After April’s Duolingo research piece was sent out, I planned to write about Twitter for the month of May. The Twitter-Elon Musk events of the previous days forced me to quicken my pace and to send next month’s piece today.

Please hit the like button and feel free to comment.

Don’t open Pandora’s Elon’s box

Pandora's box is an artifact in Greek mythology connected with the myth of Pandora in Hesiod's Works and Days. Hesiod reported that curiosity led her to open a container left in the care of her husband, thus releasing physical and emotional curses upon mankind.

Some historical context..

Jack Dorsey (“Jack”) co-founded the microblogging social networking company in 2006. By 2013 Twitter IPO’d making Jack a billionaire. But how have those that bought on the IPO fared?

If you bought at the IPO price of $26, you achieved a CAGR of 7% with massive swings along the way. If you were not one of those chosen few to get in on the IPO and bought at the IPO trading-day high of $44.95; you made exactly 0% in almost 9 years.

In other words the share price has gone exactly nowhere for almost 9 years. During that time revenues have been steadily increasing, but so have costs and staff count. Twitter management has simply not managed to make a buck for the company. But they have enriched themselves along the way.

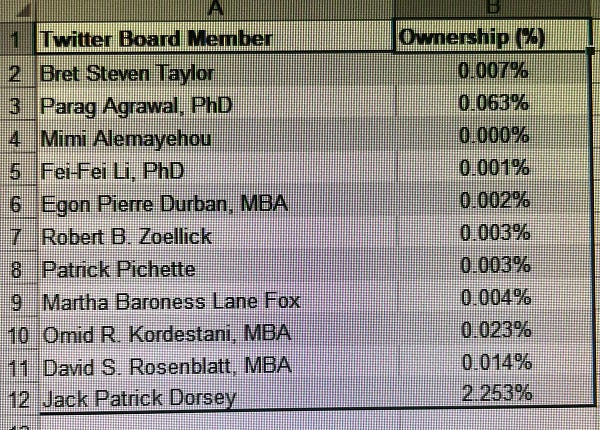

For example, the company’s CFO of the past 5 years owns ~500,000 TWTR shares and has sold ~$14 million worth of shares during his tenure at the company. His stake is worth another $22.5 million as of yesterday’s close. But we are not singling him out..

I believe management simply does not care about making money for investors, but cares deeply about making money for themselves. Sad Fact: Share-based compensation is ~$500 million per year, since 2013.

Some thought from Twitter:

In fact, Jack co-founded another company (Block Inc.) and took it public reaping more billions in the process. Until famous activist Elliot Management pushed Jack to resign as CEO of Twitter, he was CEO of both these companies! 🤦🏻♂️

Can Twitter ever make money?

We think so but it depends. Revenues have been steadily increasing and were $5 billion for 2021. But the problem is costs are also increasing. Twitter added 2,000 employees in 2021 alone (for a total of 7,500).

What some corners of FinTwit feel about the company..😹

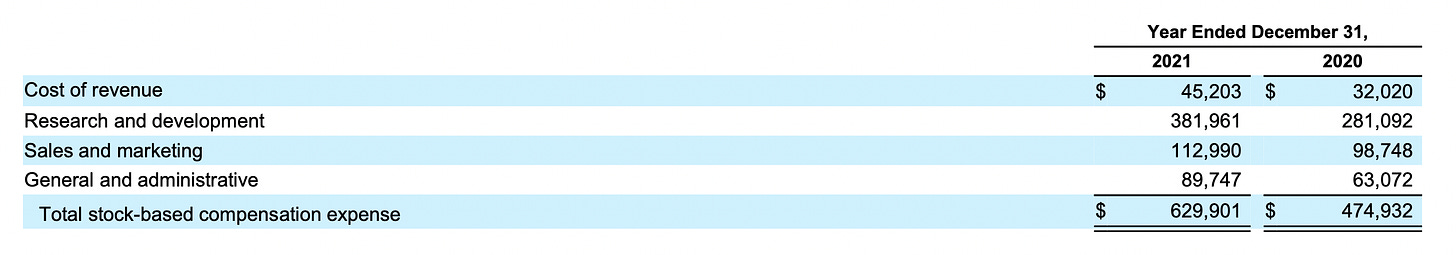

Twitter achieved a 65% gross margin on that $5 billion but spent 25%, 23% and 21% on R&D, Sales & Marketing and General & Admin respectively for every $1 of revenue. Twitter manages to grow every year but still never achieves that operating leverage investors are looking for.

Maybe it’s that $630 million in share based compensation that went in the books for 2021? 😩

Sure, it costs money to build and maintain the amazing media asset that is Twitter…And it costs money to attract and retain talent.

