I sent this message to a (wealthy) friend on June 30th. When you think about economics, markets and politics all day — sometimes the trades just come to you (at 3AM in the morning).

Read my message below for the setup.

“I predict that it won’t be a slowdown in inflation that causes rate to get cut, I think it will be an economic slowdown” —Scott Bessent

I hate government bonds, you know I do. The insolvency of the major Western blocs has been a recurring theme on Philoinvestor.

But so what?

In the case of US treasurys it’s the safety they provide in times of crisis as investors bid up their prices the worse things get.

“But if you have this model in your head, when you see it playing out, you know what to do.”

Let’s have a look at the setup in more depth…

The Technicals

The uptrend in yields on the 10-Year broke down this week, as shown by the red arrow. Yields are also now below the weekly MAs, indicating a reversal of the trend.

One could argue that this is a sort of Head and Shoulders pattern, but whatever — the substance is that the yield couldn’t move above 5% and is now slowly dropping.. *More on this later

Inflation

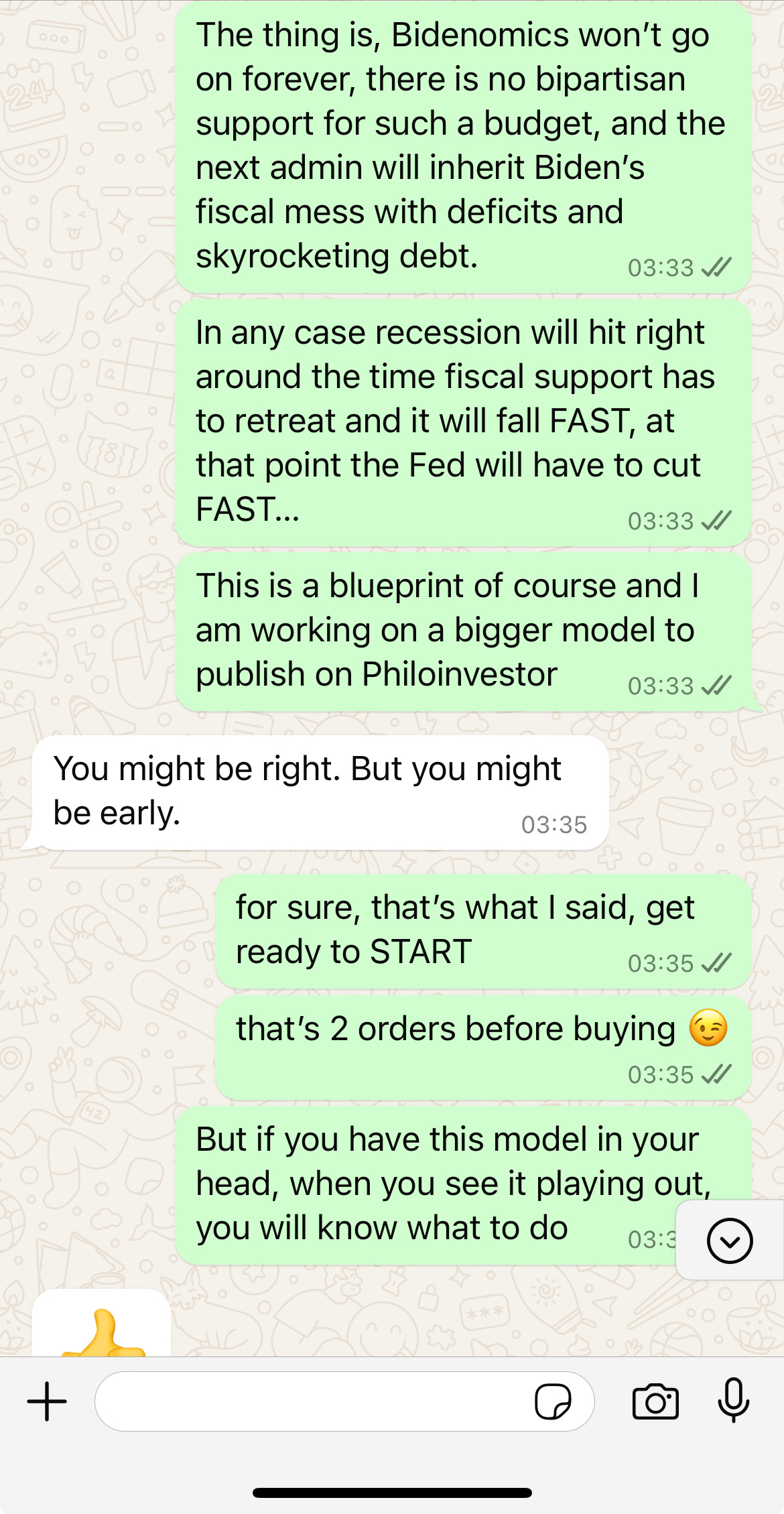

I think markets and the Fed are jumping the gun on being overly excited on progress on inflation.

