During the past few years in the crypto space, many projects used the airdrop model to jumpstart momentum on their network/protocol and achieve critical mass faster.

An airdrop is when cryptocurrency is sent into someone’s crypto wallet without him actually buying it. This is how it happens - an airdropper wants adoption of his crypto-related project and by having a large number of airdropees receive his cryptocurrency, he is one step closer to achieving it.

Airdroppers usually send crypto to people that have contributed to the early success of the project in one way or another. This could be software developers that helped build the network, miners, liquidity providers, community members etc.

Before the airdrop, other ways were used to achieve adoption and critical mass. For example, the early miners of Bitcoin (BTC) back in 2009 provided their modest CPU power to mine the first blocks of the Bitcoin blockchain at rate of 50 BTC per block. They weren’t really doing it for money back then, they were just enthusiasts and supporters of the whole idea. Bitcoin barely had a market price so their BTC was not worth anything.

On May 22nd, 2010 Laszlo Hanyecz famously known as the “Pizza Guy” traded 10,000 BTC for two pizzas. 11 years later and the price of a single BTC is hovering around $50,000. The network increased in vale by literally thousands of times in a span of 11 years.

How could network value increase from practically $0 to $50,000 in 11 years? The answer lies in network effects.

A network effect is the effect by which the value a user receives from said good or service is dependent on the number of users in the network at the time. The more the users, the higher the value and vice versa. But what happens when critical mass has not yet been achieved?

Many projects get stuck in the early stage and fail, it’s a catch 22. In the early stages, network utility is at its lowest so there is not much incentive for a user to migrate to the network.

The Bitcoin network was allowed to function and stay live by its first adopters - the first miners and first transactors of the network. The earlier the adopter, the greater the total future value. The early adopters of the network have been awarded massively as adoption and network effects took the price of BTC to $50,000.

