Peak American Empire

The weaponisation of currency

“Gold is money, everything else is credit.”

- J.P. Morgan

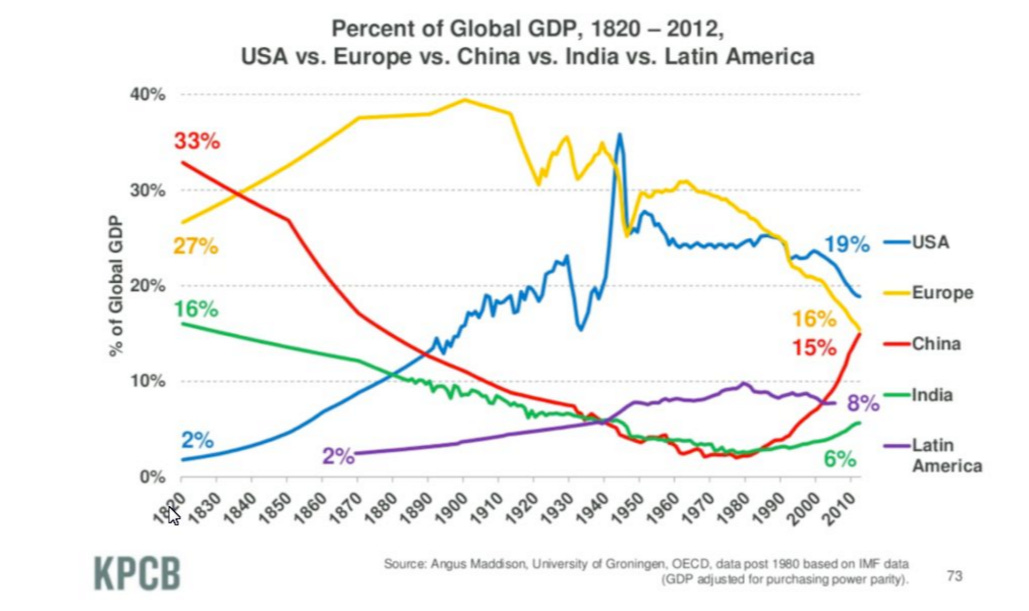

The world has been dominated by the dollar for more than a century. The dominance of the US and its allies put the USA in the forefront of economic growth and development. No country existed to rival that dominant position.

Since the late 1800s the US monetary system operated under the gold standard where the dollar was linked and convertible to gold. Money was basically paper gold.

Then in 1944 the Bretton Wood system was formed (i.e. the dollar standard) where the dollar was pegged to gold and other currencies were convertible to the dollar with a fixed exchange rate. Gold convertibility applied only for foreign governments and central banks (the “foreign countries”) and not private holders.

Foreign countries kept their reserves in dollar believing they could convert them to physical gold anytime, they trusted the system. For decades it worked until the US started to print new dollars, run budget deficits and debase the currency. Foreign countries took note and realised their dollar reserves were losing value.

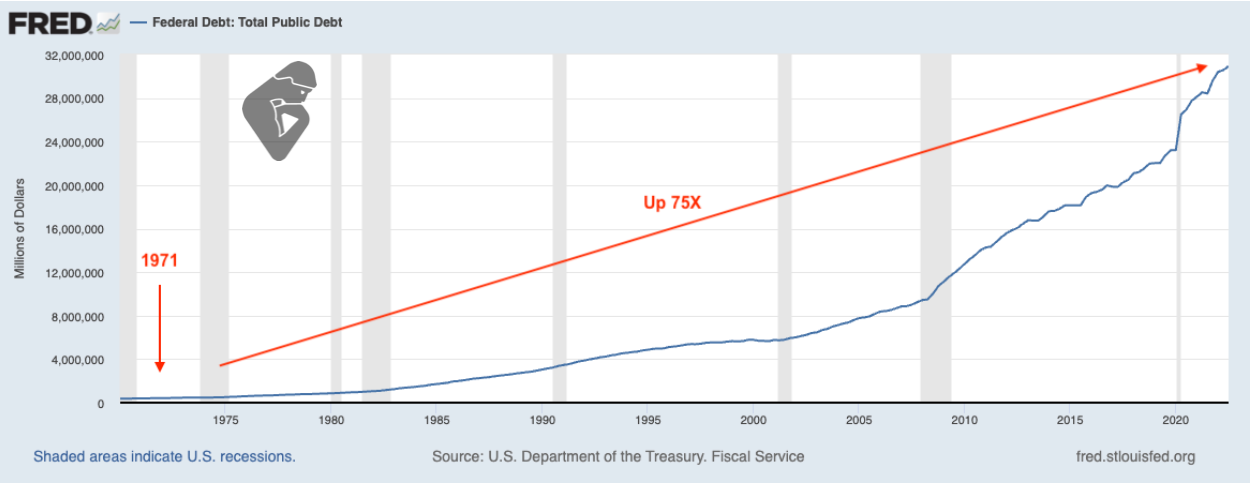

In 1971 as foreign countries were converting their dollars to gold (i.e. a run on gold) and leaving the Fed with diminishing gold reserves — Nixon decided to front run them. The US pulled out of Bretton Woods and left them holding the bag.