12-month CPI is at 3%, but I guess that’s progress from the 3.1% from last month🤦🏻♂️

Indeed, there is clear progress on inflation increases from previous periods. Last June, CPI ex-food and energy was at 4.8%, now at 3.3%.

—> Still unacceptable, but the economy is already thirsty for rate cuts and some pump!

And so Powell is signalling a readiness to cut before inflation approaches 2% — because of the risk it would undershoot. 👇

“You don't want to wait until inflation gets all the way down to 2%, because inflation has a certain momentum,” Powell said. “If you waited that long, you’ve probably waited too long, because inflation will be moving downward and will go well below 2%, which we don't want.”

So the play is that they expect inflation metrics to continue trending down, setting the stage for them to cut rates pre-emptively.

—> I am not sure that’s the case here, inflation could be STICKY, evident from the many months that Core CPI is stuck at 3%.

Maybe this rhetoric is keeping the economy under loose financial conditions — assisted by the strong stock market-induced Wealth Effect on top.

But if the economy reverses, the wealth effect and a contracting economy will be both reinforced to the downside. 🔁

Economy Reversing?

As revised in my Whatsapp message above, the US economy regained massive momentum when the economy transitioned from Covid Lockdown to Covid Re-Opening.

Pent-up savings and pent-up desires were huge — and stimulus checks and massive fiscal support tend to help too! But now, ~3 years later the economy is getting tired, evident by the many stocks reversing violently or moving sideways for years.

Note: Not all stocks are Big Tech or AI!

