Nasdaq breaking down. Saylor breaking down too.

Issue #12. The importance of the >2 Year AI Trend.

For the last Breakout issue, click here. For the emergency breakout sent on Hesai Group and the Lidar opportunity, click here.

In this issue we will review market moves, see how our stance and expectations from previous issues has been playing out and formulate hypotheses about future moves.

Gold

Gold in a long-term uptrend. Blue arrows show breakouts from older technical formations that we flagged right here in Breakout. The turmoil of this week and obviously resistance around the $3,000 level brought some selling to the yellow precious metal.

It seems the flow was profit taking in Gold and a move to treasuries, we’ll get to that later. Right now the catalysts that could stop this trend in its tracks and cause a reversal will be: 1) Recession and/or 2) Disinflation.

Also progress on the infinite budge deficit tactic of all western nations, especially the US.

Moving on to the Dollar…

Dollar Index (DXY)

After a retracement back to the upper boundary of the 7% long-term range, the Dollar found support and moved up. I think this was precipitated by a risk-off / safe-haven trade with the turmoil of this week.

Everyone is confused — and so are markets. So what did they do? Bought some USD and some Sovereigns.

The Euro

The Euro benefitted from some Ukraine-related green shoots as progress on the front was brewing, with Trump and Putin making historical moves to solve the impasse. But antagonism from the Europeans and the sell off in stocks benefited the Dollar, weighing down the Euro.

The Yen

What did we say about the Yen in the last issue? Check here. And indeed the USD couldn’t move higher against the Yen with the current setup, giving a good trade to go long the Yen.

Then a strong CPI caused a rally in the USD/JPY which later sold off. I traded and gave my thoughts on the setup live on the Philochat, here.

Now the pair is finding support on the previous support level in late 2024 and bouncing together with the USD. The setup is still strong for the Yen strengthening with the BOJ-eans ramping up a rhetoric of further rate “escalation” 😂🇯🇵

If you didn’t get it I mean they are hiking rates, we could see the USDJPY back to 140ish.

The Yuan

Triple resistance — for now. The USD can’t break above the 7.4 level against the Yuan. With progress in China as Xi re-opens his arms to his business-children (Jack Ma etc.), and the Chinese market reacts positively — it may not be easy for the Yuan to fall lower.

But technically speaking, we are here for every eventuality.

Crude Oil

Same setup on Crude. Going nowhere. This market needs a major event to get it out of its rut — whether up or down. When there are moves we will talk about them.

Now, there is nothing to talk about!

Bitcoin & Microstrategy

Ah! Our beloved digital coin!

We called out the sideways formation on BTC and viewed it as the calm before the storm. We informed Philoinvestors not only on the Philochat and in Breakout — but also with Dump your Crypto 2.0.

Same story with Microstrategy. We heavily warned against Saylor’s practices with Microstrategy and the delusions surround this Bitcoin Supremacy stance.

MSTR’s Average Price per BTC right now stands at $66.5K. Another sell-off and we will be close. What happens then Saylor?

Ethereum

Do you see the yellow resistance area?

We previously talked about how the resistance area of $4,000 would prove to be a problem for Ethereum — especially as the Crypto coin was definitely not a strong part of the current crypto cycle.

It touched $4K a few months ago and almost hit $2k today in its post-Trump tariff dump. Too fickle!

Ethereum is nearing the $2,000 level and the whole project is going through an existential crisis and a crisis of confidence regarding the future of the project..

If something drastic doesn’t happen, we could see this back below $1,000 — where is Vitalik?

EQUITY INDICES

We have been preparing the ground for Philoinvestors to understand where we are in the cycle with pieces on the AI Cycle as well as pieces on the Macro/Geopolitics setup + individual pieces on single stocks that have led this bull market like Microsoft, Apple etc. (Refer to Downside by Philo)

In this section we focus on the technicals, having covered the fundamental setup part of the equation! 🔮♟️🦉

