You can opt out of Breakout if you don’t want to receive it in your inbox here: Opt Out Here.

In late December I announced my intention to launch Breakout by Philo, a section of Philoinvestor that would fully focus on analysing markets from a technical perspective.

My goal with Breakout will not be to “predict” markets — but rather to listen to them intelligently.

Considering how complicated the current setup is — with all the macro and geopolitical issues around us, one could always use technicals to listen to the markets for help in his decision making.

Having said that, whether times are bad or good, technicals can always help!

Personally, I started out in markets with technical analysis — then moved on to fundamentals, and then shortly thereafter added macro on top.

In the past few years I could have listened to technicals in many occasions to make better decisions, but ignored it and sided with fundamentals 100%. However we all know markets don’t follow fundamentals perfectly. Even George Soros thinks so.

“Scientific method seeks to understand things as they are, while alchemy seeks to bring about a desire state of affairs. To put it another way, the primary objective of science is the truth - that of alchemy, operational success.”

—George Soros

From Shadows & Traps. I recommend you all read it.

If you are a macro guy, you only see macro and economic figures. If you are a technical analyst, you think charts are the only truth. If you are a fundamentally-oriented investor, you think only your company’s fundamentals should influence price. No.

If your perspective is limited, you only know what you see. This is the trap that macro-intellectuals fall into, they only know economic theories, news and economic figures. They end up believing their own theories and for them — those things must happen, they must play out.

Every additional data point is used to confirm their biases and pre-conceived notions. Then, when their thesis doesn’t play out they move the goal posts and find excuses.

Breakout, Issue #1

Where do we find ourselves in markets in January 2024?

Well, the US indices have been rallying since late October, primarily on the back of falling inflation and expectations of the Fed lowering rates within 2024.

The US 10-year went from a 5% in October 2023, to swiftly crashing to under 4% by the end of the year. Panics and fears of a blowing out of yields subsided and the stock market caught a bid resulting in rallies for the major US indices of 17% to 27%. Bottom to peak the infamous ARKK rallied a staggering 61%.

