“The world is getting more and more fat tailed.” —Philo

“The market is not efficient.” —Philo

I first talked about “Broken Markets” in this short podcast here.

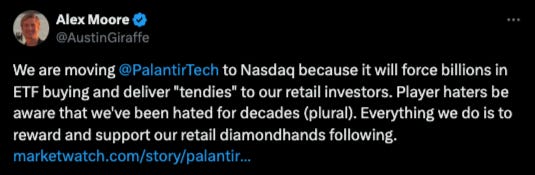

Trading in the shares of PLTR is getting out of hand, with one of the company’s directors yesterday coming out with a stupidly incriminating tweet.

This came after the announcement that Palantir will be listing on the Nasdaq, from the NYSE where it currently trades.

Alex Moore later deleted this tweet and disabled his X account… WOW! Doesn’t seem too serious. PLTR is up 4X YTD.

“We are moving Palantir to Nasdaq because it will force billions in ETF buying and deliver “tendies” to our retail investors. Player haters be aware that we’ve been hated for decades (plural). Everything we do is to reward and support our retail diamondhands following.”

A Few Thoughts

"Tendies" is a slang term referring to gains or profits made on investments, such as stocks, though its origin comes from a favored food.

After cashing out $20mln in share options in the past 5 years, Alex Moore owns ~1.5mln shares, valued at $66 right now = $99mln.

No wonder he is losing his head.

Alex Moore’s comments show how companies are GAMING this whole Passive/ETF wave and the ways that retail invests these days.

That means companies/managements are getting CONDITIONED to act in ways that short-circuit the top-down value-agnostic ways that ETF’s and the like seek to invest.

In short: this won’t end well.

Conclusion

In the podcast I give my thoughts as to what could be giving rise to these ever-increasing market phenomena.

Namely, I think FOMO is increasingly infiltrating every aspect of our lives — and this is reflected in markets exponentially.

For the course, philomastery.com

Sincerely,

Philo 🦉

P.S. PLTR is in a parabolic short and I will look to short on confirmation. Will analyse its technicals in tomorrow’s Breakout issue.

Share this post