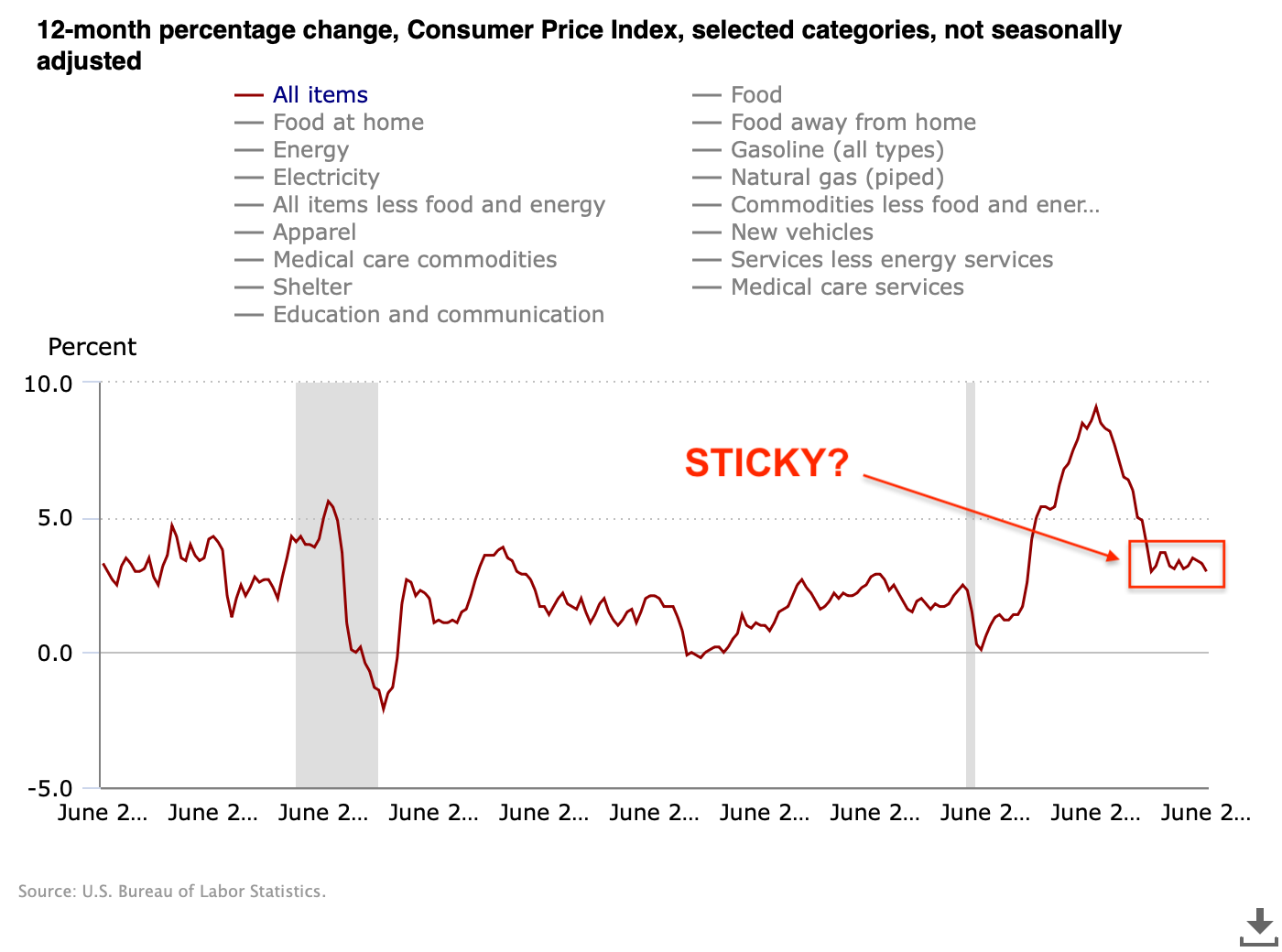

Droves of housing-related stocks are falling this year, giving us more proof that the housing sector is getting hurt from high interest rates. And consumer discretionary stocks aren’t exactly flying either.

—> US ISM Services PMI for June dropped to 48.8 from an expected 52.5, another sign of contraction.

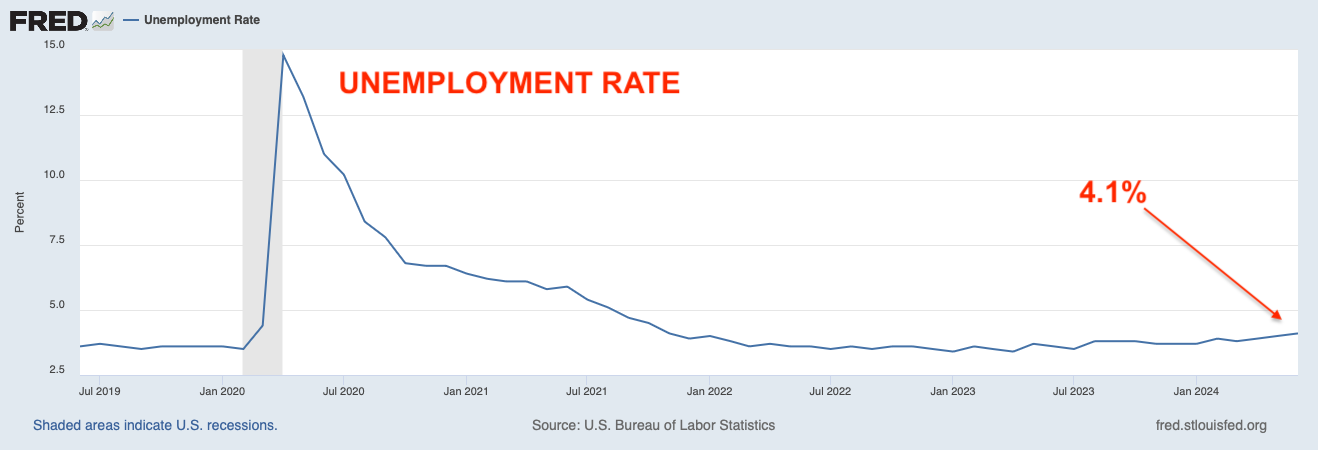

Unemployment already ticking up…

—> June unemployment stood at 4.1% from a 3.4% bottom last year.

Some say the unemployment/NFP figures are being manhandled but if we just go with these figures it’s clear the “rate sensitive” economy is starting to get hurt.

Which brings us to Bidenomics!

I have recently taken a serious interest in the Biden Administration and how their massive fiscal stimulus program affected the US and global economy.

