Picks from Philoinvestor.

Could ASOS be bought out? Tweet.

The teachings of George Soros in short note form. Link.

How the Chinese Yuan is paying for the COVID ZERO policy. Tweet.

Thread on UK and EU politics exactly one year ago. Tweet.

Plato’s allegory of the cave and the stock market.

The last mindset piece on Philoinvestor.

Previous Megaposts.

Paid Post List

Dump your Crypto. October 27th, 2021 @ BTC >$60,000 & ETH >$4,300

Updates on Wayfair, Vermilion and Farfetch. January 24, 2023

ASOS

I wrote about ASOS on December 13th 2022, when it was selling for 5.40 Pounds. It first rallied to 10 pounds and is now at 4. A lot of volatility on this formerly-loved but recently much-hated online retailer.

Market wasn’t pleased with uncertainty surrounding the RCF and short-sellers were circling the name. Market narrative turned from hope (late 2022, early 2023) to despair as the market didn’t respond well to the May 10th results of the first-half 2023 (ending February 28th 2023), or the company’s developments with their capital structure and their debt.

In my opinion, by reading tweets on the name and discussions with investors - the company is deeply misunderstood.

What’s the narrative?

ASOS is being outcompeted by physical and online retailers. ASOS can’t possibly keep up with NEXT, Primark or the Chinese marketplace Shein. They borrowed money at 11% rates and so they will have a slow and painful death. The equity is worth zero. Management is saying all the right things but I don’t trust them anymore. I got burned so I will never believe in this name again! They are useless.

And what’s closer to reality?

ASOS was spending too much time and energy on the RCF amendment and extension situation, and this was being reflected on investor sentiment and uncertainty. I assume there must have been pressure from major shareholders to deal with the issue more robustly, as the last amendment was only until November 2024.

There was a fear that ASOS wouldn’t have enough time to execute its Driving Change agenda during that time, and covenants from the syndicate of 5 banks that provided the RCF would possibly be breached. So what did ASOS management do?

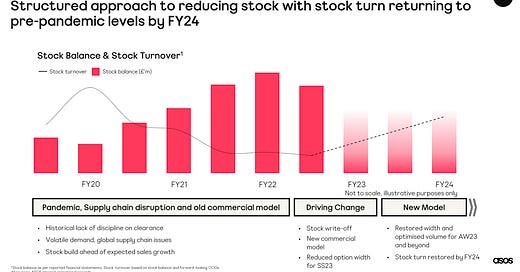

“As announced on 25 May, the Company strengthened its balance sheet through a new, long-term 275mln GBP financing facility and an 80mln GBP equity raise. The new capital structure provides ASOS with increased resilience and financial flexibility, free of any profit-based covenants. It is fully aligned with ASOS’s shift to its new commercial model, which includes reducing inventory, faster clearance of unsold stock and improving stock turn.”

The new facility matures 2026 with option to extend, at an interest rate off 11% per annum, which is not much higher than the rate paid on the RCF the company had before redeeming it. The loan only carries a liquidity covenant and management believes it gives it ample room to execute the required transformation.