Downside at AI, Part #2. Link here.

We soft-launched Downside at Philo in early 2023 with two pieces — on Moderna and Transocean. They are both down 50% since then.

Earlier this year I wrote, “Is the Nasdaq in a Reflexive Bubble?” and later on “Biden’s Techno-Imperial Cycle.”

These are big picture thematic pieces on the economy-at-large and their overlap with the Techno-AI cycle. This context serves not only us a warning for what may come, but also for preparation.

If you aren’t prepared you won’t maximise the payoff.

Top-Down Investing and the AI theme

Is it good to invest top down? That is to say to invest based on a BIG IDEA or over-arching theme? Depends — do you have the skills to do it?

I say this because most out there are just “investing in AI” purely on a top down basis, not bottom up. I touched upon this greater theme in my Contra piece, with a really interesting POV from my contra. Read the below 👇

Complications 🔄

Now you might say — so what if they invest in stocks that may be overpriced? So what if AAPL is expensive. They will just lose their money, right? No.

I broke down in Techno-AI — that the way we think about the world (i.e. our fallibility) ends up SHAPING the world. I offer an excerpt below, which I explain in a 2-minute audio file.

So, how much value does AI really create?

Let’s begin…

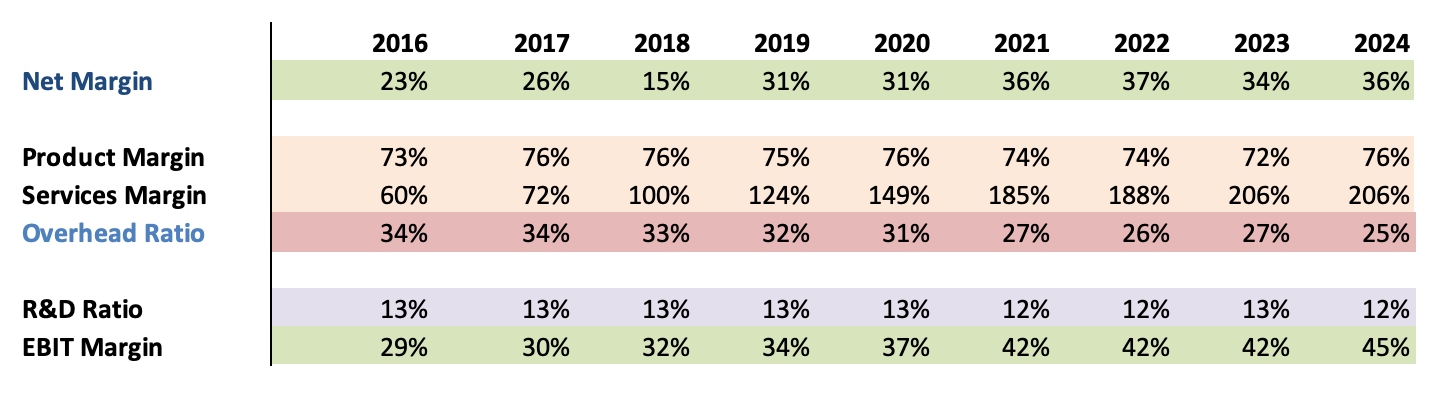

I started by assessing Microsoft, see the table below.

Microsoft Economics

Follow the progression of all these margin lines year-by-year.

Margins expanding, primarily in Services obviously.

Overhead as a ratio shrinking due to the explosion in Revenues.

R&D Ratio staying consistent, which means in absolute terms it has absolutely exploded.

And we see EBIT margins moving from 29% to 45% — a huge improvement.

—> But there is one thing missing, where is Capex in all this???

Capex is CASH

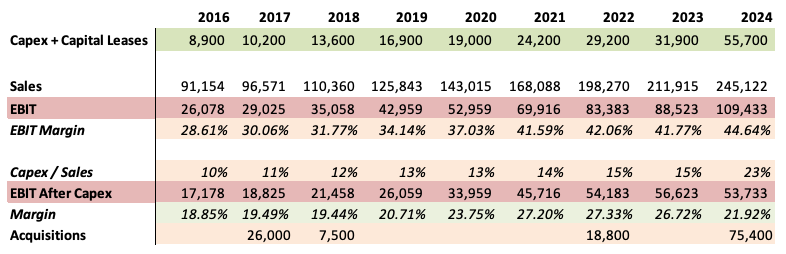

Capex is cash, but doesn’t directly flow through the income statement when the cash outflow happens. We’ve previously talked about the capital-intensity change in the Microsoft business model, let’s illustrate.