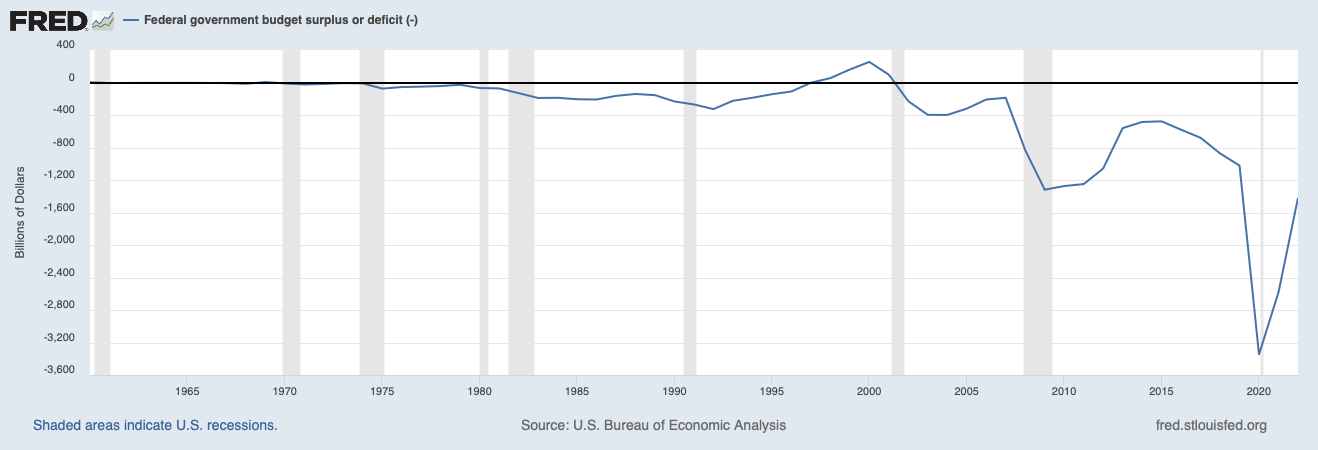

In his four-year term, Biden is approaching a $7trln cumulative budget deficit, with a large chunk of that going in squarely NEGATIVE ROI activities. It’s important to make this distinction, because if budgets funded POSITIVE ROI investments — GDP and the quality of said GDP would be sky high.

But when an administration is spending money simply for political gain, you tend to run into problems.

—> Last year the House Budget Committee published this fact-checking rebuttal to Bidenomics, with fact and figures here.

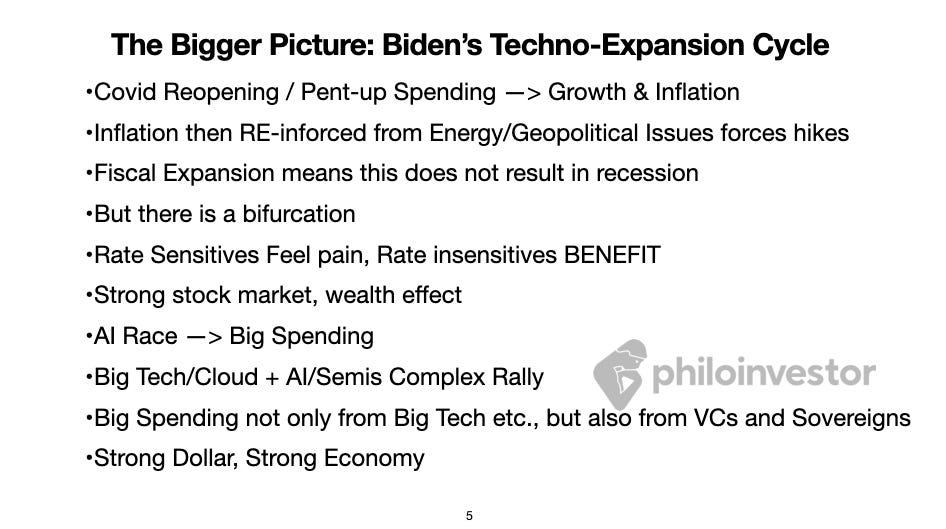

Biden’s Techno-Expansion Cycle

This is a sample slide from my presentation1 on Biden’s Techno-Expansion Cycle and the Techno-AI Boom/Bust Cycle. I decided to break down the whole picture into two processes, to make them easier to follow and understand.

Conclusion

My working hypothesis is that Bidenomics will run out of steam, probably at a time when the overall economy is starting to move south. Trump will probably not be interested in continuing with Biden’s Central Planning playbook.

This means the malinvestment of the previous years will have to be unwound, with considerable pain in the process.

Things I am looking out for:

Consistent to Powell’s signalling on pre-empting crashing inflation, I expect the Fed to pick up the rhetoric on fast-dropping rates when the economy turns.

Without massive fiscal support, the Fed won’t be able to do much to stop the economy from going through a normal recession cycle.

Falling economy would definitely hurt Big Tech, forcing them to cut back on their massive Capex programs — they have enough GPUs and Data Centers anyway!

Falling rates and falling stocks means falling dollar.

I am not so sure about a crashing inflation though, the inflation might stay around when we do get the stag

Resulting in the mythical STAGFLATION.

We will continue to discuss these and other setups on the Philoinvestor chat (link below). I remain open to revise my theses and adjust my views, accordingly.

Besides, operational success is about making money, not about being right.

Sincerely,

Philo 🦉

P.S. Look out for the full presentation of the Boom/Bust Cycles mentioned above.

Excellent read. Could you do a piece on the impact of Trump becoming president? For example, it could be interestign to take a look at the sectors that will benfit the most and overall what effects it will have on the fiscal policy.