Duolingo, platformizing learning.

Conquering learning via gamification and AI/ML.

“Our mission is to develop the best education in the world and make it universally available.”

Duolingo is a language+ learning platform which uses gamification to make users more engaged; and allows them to learn easier and faster while using big data analysis and machine learning to make learning more effective.

Its two founders are Severin Hacker and Louis Von Ahn (the CEO). Louis earned his PhD from Carnegie Mellon and then became a faculty member. That’s where he met Severin, who was his student. Louis was the founder of the famous CAPTCHA and ReCAPTCHA.

Duolingo was founded in 2011 and IPO’d in July 2021 at a price of $102 per share (~$3.5 billion).

For 2021 sales were $294 million and year end market cap was ~$4 billion giving it an EV/Sales ratio of more than 11 times! 🤦🏻♂️

Investors have a really hard time getting their head around non-capital intensive business like platforms and SaaS…

Sentiment around Duolingo isn’t exactly cheery. The fine gentlemen can believe anything they like, but I would like to make my own points about valuing this company.

The Business

The Duolingo app is the world’s most popular way to learn languages. The TAM for language learning is 2 billion people and $61 billion of spend per year (most of that offline). Much of that demand is rooted in the reality that English can unlock tremendous economic opportunities. Exceptional english skills are expected to get you a 30-50% higher salary relative to average english skills. Simply put, the demand for learning language is huge.

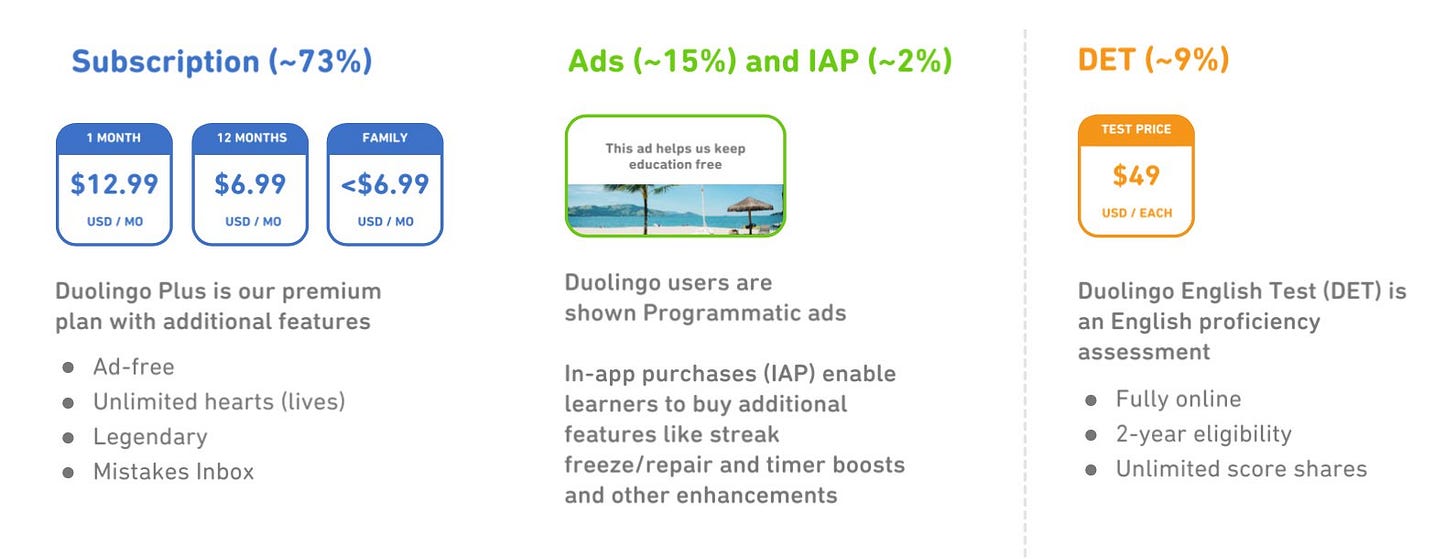

Duolingo currently generates revenue via 4 ways.

Duolingo Plus (~73%). Duolingo is freemium. Everyone can access the app but Plus offers additional features to enhance the learning experience.

Duolingo English Test (DET) (~9%). An on-demand, online English proficiency assessment that can be completed in less than 1 hour. Costs $49 per test.

Advertising (~15%). Duolingo monetises free users by displaying ads during their use of the platform.