Nasdaq

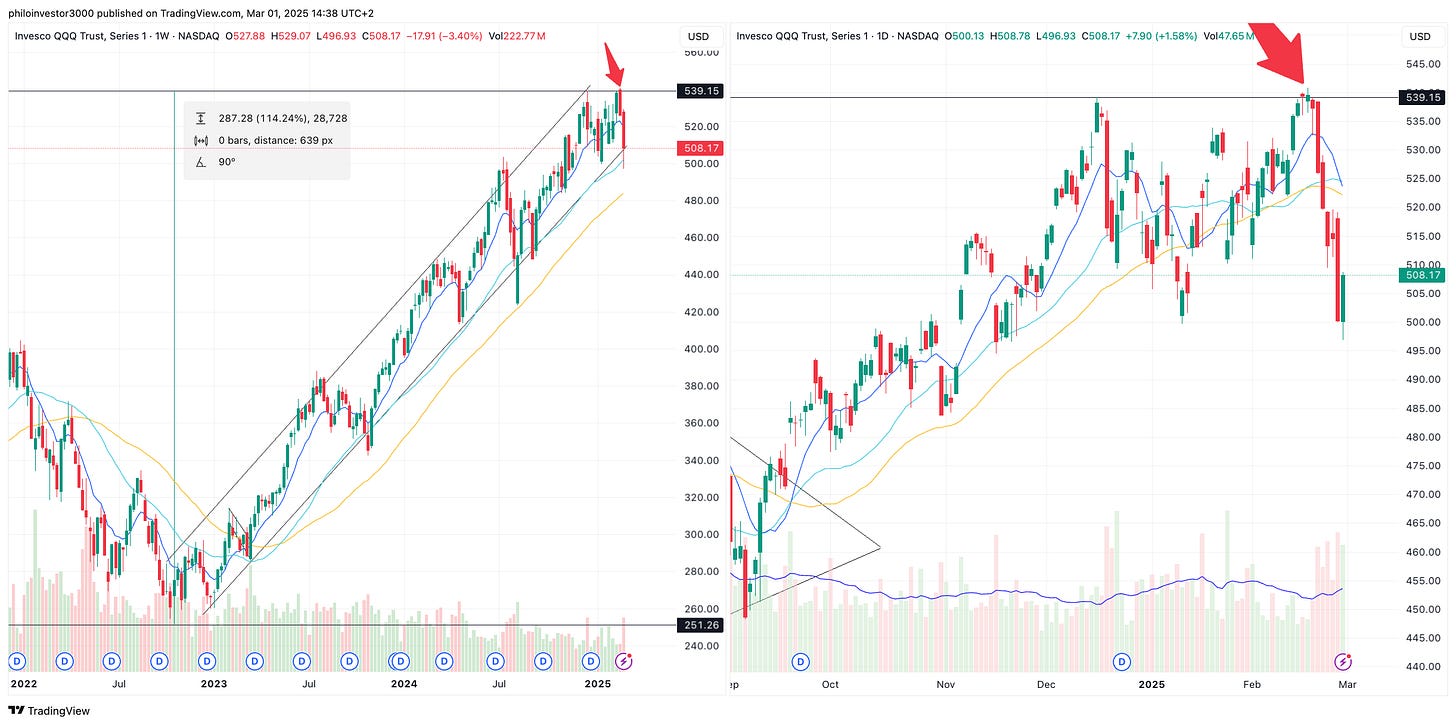

From the Philochat on February 19th, LINK.

Nasdaq flirting with ATH, last high from December. I bet everyone gets excited of the level as it breaks, and then the index smacks back down.

—> And this is exactly what happened. The Nasdaq made new highs briefly and has been tanking ever since. The market breached the lower bound of the channel (See chart) and managed to stage a rebound on Friday.

We used this setup to look for intraday reversals to go long, as explained in yesterday’s Philochat here.

“Every correction is a test.” —George Soros

Not looking to get too cocky here, this sell off could have been another test of the overall progress. We don’t know the news that will come out next week and how they will affect stonks.

We will continue to play the field as it evolves. That being said, I don’t see much upside from these levels so I am biased for bearish moves! 🔻

Russell

Poor old Russell… Not even Trump 2.0 Hype could keep you up..

We never really got interested in this market as we covered the reasons why we were fading Trump 2.0 rhetoric in “The Spell of Donald” and many other pieces.

The yellow resistance area (on previous high) was the test. Russell was probably going to fail on that level if the narrative failed — and so it did.

Commentary from the previous Breakout issue

With all the Trump Trade hype and the Russel hasn’t even managed to break its late-2021 high. Sucks.

This market could easily reverse back down to 2,000, so why bother? I see nothing to play here.