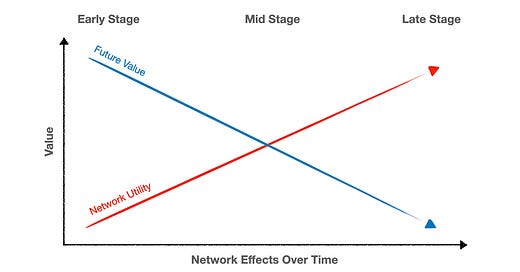

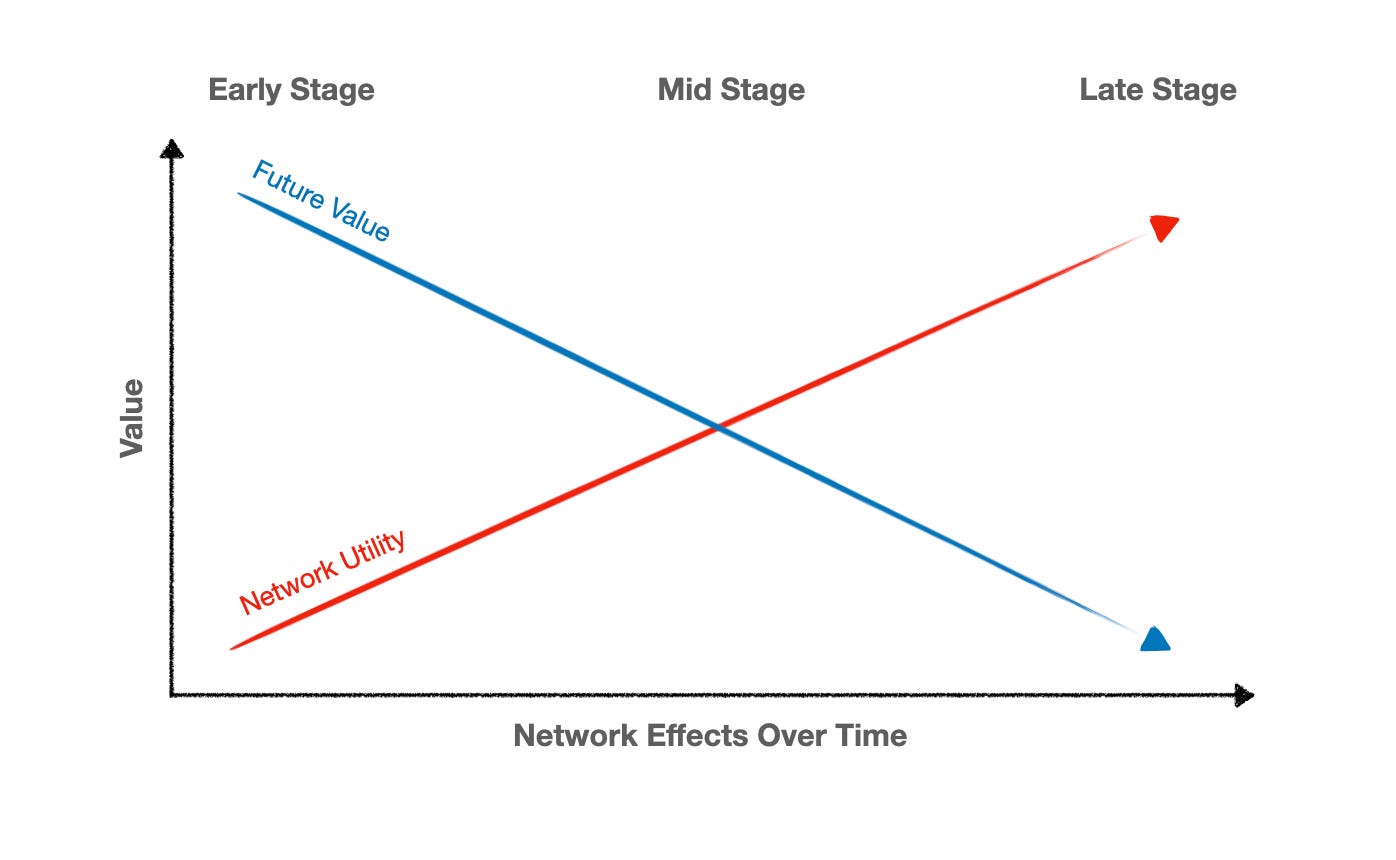

The chart above illustrates what I am trying to say. In the early-stage, value is low as network effects have not yet reached critical mass. Due to this, it does not make sense for users to flock to the network en masse as the value they are getting from that network is low.

However, when you find a way to reward them with something that will gain in value as the network gains in value, you are reimbursing them for the value they are foregoing should they have migrated to the network later on as well as offering an incentive for their assistance in jumpstarting the process.

In the case of the Bitcoin network, that reward was BTC which appreciated in value as the network was adopted over time. The results was that there are thousands of Bitcoin millionaires around the world today which became wealthy as the network succeeded.

On the contrary, the early adopters of PayPal, eBay, Facebook, Twitter etc., did not benefit financially from the subsequent successes of the networks they helped jumpstart. In other words, their network effects chart was missing the future value (blue line) as above.

Network effects also exist in other sectors besides crypto or internet companies. The effect is much less pronounced because the divergence between network utility today and future value is not as big.

In the investment management industry, without critical mass in assets under management (AuM) - a fund cannot even launch. The regulatory burden has increased in the past decade, and so have costs. Therefore, all startup fund managers were allowed to jumpstart their operation by the help of anchor investors who helped them get to critical mass in AuM.

The ones who had a good investment strategy and racked up a decent track record create massive value for their investors and their company.

I propose a model of jumpstarting early stage businesses by attracting the first adopters to migrate onto the network or company, use its goods or services, and act as a magnet for new users - by incentivising them financially.

For example, for an investment fund launch, the first investors that come in the fund could be incentivised by receiving a given percentage of the management company considering they stay invested in the fund long enough.

This simple tactic would do a lot for jumpstarting momentum for the fund and help achieve critical mass going forward.

“Someone is standing in the shade today because someone planted a tree a long time ago.”

-Warren Buffet