Notice the increase in Capex year-by-year

Notice the increase in Sales as well as Reported EBIT

And of course, margin expansion!

But everything is relative, my friend… 👇

The Capex/Sales ratio went from 10% —> 23%; which means MSFT now spends 23 cents in Capex for every dollar in revenue.

Adjusting Reported EBIT by the Capex spend immediately takes EBIT down 23% points to $54 billion (from $110 billion).

—> That’s a 22% margin, not much more than the 18.85% from 2016!

But there’s more…

Microsoft had to spend a lot of money for acquisitions too. There’s no use in assessing the economics of a company by looking back at its business progress (sales + profitability increases) without also gauging how much capital it took to create said progress.

You can see from the table above that acquisitions worth >$125bln have been executed. Not to mention the “acquihire” deal with Inflection AI and the Open AI investment — and how that creates a multiplier effect across the Semis/AI ecosystem. CONTEXT.

The ROI on the Capex….

But before we get to ROI on Capex, let’s paste an excerpt from the Downside at Microsoft piece — on Microsoft’s fast-changing economics 👇

You may have thought just previously, “What’s the problem with Capex Philo? Won’t all that get depreciated and flow through the income statement? Which would eventually result in the company publishing their TRUE ECONOMICS?”

Well yes, but look at the excerpt above. Microsoft even changed its depreciation accounting for network and server equipment — increasing their useful lives from 4 to 6 years, altering their reported economics in the process.

It’s either one or the other

Due to the “Everything is AI” theme mentioned above, and the oversimplification of top-down investing, both the companies who SELL and those who BUY AI infrastructure (like GPUs) are moving up in valuation. Top-down investors just don’t differentiate between the two or understand the differences.

Which complicates things…

If Microsoft assumes a useful life of 6 years for this type of equipment, on average. It means every dollar they spend today on said equipment, will only need to get replaced in 6 years, on average.

Which means that, considering constant capacity requirements — Microsoft won’t keep spending $50 or so billion in capex every year, perpetually!

And if that happens, what’s NVIDIA going to do?

Hence why I say — It’s either one or the other!

The ROI

Even after having determined that NOT everything is AI, and one company’s gain is another company’s loss — we still haven’t figured out what the ROI is in all this spend.

No Big Cloud company actually breaks down the profitability they are achieving, or their expected economics from these investments. They do say that this process is in the early innings and that they are investing for the longer term though… Ok…

