Jumbo, more money more problems.

$BELA 💶ACTIVISM WANTED💶 Top quality business, suboptimal capital allocation.

❤️ Dominant and growing retailer drowning in cash seeks activist suitor for optimal capital allocation 💶

Jumbo is a general retailer which started out as a toy store 35 years ago.

The toys segment has steadily reduced in importance over the years. Today, 80% of sales are ex-toys, consisting of home, baby, seasonal and stationery goods.

Jumbo leveraged their brand, existing foot space and staff to diversify away from their focus on toys. That’s when Jumbo’s business economics blew up (positively).

The average Jumbo store has a size of around 9.000 square meters, and the company has 80 of them in 4 countries. The stores have a cheap-built feeling, constructed using low-cost structures and benefiting from very large parking lots.

Annual capex required to maintain the stores is very low, and gross margins run at 50%. Operating margins are safely above 25%, giving the company top-class business economics.

Jumbo generated €170 million of EBIT for 2020 (€220 mln for 2019) and only requires a fraction of that to fund its growth plans. The company pays a healthy dividend but which is still much less than annual free cash generation.

This has been going on for yeeaarrs, year in year out. That leaves the company today with a fortress balance sheet and gross cash of ~€750 million, with long-term loans of only €200 million.

Market cap at the time of writing is €1.7 billion (share price at €12.70). Netting out the cash gives Jumbo a market cap of €1.15 billion, and a 2019 EBIT of 6.75x.

The share price has gone through some real ups and downs. Meanwhile the business has not been affected that much considering the Greek saga of the past 10 years.

Jumbo shares bottomed in 2012 at 2.40 per share (ridiculously cheap), and recovered to 15 per share by 2015 (85% CAGR for 3 years). Obviously Greece was going through historical times as failed bailout after failed bailout rocked the country at its core.

At the time there were doubts about the country’s membership in the EU / eurozone and fear and uncertainty were at their peaks. But that’s when you get the best investment opportunities right?

➡️ That's when Third Point made the Greek government bond bet and cashed out big time.

Some History..

The man behind Jumbo’s massive success is Mr. Apostolos Vakakis. Vakakis was born in 1954 in Egypt, the son of a Greek businessman. Apostolos benefited from the privileges of being born into a wealthy family but his fortunes soon reversed.

The family was forced to leave Egypt due to political turmoil and they soon relocated back to Greece, setting up a toys factory in the Greek island of Zakynthos. The factory was thriving until the family’s fortune reversed once more.

Disaster struck when a fire in his family’s factory crashed him back to earth and forced him to abandon his studies to work for the family business.

He turned the business around and managed to sell it to Hasbro, before finally deciding to enter the Greek retail sector with Jumbo.

Jumbo used the demand/supply dynamics of the Athens shopping mall sector (rampant at the time) to get a foothold in good locations but with reduced cost.

What was the situation? Demand was high for ground and first floor real estate but much lower for the upper floors. Mr. Vakakis leased space in the upper floors because it made economic sense to him.

The business model succeeded and Jumbo thrived, but that wasn’t enough for Mr. Jumbo, he wanted more.

His future plan was to make the next step and progress to bigger and more prominent real estate. How could he achieve this?

Vakakis used the booming Greek stock market to float Jumbo in 1997 and raise growth capital. Jumbo listed at €0.25 per share, and has been rallying ever since. 🚀52X return in 24 years, without taking dividends into consideration🚀

Jumbo used the capital to steadily grow store count in Greece and enter new geographies. First, they entered the Cyprus market swiftly conquering the segment.

Then they moved into Romania (same GDP as Greece) and Bulgaria. Greece and Cyprus are the company’s core markets, while Romania and Bulgaria are its growth markets.

Jumbo may already be the dominant player in these four countries, but that doesn’t mean it won’t continue to grow. Market share is high, but can go much higher as Jumbo becomes the destination-location for their products, weakening competition and forcing them to fold.

But physical stores are not the end of the line for Jumbo.

e-Commerce roll out

Jumbo has also invested in online growth by rolling out e-Jumbo, the company’s online shop. The e-Jumbo in Greece currently does 5% of total Greek sales, and the e-Jumbo in Cyprus was launched in 2020. The Romanian e-Jumbo was planned for 2021 but has been delayed.

“Although the Group has not cut its investments, the lack of products due to the disruption of the supply chain, leads to the postponement of the operation of the new stores and warehouses as well as the operation of the online store in Romania.”