Since then, those dollars are down 57X vis-á-vis gold. I am certain the foreign countries did protest but could not force the Americans to give back the gold.

Still without any alternatives the dollar remained the reserve currency of choice keeping it strong. Under a fiat-currency system, printing dollars was much easier. Money went from being paper gold to being just paper.

With the gold peg now fully abandoned, Keynesianism1 went into overdrive and further dominated economic thought and policy making. Increased GDP across the Western world and an expanding public sector all worked together reinforcing the US economy — albeit with considerable budget deficits.

Productivity gains from technological advances and labour gains arising from cheaper manufacturing overseas masked the inflation that would have been caused by the monetary expansion.

Meanwhile, no power was strong enough to threaten the American military reinforcing their position as hegemon of the free world. But all this military advantage came at a cost — today the US spends >$900 bln in military expenditure2 a year.

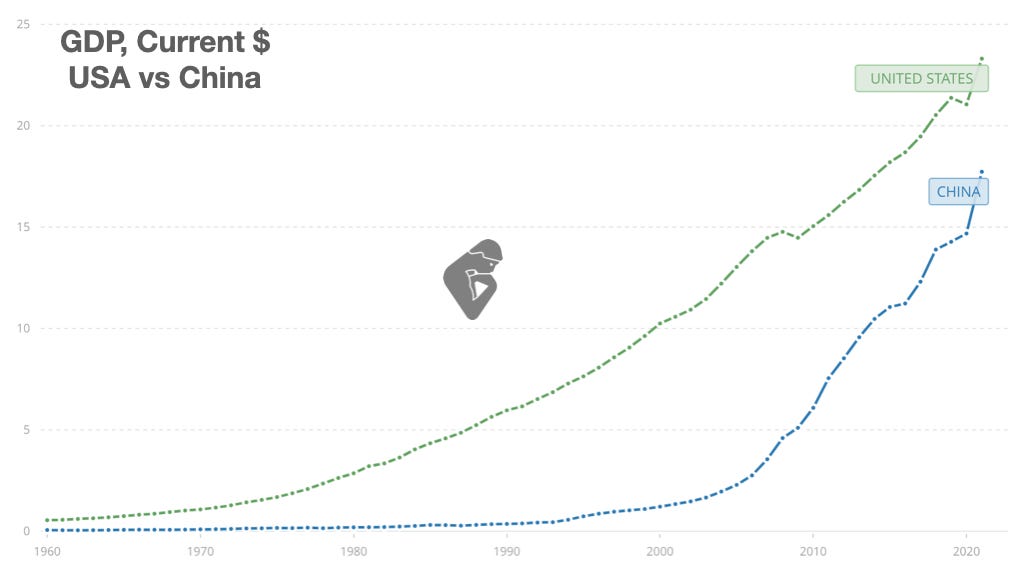

The dollar's reserve status allowed the US to finance its deficit cheaply, which enabled this massive army. But now the USA no longer has the monopoly in world domination. Looking at percentage share of global GDP the West is in decline3 while the East is ascending.

Now alternatives do exist. Recently the Biden administration had a public tussle with OPEC and the Saudis about annual crude oil production. Biden asked for increased production as he looked for ways to relieve inflationary pressures.

When the OPEC declined for reasons they publicly communicated, Americans issued threats. This is not smart diplomacy and this sort of rhetoric will result in further counter actions. The KSA (Kingdom of Saudi Arabia) has applied for membership in the BRICS4, a coalition of countries which are viewed as a threat to American hegemony.

The Saudis understand how much power they have conceded to the Americans by selling their oil exclusively in dollars. I am of course referring to the famous Petrodollar Agreement.

The more Eastern economies grow, the higher the chance that the Petrodollar Agreement breaks down. The agreement was struck in 1973 between the USA and Saudi Arabia. Now the Saudis want to diversify their foreign reserves and adapt to the new trend of a multipolar world.

Today 60% of foreign exchange reserves are held in dollars, down from ~71% some 20 years ago. Almost 40% of the world’s debt is issued in dollars, even though the US only accounts for around 20% of global GDP.

The Petrodollar agreement sealed American hegemony of the world. The US orchestrated the trade of the century — they used their reserve currency status as a path towards world domination.

An expanding economy with a strong dollar and capital inflows further strengthened the economy and reinforced the uptrend. More importantly, a strong dollar and a strong economy allowed the US to finance its debt cheaply.

50 years later the entire arrangement is at risk. The Saudis are signalling that they are getting ready to push the dollar to the side. Besides, why extract resource from the ground to sell it for depreciating dollars?