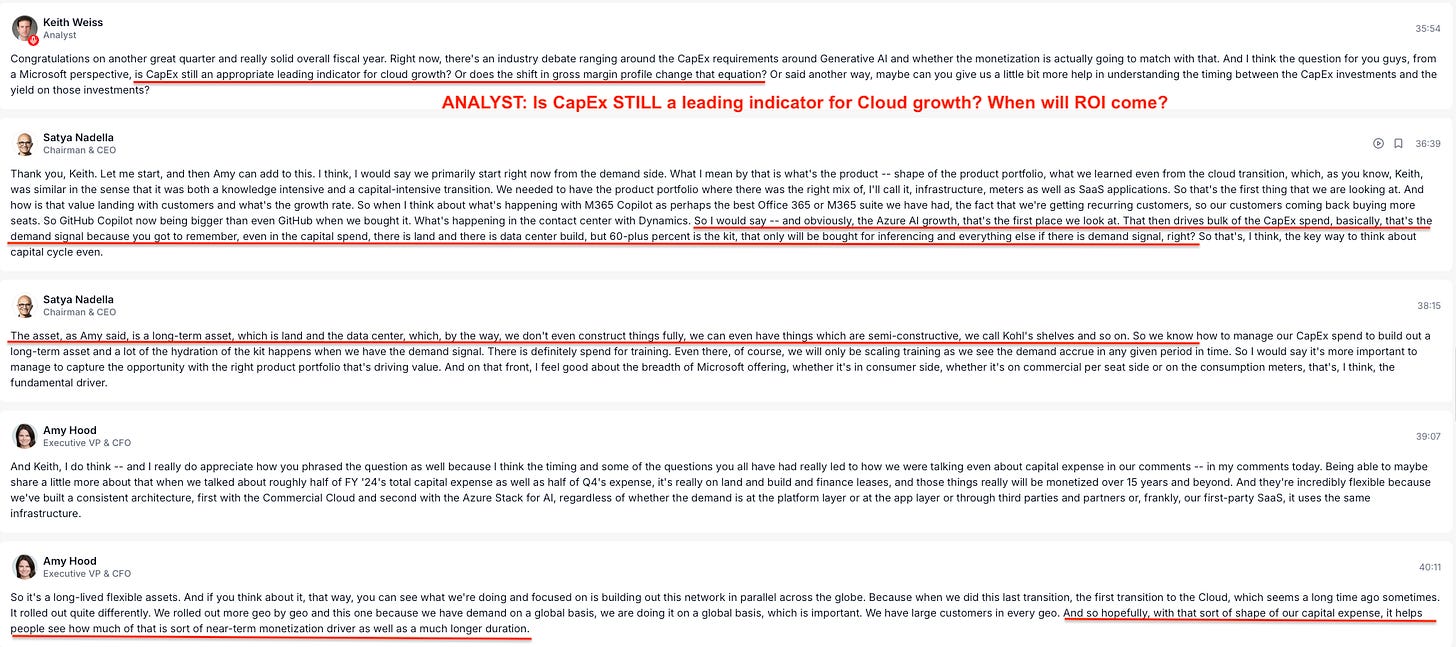

Here are some clues from the last ER.

Satya and Amy explain that half of the capex right now is for land and build, suggesting that the capex is long lived. The other ~half is the kit, comprising of the network equipment required to run the data center.

“Being able to maybe share a little more about that when we talked about roughly half of FY '24's total capital expense as well as half of Q4's expense, it's really on land and build and finance leases, and those things really will be monetised over 15 years and beyond.”

Amy, the CFO, goes on to explain that these capex costs will be monetised over 15 years and beyond.. What does that mean?

That some of those data center empty shells could remain unused for years and years? That the life of those shells are >15 years? They are just not giving enough clues to what is happening here, or what they expect to happen.

Simplified ROI

So instead of running around in circles, let’s just simplify.

As demand for AI-related Microsoft products increases, so does the CapEx cycle proceed. They only buy the GPUs and the equipment needed to fill the data center when they SEE the demand coming in.

That means companies like Nvidia are highly sensitive to demand on AI usage. (No shock there)

But what it ALSO means is that they have a bunch of land and shell-structure data centres sitting there with no return. This is why it’s impossible for analysts to ascertain what the ROI is on this whole AI venture.

And even if MSFT management could tell us — they don’t want to or need to. They would rather sit there and hold all the cards.

Right now Microsoft is constrained in AI capacity, so they have already started using third-party capacity to serve their demands.

“We are constrained on AI capacity. And because of that we have signed up with third parties to help us as we are behind with some leases on AI capacity. We've done that with partners who are happy to help us extend the Azure platform, to be able to serve this Azure AI demand. And you do see us investing quite a bit as we've talked about in builds so that we can get back in a more balanced place.”

The AI GRID & AI Problems

Now I find this very interesting…

Because it’s one of the many dynamics that will create the cycle in this business, and that can skew the ROIC for AI infrastructure spend.

I will touch upon this in the next part, as well as explore the real-world uses of AI — What are they? What large-scale industrial problems can they solve? Which industries or sectors? What can it do TODAY?

Basically, what BIG PROBLEMS can AI solve?

Because document organisation and data retrieval and analysis from Walmart’s massive database isn’t something crazy or revolutionary.

P.S. I bought the subscription to Chat-GPT 4o a few weeks and started playing with the product much more. I am using it to try and log my calories to lose weight. To create and schedule content for Philoinvestor and to get content ideas and suggestions.

Even to organise and work on the Zero to Hero investing course. Basically, I am pushing the limits of what this product can do for a typical, tech-savvy young professional. I am really pushing the limits of this thing’s “intelligence”.

That should help us figure out if AI is just starting, or if it’s already 3/4 of the way there! Keep an open mind.

Sincerely,

Philo 🦉