In-App Purchases (~2%) to a much lesser extent.

Early Innings

Duolingo is in the early stages of its life cycle. It must invest in R&D to optimise its current offering as well as develop new products. It must spend on marketing to attract learners and ramp up the platform.

Not all business models are made the same. A persistent theme that I see is that investors are myopic and naive when it comes to certain types of businesses.

Duolingo has been increasing DAUs and MAUs steadily every year. At this point I believe Duolingo barely needs any marketing to continue growing. Word of mouth is the strongest form of marketing.

But what about monetisation? Why is the company not making money? Because monetisation is just now beginning👇

Revenues and MAUs were 55% and 15% higher respectively in 2021.

How far can Duolingo go? Read closely 👇👇👇

Our paid subscriber penetration has increased steadily since we launched Duolingo Plus in 2017 and, combined with our user growth, has let to revenue growth each year since. We have a strong future roadmap of feature improvement and optimisations, and believe we are in the early stages of increasing our paid subscriber penetration.

We believe that there is an opportunity to diversify the scope of our platform beyond language learning to a variety of subjects, using the same product-focused, mobile-first, gamified approach to education. New products will leverage our scalable technology and benefit from our core competencies in product development, gamification and use of advanced data-driven analytics to deliver quantifiable efficacy. We believe that expanding the scope of our platform to additional learning subjects will further expand our addressable market.

Duolingo is early in its life cycle, it’s full-on investment mode. It’s not only investing in its existing portfolio of products (making them better, increasing monetisation etc.) but also has more products planned in the future.

“We invest heavily in R&D in order to drive user engagement and customer satisfaction, which we believe helps to drive organic growth of new users. This, in turn, drives additional growth in, and better lifetime value of our paid subs, as well as increased advertising revenue from impressions from our free users. Expenses are made up of costs incurred for the development of new and improved products and features in our applications. Such expenses include compensation of engineers, designers, product managers….”

“As a result, the benefits of our R&D investments may be difficult to forecast. We expect to continue to spend a significant portion of our revenues on R&D in the future.”

💥 But because R&D is an operating expense (and not a capital expense), it flows through the income statement, affecting the bottom line. Which means the company incurs a cost today, but makes a return for years to come. Let’s call it a “business economics is not accounting” imbalance (BENA imbalance)..💥

Variable Contribution Margin & Operating Leverage

Variable contribution margin is the margin that results when only variable production costs are subtracted from revenue.

It’s clear that the company has a lot of fixed costs - but how will its bottom line behave as revenues ramp? A good way to gauge that is the variable contribution margin.

While the company’s gross margin is safely above 70%, it’s adjusted EBITDA margin was -1% for 2021. What makes up the CoR (cost of revenues)?

… third-party payment processing fees charged by various distribution channels, and also includes hosting fees. To a much lesser extent, cost of revenues includes costs for contractors, wages and stock-based compensation for certain employees in the capacity of customer support, amortization of revenue generating capitalized software, and depreciation of certain property and equipment.

CoR is not all variable costs, there is even a fixed cost component (contractors, employees, amortization, depreciation), which would allow for even further operating leverage. But let’s assume for simplicity that the variable contribution margin is equal to the gross margin of 70%. This means that operating leverage going forward is material.

But for 2022 the company still has not guided for profitability. Guidance is for ~35% growth in revenues to ~$335 million and Adjusted EBITDA of ~$-5 million.

Still no profit - but this makes sense because the company is still deep in investment mode. The company is laser focused on creating value; the profitability will come.

Value Creation is not Cash Generation 💸

There are ways in which value is being created but not reflected in profit. This value will be monetised by the company going forward.

User Base. Duolingo started at 0M users 10 years ago, now it has 42M MAUs and over 500M downloads. I consider the latter to still be within the Duolingo ecosystem, as they can more easily be reached by Duolingo. 0M is not the same as 42M, or even 500M. The first Duolingo product started at 0M, future ones will start at 500M.