Quoted from the Jumbo first half 2021 report.

I see the online shop offering as a way to achieve higher sales without having to build physical locations in every single area. The e-Commerce segment is one of the most important developments for future growth. The segment is in the first innings (baseball analogy) of its lifecycle, and it is possible that the company will use it to sell a wider variety of goods.

Current Issues

From Jumbo’s annual report 2020.

70% of the Group’s products originate from China. The facts that could lead to cessation of Chinese imports (such as embargo for Chinese imports or increased import taxes for Chinese imports or political- economic crises and personnel strikes in China, capital controls or an epidemic) could interrupt the product supply for the Group’s selling points, resulting in a negative effect on the Group’s operations and its financial position. Having invested in increasing the number, location and size of warehouses and facilities, the Group has the opportunity to proceed with inventory storage to deal with delays in the supply chain.

70% of the products Jumbo sells are sourced directly from China. The current supply chain disruptions are causing issues for the company and slowing down its growth plans.

Together with the pandemic, we believe that these are the primary reasons for Jumbo’s lagging share price and why investors are afraid of touching it.

Covid still a thing

Greece. After being the poster child for low covid cases and a relatively easy summer 2020, coronavirus cases finally spiked near the end of 2020. Things have been bad ever since.

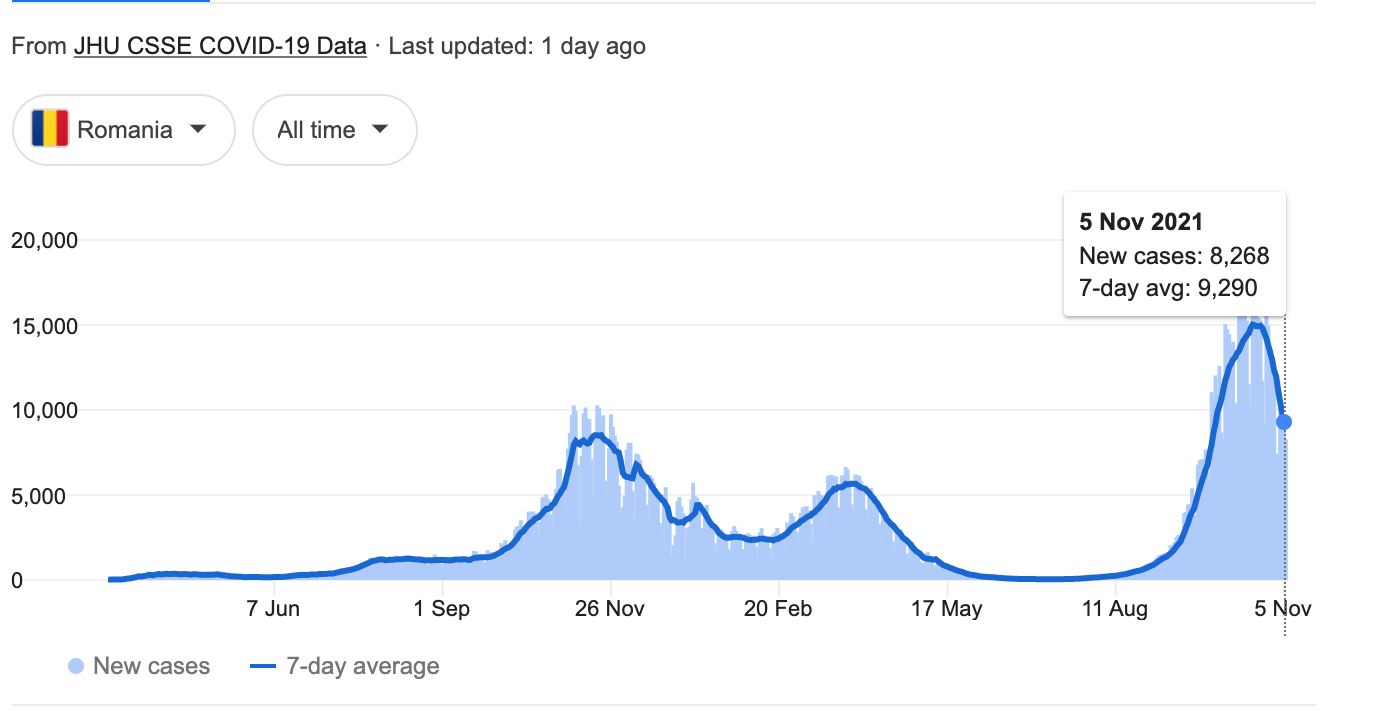

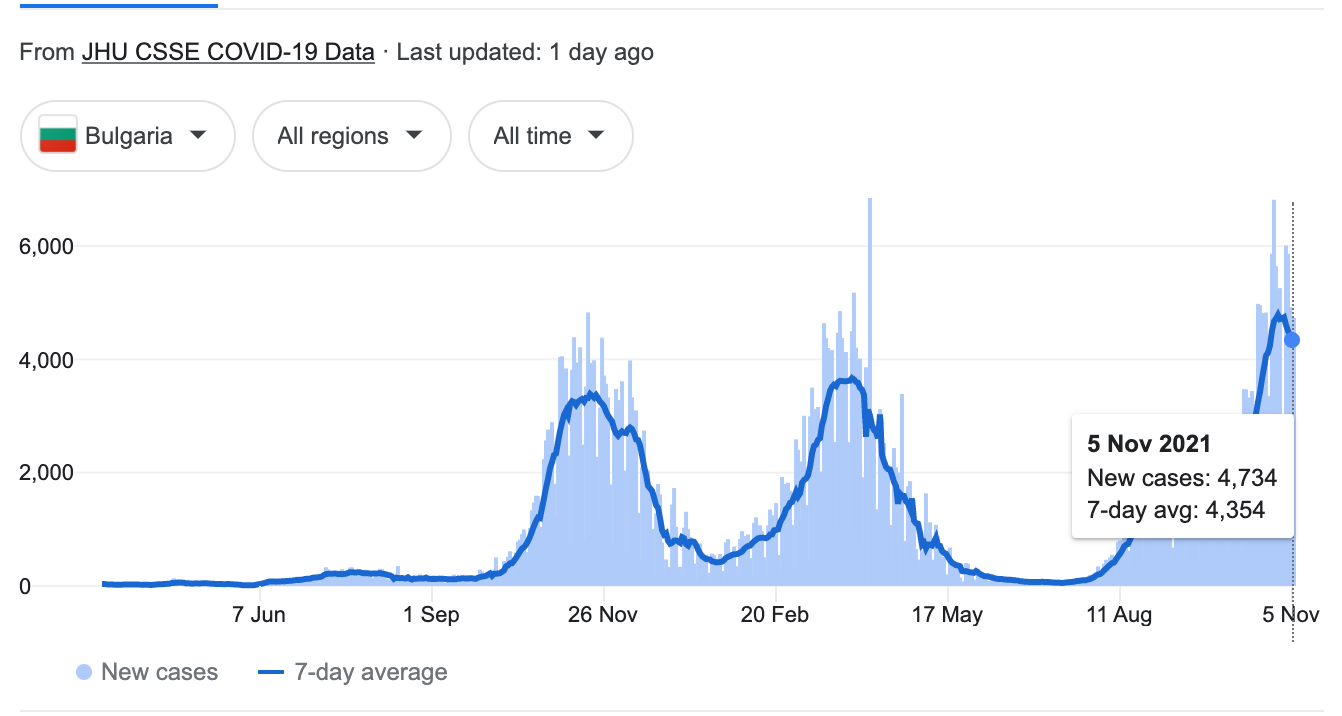

Romania and Bulgaria. Lowest vaccination rates in Europe. Covid cases spiking hard for both countries since the summer of 2021 plateau.

Bulgaria, the EU member with the lowest percentage of people vaccinated against COVID-19 (25.3%), reported a record number of 310 deaths Tuesday (2 November), while Romania, the second least-vaccinated, also hit a record of 591.

In Bulgaria, 93.87% of the deceased have not been vaccinated. These latest figures bump the death toll from COVID-19 since the start of the pandemic, to 24,309.

Doctors in Romania have issued a public plea, saying they are “desperate,” as infections and deaths continue to mount. A dramatic letter called “Call of despair” was published on the official page of CMMB, a medical professional organisation based in Bucharest.

