leverage #2 (Above the Line)

The definition of Cost of Revenue above shows us that there is indeed a fixed cost component to the cost of revenues, indicating even further operating leverage going forward. Let’s call it above the line operating leverage because it is the fixed costs within the total cost of revenues that are being levered to result in a higher gross margin percentage.

The Coursera platform-type business model, characterized by significant operating leverage and non-capital intensity, makes it unsuitable to be assessed using conventional valuation metrics.

Coursera is currently selling at $4.27 billion ($31 / share), and has FY2021 revenue guidance at ~$400 million. It is selling for more than 10x sales. And if that were not enough, it isn’t even profitable! Infinite price to earnings! How can you value this company?

Going back to first principles; it’s not price to sales, price to earnings or any metric that judgers whether an investment is good or bad.

Fundamentally, it is the value creation (or destruction) going forward, relative to the price you pay for it that will help you make your investment decisions.

“Intrinsic value is an all-important concept that offers the only logical approach to evaluating the relative attractiveness of investments and businesses. Intrinsic value can be defined simply: It is the discounted value of the cash that can be taken out of a business during its remaining life.”

–Warren Buffet