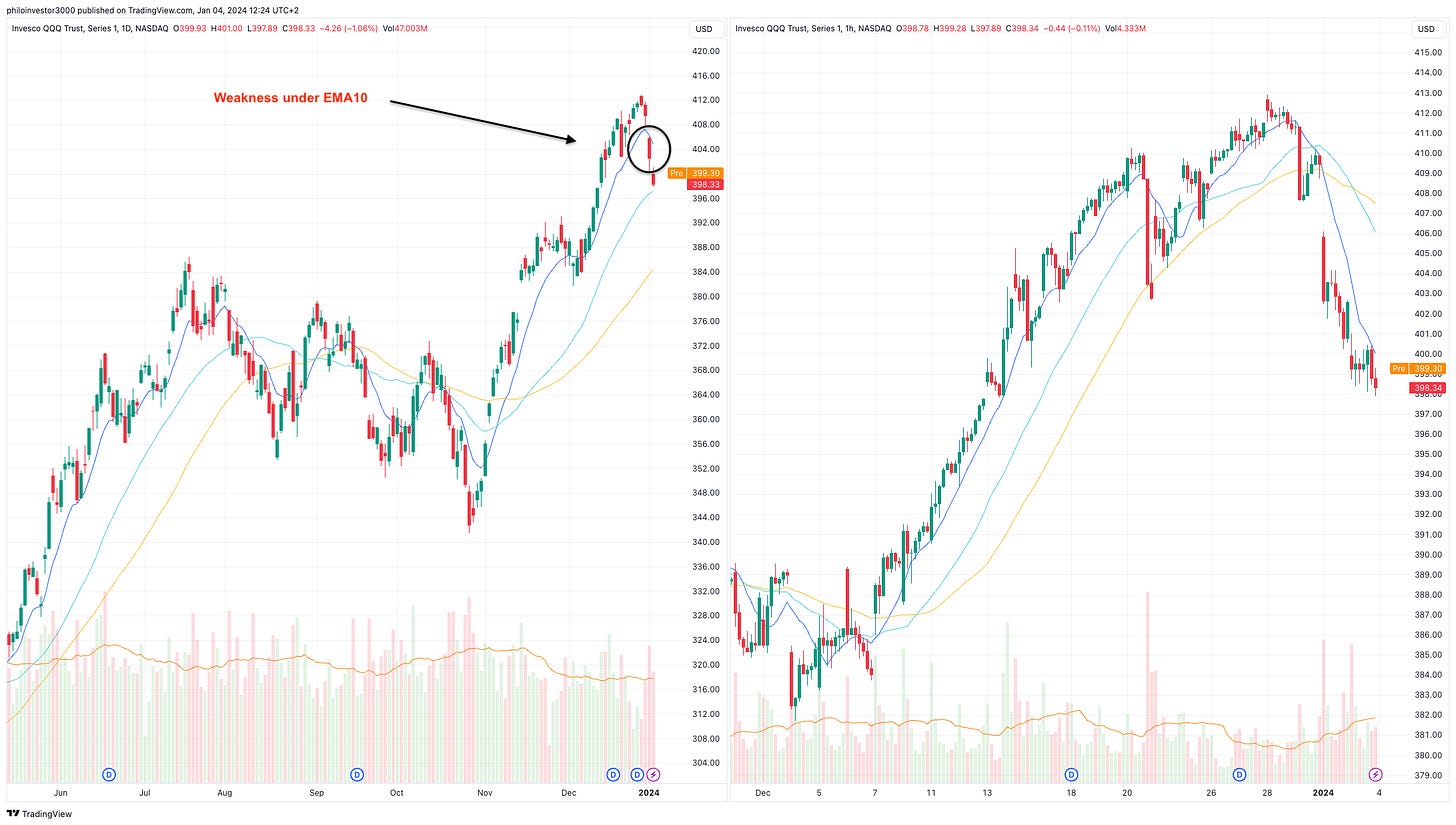

But everything sharply reversed as we entered 2024

The narrative started to change as the single-day selloff of December 29th tripled down to selloffs on January 2nd and January 3rd.

After such major rallies, why buy now?

Even Crypto caught a bid…

BTC is up 60% since mid-October and ETH ~50%. But expectations of falling interest rates wasn’t the only driver for this. The SEC is generally expected to approve 10 Spot Bitcoin ETFs before January 10th, or otherwise very soon.

This spurs expectations that more people will buy BTC directly, raising the price of Bitcoin when the ETFs do indeed launch and start buying BTC directly from the market.

Granted, markets are seldom this linear and it seems prices have already rallied in anticipation of this. 👇

Interesting setups

I used my momentum scanner to look for stocks that rallied parabolically during this short bull market, and prepared to look for setups to short them.

In the past two weeks I established shorts in Crypto miners, pharma stocks and other tech-related companies.

By the way, a brief look into the fundamentals of listed Crypto miners tells me these companies will probably never make money.. making them primarily trading sardines, rather than actual companies.

C4 Therapeutics

C4, a biotech company spiked in early December after they announced a massive deal with Merck:

“C4 Therapeutics shares were up 77% to $2.09 after the company entered into an exclusive license and collaboration agreement with Merck to develop drugs that are designed to selectively target and neutralize disease-causing proteins in cancer cells."

After fading back down C4 formed a flag and broke out of a tight range in late December. Before the broad-based selloff C4 was up ~50%. I am keeping this one in my watchlist for future setups.

Absci Corporation

A typical parabolic short pattern as described by Stockbee and Kristjan Kullamagi, ABSI rallied 4-5x from its bottom, moving parabolically in the final few days before its peak. I shorted at the first signs of weakness at 4.50ish and still holding. Absci is an AI-powered drug company, whatever…

Fusion Pharmaceuticals

Another biotech company in the parabolic short pattern. This momentum burst was fuelled by analyst upgrades and a lot of activity in the space that Fusion is in.

“Fusion Pharma climbs as analysts flag radiopharmaceutical company as potential merger target”

It is what it is — I shorted Fusion at 9.39 and still holding. I wouldn’t be shocked if this name revisits $6.

MARA, SDIG and WULF

These cryptominers rallied with the rally in BTC and ETH, and went parabolic as well. I stalked these setups and shorted them all as they broke down. I didn’t treat these shorts like others because overnight reversals in Crypto usually wreak havoc in these trades and you need to stay more vigilant.

So this is how I played it: I shorted them all as they started to break down, but took profits when they violently approached their EMA10 on the daily. Next day the gapped up because of movements in Crypto underlying assets, and I re-shorted them on weakness. On Wednesday they actually gapped down and I took profits when I realised that a rebound could be shaping up.

I’d rather be lucky than good..!

One Single Breakout - EyePoint Pharmaceuticals

Not many longs setting up these days for the reasons explained above, but there was one “special situation” breakout that I took. EYPT announced positive data for macular degeneration and the stock gapped up violently. After forming a flag it broke up again and I went long, sold half after a few days and closed the full position when I saw weakness and the indices confirming.

Enough for today.

Sincerely,

Philo 🦉