Technology for Personalisation & Teaching. “A lot of people don’t realise there is quit a bit of sophistication in the background. For example, whenever you start a lesson with Duolingo, that lesson is entirely personalised to you. Whenever you are using Duolingo we watch every exercise that you get whether you got it right or wrong. And why you got it right/wrong. And we use all that data to build a model for each user.. but actually it’s more sophisticated that that. If we only gave you exercises on the things that you were not good at, those lessons would be from hell. So whenever we start a lesson for you we optimise for two things: We try to teach you better but also we thank you try to give you things you have a chance of getting correct! All of that sophistication is something that can be transferred pretty easily from languages to other things that can be learned from a lot of drills like maths and literacy. A lot of the tech and gamification can be transferred. I strongly believe we can create very good products to teach these other things, I am pretty sure of that.” All this tech cost time and money, and now it’s transferrable to future products. That sounds like a lot of value to me.

Technology for Monetisation. “The way we grow our paid subs is by running hundreds of A/B test to try to get more people to subscribe. And that seems to be growing by 1% to 1.5% per year. These A/B tests focus on two buckets, the first bucket is changes to how we merchandise…and it keeps just getting better and better…and the second bucket is adding features to our premium subscription.” Same value as above, Duolingo now has the tech to monetise its free users much more effectively. They will apply this tech to their other products. Gotta love compounding!

New Products & Offers. A recently-launched Family Plan and a yet to be launched higher tier of subscription. The Family Plan drives retention and use growth. Imagine the possibilities; with 1 new user you get his whole family. No marketing needed. When one family member falls of the wagon, the account is still running because one member could still be learning something. When new products launch, the users are just sitting there ready to be sold on these new offerings! For example, see below.

Duolingo English Test. Standardised English Proficiency (SEP) exams are a big deal. So Duolingo made their own SEP online. Duolingo sold >500K tests in 2021 (up 50%). Their aim is to make the DET the new standard of proficiency. For example, “I am a Duolingo 65 in Spanish” will replace “I am a B2 in Spanish.” - this is their goal. As more users choose to take the DET, more institutions accept it.

Duolingo ABC. Working on an application that will teach children reading skills in their own language.

Duolingo Maths. Working on an app that will help children acquire maths skills. Duolingo will turn on monetisation as these products gains more users.

Distribution Channels. “For almost a decade, Duolingo’s learner community has grown organically through word-of-mouth virality. In recent years, we have made investments in marketing to supplement our organic model and amplify the voices of our existing users.” Duolingo has grown organically. Management has only spent on marketing very selectively to get the flywheel running in under-penetrated areas (like in Japan with influencers). The Tik Tok account was launched February 2021 and a year later has 3.5M followers and 68.6M likes. The company spent virtually nothing for this exposure.

So while the market is focusing on Duolingo’s lack of profitability, we prefer to focus on value creation. Do the 8 points above not constitute tremendous value creation that the company can monetise going forward? Just because it’s not easy to see does not mean it’s not there.

In fact, companies that have created the most value had something that was intangible and hard to see, rather than something readily apparent. Excerpt from a future Philoinvestor piece to drop on companies that return 100X+ 👇

“It creates value that cannot be captured by accounting considerations or value-dogmatic preconceived notions. Sometimes value creation is a positive on a balance sheet, sometimes it’s a negative on the income statement. Sometimes it is nowhere to be found. But just because you can’t see it on a financial statement, doesn’t mean it’s not there.”

Back of the envelope

Duolingo is currently selling for an EV of $3.2 billion. Sales guidance for 2022 is ~$340 million giving Duolingo an EV/Sales multiple of ~10X.

Assuming Duolingo grows its users by a mere 2 times and takes its monetisation from 5.9% to 10% of MAUs, would give it 8.5 millions paid subscribers from 2.5 million currently. Duolingo Plus revenues would be ~$700mln per year. (A bit more than just 1% of the TAM for language learning)

A doubling of users would take DAUs to ~20 million. The company currently earns $3.8 of ad revenue per DAU per year, up from a $3.2 last year. As user engagement increases, so will ad revenue. Assuming a $5 ad/DAU/year and ~20 million DAUs gives you another $100 million in ad revenues per year.

503,000 Duolingo English Tests (DET) were taken in 2021 at $49 each, up from 309,000. Louis has explained that they are investing a lot in the DET and they expect it to grow nicely. Assuming an easy 1 million tests per year gives you ~$50 million of revenues per year.

This equals to ~$850 million of sales, giving you an EV/future Sales of less than 4X. Considering the leverage embedded in the business model, EBIT margins of 20% should be easily achievable going forward.

The back of the envelope calculation above does not include potential revenues from future Duolingo products.

“Good things, sometimes, take time.”

For an easy navigation of all Philoinvestor content, click here.

That $3.2b EV doesn't seem right...