But in a capitalistic society isn’t profit the motive? Should corporate profit and shareholder wealth not be the result of such clear value offered to the consumer?

Especially when management and staff enjoy the fruits of this value creation while shareholders seldom do?

I think it should, but that doesn’t mean it will.

Enter Elon Musk

I won’t waste space here talking about the preamble to Elon’s buyout offer as I covered it here, and will get directly to the chase.

With his offer Elon said, “Twitter has extraordinary potential. I will unlock it.”

What could Elon be referring to? Let’s take a deeper look at Twitter’s economics and performance thus far.

Sales going up every year and margins not really expanding. The company almost turned the corner in 2019 but then overheads increased once more keeping margins close to 0.

mDAU also up every year while the company is working on interesting monetisation features that could help it achieve even more revenues👇

The CEO for the past 5 months but previously CTO for 5 years Parag Agrawal had this to say in the company’s 4th Quarter earnings call.

“I want to describe how several of our new products that we've been iterating on at a rapid cadence for them. I'm talking about Spaces, Communities, Newsletters, Professional Accounts, creator monetization efforts around Super Follows and Tipping and also a test with shopping and commerce. All of these come together to enable an ecosystem of products that enable content creators, publishers and businesses of all sizes to build and connect with their audience.”

Many of these initiatives are still in their early days and there is no knowing how far they can go. For example, Super Follows and Ticketed Spaces have recently launched on Twitter as an attempt to monetise the platform more. The value being exchanged on the platform every day is extremely high and I ascertain a high probability that the company WILL be able to convert some of that into revenues.

However, I have no way of knowing how much of that will accrue to the bottom line and how much time it will take to do so. Considering the previous sentence, management’s history and the uncertainty surrounding Elon’s bid; a skeptic could say that a bet on TWTR equity has good upside but sufficient downside risk as well.

Current Valuation

At Friday’s close Twitter was selling for ~$34.4 billion. Using 2021 sales of $5 billion, the company is selling for a price-to-sales ratio of ~7 times. Not exactly cheap for a company that has proven not to be able to make a buck for shareholders even with increasing revenues.

Even assuming a ~20% EBIT margin on those sales, the company would still be selling for 35 times EBIT. With a doubling of revenues and similar margins, that would take it to ~17 times EBIT.

Risk/reward on Twitter shares is not great - even if monetisation increases from here.

But is there a better play?

The Convertible Notes

Hat tip to the portfolio manager who pointed me to the direction of this instrument as a better play than the equity.

Twitter first started issuing convertible notes for “general corporate purposes” in 2014. Twitter has four tranches of convertible/senior notes in issuance with different coupons and conversion prices.

From the 2021 10K filing:

In 2018, we issued $1.15 billion in aggregate principal amount of 0.25% convertible senior notes due 2024, or the 2024 Notes. ✅

In 2019, we issued $700.0 million in aggregate principal amount of 3.875% senior notes due 2027, or the 2027 Notes. ❌

In 2020, we issued $1.0 billion in aggregate principal amount of 0.375% convertible senior notes due 2025, or the 2025 Notes. ❌

In March 2021, we issued $1.44 billion in aggregate principal amount of 0% convertible senior notes due 2026, or the 2026 Notes.❌

The 2025 notes are all owned by Silver Lake Partners, the 2027 notes are not convertible, the 2026 notes are convertible at $130 per share (3x the last price).

This leaves us with the 2024 which are convertible at $57.14 per share. Less than $3 away from Elon’s bid at $54.20. Above this conversion price - all share price gains accrue to the convertible note as well making the note behave like a call option that is in the money.

Below is a weekly chart of TWTR equity with a smaller price chart of the 2024 notes and it’s price behaviour as the share price moves above the conversion price of said notes.

The 2024 notes are now trading at 104 and expiring in 2 years at 100. Downside: 4 points. If there is a higher bid or better yet, management moves to create further value in the stock and it moves above $57ish, then the note will move up linearly to the share price move.

If nothing happens you lose less than 4 points. If something good happens and TWTR shares start moving; you are effectively long TWTR equity and stand to make solid returns.

These notes however are only for QIBs (Qualified Institutional Buyers) and if you don’t comply with those requirements you can’t play here. If you are a non-US persons, other exemptions apply.

Twitter’s destiny & making a profit

Until management gets serious about actually monetising - first by applying stringent cost control and second by extracting the platform’s true value in terms of revenue conversion, Twitter shares will be dead money.

Current valuation relative to future growth prospects just won’t cut it for those seeking to make extraordinary returns going forward.

And from the looks of it, management has not yet signalled that it’s willing to get down and dirty… 💸💸💸