PODCAST: Philo interviewed by Security Analysis

And more content inside. Nasdaq down 1.3% intraday.

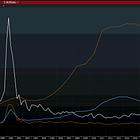

As I’m writing this, the Nasdaq 100 is down 1.4% and decisively piercing through its 30-day moving average.

I touched upon the massive rally in the Nasdaq and the setup for an AI-induced Reflexive Bubble last month — and analysed the setup technically on the second issue of Breakout last week.

I was interviewed by Value Stock Geek from Security Analysis a few weeks ago.

To listen to the podcast on Spotify click here.

Here is the Substack post which includes access to the podcast.

Click on the footnotes next to each sentence for more content on the matter..

What did we discuss?

Using George Soros's teachings as tools for an edge1

Developing macro themes and playing them

The future of the Euro and the EMU, politics etc2

Brexit and the future of the UK

Japan macro and the Dollar/Yen trade

Investing in Apple 11 years ago and what my thesis was

My transition from a value guy to a true value-oriented investor!

Investing in Quality Vs "Bad" Companies3

Market Efficiency and Passive vs Active Investing4

On investing psychology and discipline

A rant on passive investing

Big Tech/AI Hype and the Nasdaq Reflexive Bubble5

Passive investing as a foundation for extracting optionality

The pressure to OUTperform is a trap

Oracle/Cisco in 1999 and modern investing analogies6

Big Tech, the present and the future - too big for their own good7

Big Tech Vs the US Treasury8

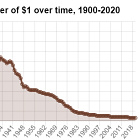

Currency debasement as a massive risk9

The setup on Netflix and what I saw in it 10

Netflix Vs Legacy Media 11

Problems at Disney

Whats the price for $DIS?

The USA being in denial about the multipolar world 12