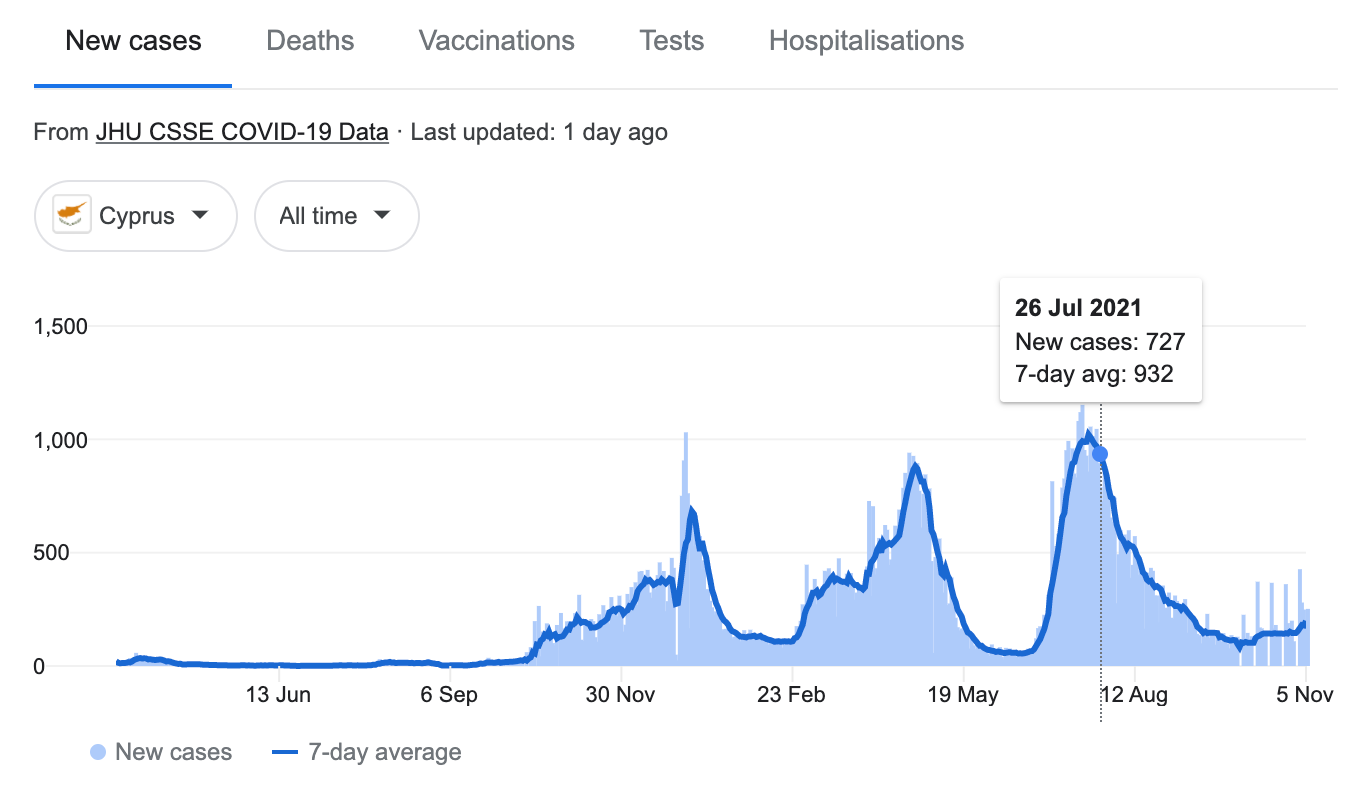

Cyprus. Covid-related business damage has been contained.

Covid deaths

Deaths in Bulgaria and Romania have been spiking materially, in line with new cases. Deaths in Greece are also elevated but seem to be controlled. Deaths in Cyprus remain at a very low level.

It seems that new cases and deaths from covid will ebb and flow for a long time until 1) we get enough herd immunity 2) we get enough vaccine immunity 3) most of the immunity-compromised persons get sick 4) and a drug is effective in stopping transmission of covid. This Pfizer drug could be it.

But how has covid influenced business performance?

For the first half of 2021, Operating income is up significantly in all these countries relative to last year’s first half. While the share price moves tell a different story, it seems that Covid has not been so destructive for the company.

Actually, we find from the historical research on Jumbo that price swings much more than business performance.

As an example, even with the massive volatility the share price has seen since 2010, the business has increased sales steadily every year since then.

Jumbo still has a lot of levers to pull to achieve more growth in the future. This growth can come in the form of 1) More sales per existing square foot of retail space 2) More foot space in its existing markets by building more stores 3) Building Jumbo in new countries as well as 4) A continued roll out of e-Jumbo.

Too Long, Didn’t Read

High quality growing business with fortress balance sheet still selling for 40% below its pre-Covid peak. We believe the reasons for this are supply-chain worries and continued fears surrounding covid in the company’s main markets, Greece, Romania and Bulgaria.