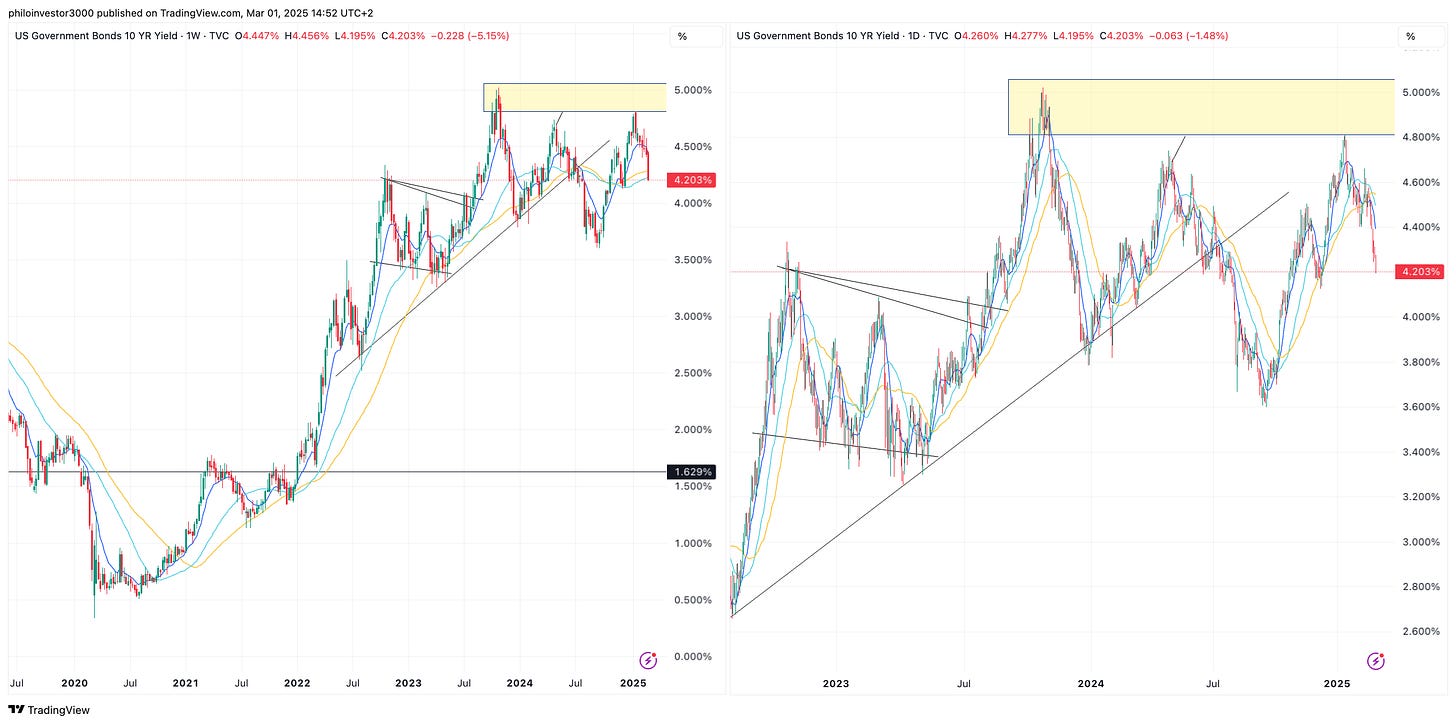

The 10-Year Treasury

Yields rallied nearer the election and post-Trump election, but hit a wall around the 4.8% level. It just so happens that the area was a level of prior importance.

If yields move above the yellow area — we will have problems.

NVIDIA & DeepSeek

In late January DeepSeek was let loose and rattled markets. We wrote a thought piece on the implications of this, here.

Nvidia found support on the 50-Weekly MA and bounced hard, now it’s moving back down even after blowout results from Nvidia this week. I guess markets price forward?..

The red circle and arrow on the Daily chart show the first green hourly candle after a parabolic move down. I used that as an entry signal and still long Nvidia as we speak. I will try to stay long as long as I strength this week — and start taking profits on reversal.

News currently seems to suggest that even the Chinese need Nvidia chips to run their DeepSeek model — which is NVDA bullish. But let’s see how the narrative shifts in the coming weeks. Because it will! I expect volatility, obviously.

Palantir

Purely a parabolic short pattern which found a wall at $125 and faded down to $80ish before rebounding. We shorted the parabolic short (I talk about it in the Philochat), covered too early (made $13 per share) — the stock bounced but then faded again, I didn’t re-short when I should have.

Anyway I am long now using the first green hourly candle shown by the red arrow.

Reasons for the sharp selloff were probably the CEO’s filing of cashing out >$1 billion in shares and signalling from Trump in cutting/re-allocating DoD expenditure. Sentiment is a strong force.

Even so, Palantir’s valuation using conventional multiples is so obscene it reminds me of this skit by Irish comedian Tommy Tiernan.

Big Cloud

How is that theme going? Let’s have a look.

The highlighter is from older charts — the stock broke up, failed and is now moving lower. It seems MSFT can’t hold up the narrative. Satya Nadella’s comments on Data Center profitability and rumours of them pulling back on their capex spending isn’t helping either.

Google seems to be suffering from the same problems with a $40 down move on a $210 stock. On the Weekly the stock is sitting on its MA50 — let’s see what happens from here. I have no strong conviction on this name.

If you have any chart requests, just let me know in the chat.

Sincerely,

Philo 🦉

Let’s discuss more in the Philoinvestor community chat, link below.