If US allies start to pull back from financing the deficit, what would happen? As the Bretton Woods system was destroyed by a run on gold, America as a global empire will be destroyed by a run on dollars. The dollar would be dumped and treasury yields would spike.

Sure, the Fed intervenes whenever needed but that is a slippery slope. Engaging in further QE would spike inflation in the country and there would be a run on treasuries. All of a sudden, the world will no longer be financing the US deficit.

The American empire would then start to officially retreat. The US military is already threatened by armies of the East as they strengthen and develop. But it’s not only money that limits the US military, it’s also the human factor.

Foreign military interventions by the US have reached the point of fatigue. After massive losses from US military operations — it is simply unpalatable to put boots on the ground again.

Moreover, the increasing wealth gap and massive social and political rifts coupled with the general preoccupation of the populace with first-world problems, shows the pendulum has already started to swing the other way.

The Russian invasion of Ukraine unleashed a series of events starting with the massive and unprecedented sanctions by the West against Russia and the subsequent adaptation to said sanctions by Russia.

It has been a year since the war started and sanctions against Russia have not achieved their stated objectives. Namely to weaken Russia, force them to stop the war and maybe even topple their leader, Vladimir Putin.

What purpose did it serve for NATO or the EU to expand to Ukraine? The Russians have communicated for decades that this would be a red line — but the West went along with it anyway!

It’s possible that they knew all along that Ukraine stood no chance against

Russia and that their aim was to find ways to weaken and strike Russia without they themselves standing against the Russian bear.

In other words, there is a proxy war playing out right now where the countries of NATO are in war with Russia and the greater East. At start, Germany and other Europeans were hesitant to escalate. Russia warned Europe not to send tanks and other weaponry to Ukraine but the rhetoric from Europe right now is one of escalation and defiance.

The West’s problem is that they are losing out on global dominance as the East is ascending. US military bases are increasingly being developed around China, to counteract the ascendance of China as a superpower.

Biden recently went all out against China and its semiconductor industry by tightening the noose and aiming to drain them of intellectual property and know-how. Chances are this will not work and will result in unintended consequences — the Chinese will adapt to this reality and end up building their own.

The technological advantage that the US had for so many decades is tightening. Globalisation comes with side effects! The US doesn’t control the world anymore, even though they are surely trying.

You see, the West wants to use Chinese labour and resources but doesn’t want to allow China to have a say in how the world is run. And Russia is seen as an extension of China and its ascendance.

The 10-year yield on treasuries now sits at 3.95% (a 15-year high), but inflation is running at more than 5%. The real return is negative.

The US is borrowing money at cheap to negative rates in real terms, and uses the money to basically control the world. Annual military expenditure is close to $1 trillion and the budget deficit is approximately the same.

For now, the Fed could intervene whenever required to calm markets in times of crisis, keep the rates down and make it easy for the US treasury to continue borrowing cheaply. But can that go on forever? Not really.

The Fed already owns 20% of US government debt. All signs point to further currency debasement for the dollar, and it is obvious that foreign holders know this and follow the trends closely.

Governments globally have increased gold purchases, diversifying away from fiat currencies. Critics to this idea insist there are no alternatives to the dollar. But it’s not only about alternatives, it’s also about trust.

For instance, why hold dollars when you can hold gold? Why buy treasuries and risk getting killed by spiking inflation? These are the predicaments plaguing those who manage their nation’s wealth today.

There need not be a direct competitor to the dollar for things to break down. In fact, the system breaks down if foreign countries start reducing their dollar reserves because the system needs ever-increasing dollar-denominated reserves to keep functioning.

The EU, via their leader Von der Leyen (“VdL”) has repeatedly declared that Russian assets have been confiscated. Some $600 bln has already been locked by the EU, and VdL is making proclamations that they will be used to rebuild Ukraine.

Other countries are taking note. China and the KSA have also received direct threats from the West recently. What if their reserves are confiscated one day too?

Western leaders seem to think that their actions have no consequences, but they do. There is talk of the Petroyuan to compete with the Petrodollar, but I don’t believe the world will transition to a unipolar order again. The future is multipolar.

Whether we move to a full-blown world war or not, the writing is on the wall. The USA is already past its peak in global hegemony and the world is entering a new paradigm. One of increased conflict, alternatives and multipolarity.

The outcome the US will get out of this will depend on the course of action they choose. Will it be one of cooperation or confrontation?

For the moment it seems the US is in denial of the multipolar world and is trying to fight it. American exceptionalism is still shaping foreign policy and prevents them from making the right choices.

This week the Chinese foreign ministry published a report5 seeking to expose the abuse of US hegemony in the political, military, technological and cultural domains. This report sets the stage for what is to come in global politics and how China and its allies see the new world order.

Excellent article. Love the way you constructed your thoughts. Many thanks.

Really enjoy these big picture articles.