💥This post was for paid subscribers only (newsletter sent October 31st, 2021) - until the company got an offer to be acquired by Apollo for $20 a share, a premium of 100% from market price.

I decided to open it up for everyone to read.

Tenneco is an automotive components OEM and aftermarket manufacturer currently in turnaround mode. Tenneco is currently selling for less than 1X EBITDA. Let’s cut through the fluff and see why.

Tenneco’s stock bottomed at around $1 in March 2009, at the lowest point of the GFC (Global Financial Crisis). The stock was selling for $37 only 19 months before.

At $1 per share, the market cap was $50 million for a company with sales of >$4.5 billion. Net debt was a modest $1 billion, and apparently the market’s thesis was that Tenneco would never be able to get out of that.

As the economy recovered (with the Fed’s nudging), the share price rebounded and peaked at $70 in 2017 (8-year CAGR trough to peak 70%). Monthly price chart of Tenneco below.

Tenneco had managed to turn itself around, but in the case of cyclical businesses, success breeds failure.

1) Management initiated a share repurchase program in 2015.

“Since we announced the repurchase program in January 2015, we have repurchased 11.3 million shares for $607 million through December 31, 2018.”

That makes out to $54 per share while the stock is currently selling for $13. That’s a lot of value destruction.

2) In early 2018 Tenneco struck a deal to acquire Federal Mogul (Powertrain and Motorparts components manufacturer) for $2.45 billion in cash and stock plus debt assumed (a lot of it), and announced plans to split the consolidated entity in two.

Carl Icahn sells F.M to Tenneco, becomes shareholder.

Carl Icahn held a stake in F.M for two decades until he sold it to Tenneco. Besides being a legendary investor, Carl Icahn is also a great stand up comedian!

Tenneco had to lever up big time to acquire F.M, adding $4 billion in debt on top of the $1 billion it previously had. Tenneco basically made a levered bet on global vehicle sales.

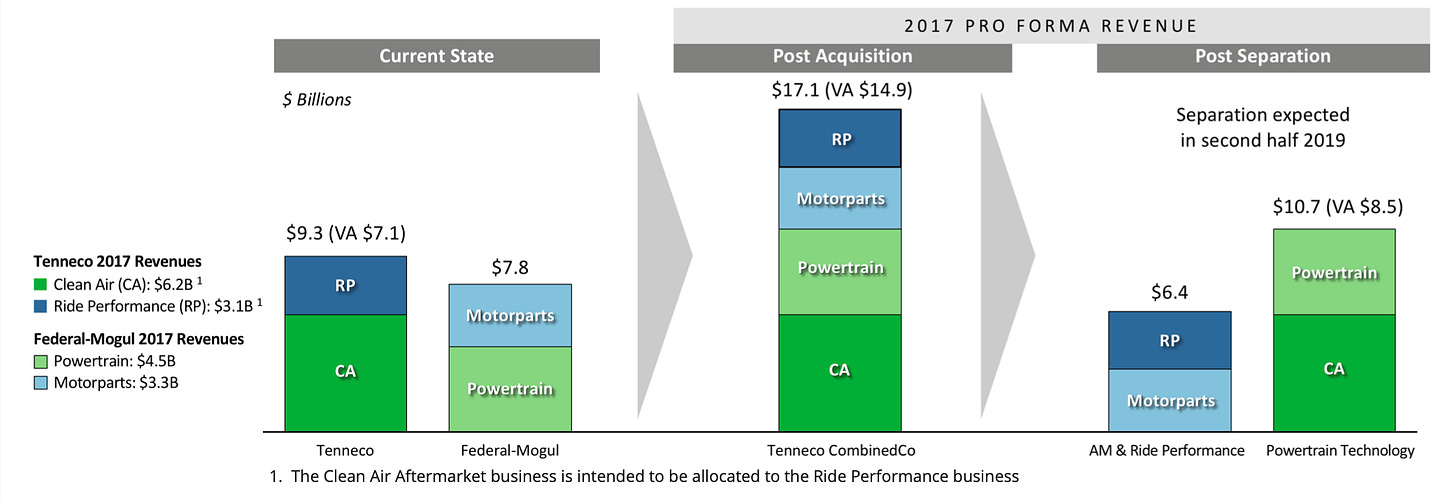

Tenneco had two business segments, Clean Air and Ride Performance (RP). Federal Mogul had two other business segments, Powertrain and Motorparts.

Tenneco wanted to spinoff the Ride Performance and Motorparts (aftermarket) segments into a new entity, called DriV.

That would leave new-Tenneco with the Clean Air and Powertrain segments, turning it into a powertrain technology pure play.

See below visual depictions taken from 2017 F.M deal factsheet.

The planned spinoff has been shelved for now as the company faced problems soon after the acquisition.

Impeccable Timing

In typical Murphy’s Law fashion, disaster struck. Global vehicle production in Tenneco key markets started to drop during 2018. The stock ended the year at $27 per share, down 53%.

Then it dropped another 51% in 2019 (to $13) as a full year 2018 earnings miss, accounting irregularities, weak guidance and a 6% drop in global light vehicle production killed investor sentiment.

And on top of all that, Covid strikes. The pandemic has had long-lasting effects on the autos business including reduced demand, production issues, delayed deliveries and economic uncertainty. If that was not enough, chip shortages make this story even crazier.

“Not only did the automotive market take a downward turn starting in 2018, but the severe impact of the COVID-19 pandemic in 2020 also led to noticeably insufficient procurement activities from major automotive module suppliers, according to TrendForce latest investigations. However, as the automotive market is currently set to make a recovery, TrendForce expects yearly vehicle sales to increase from 77 million units in 2020 to 84 million units in 2021. At the same time, the rising popularity of autonomous, connected, and electric vehicles is likely to lead to a massive consumption of various semiconductor components. Even so, since most manufacturers in the automotive supply chain currently possess a relatively low inventory, due to their sluggish procurement activities last year in light of weak demand, the discrepancies in the inventory levels of various automotive components, along with the resultant manufacturing bottleneck, have substantially impaired automakers’ capacity utilization rates and, subsequently, vehicle shipments.

The recent shortage situation in the IC (Integrated Circuit) supply chain has gradually extended from consumer electronics and ICT (Information and Computer Technology) products to the industrial and automotive markets. In the past, manufacturers in the automotive semiconductor industry were primarily based on IDM or fab-lite business models, such as NXP, Infineon, STMicroelectronics, Renesas, ON Semiconductor, Broadcom, TI, etc. As automotive ICs generally operate in wide temperature and high voltage circumstances, have relatively long product life-cycle, and place a heavy demand on reliability as well as longevity support, it is more difficult for the industry to alternatively transition its production lines and supply chains elsewhere.”

Quoted from TrendForce article, January 28th 2021.

Since January, there have been further chip-related disruptions including a Texas winter storm-induced electricity blackout and two fires in Japanese chip maker Renesas.

As the automotive industry relies heavily on just-in-time supply chain practices, it lacked a backlog of chips to ramp up production. Complicating matters, chipmakers had their own issues. Electricity blackouts following storms in Texas forced Dutch semi-producer NXP to temporarily suspend production. Renesas had a fire. For nearly a week, the Suez Canal, which provides a gateway between chipmakers in Asia and car makers in Europe, was blocked by the Ever Given.

Renesas plant fire, March 2021.

And naturally, global light vehicle production (forecast) for 2021 drops some more.

“The IHS Markit light vehicle production forecast has been cut by 6.2% or 5.02M units in 2021, and by 9.3% or 8.45M units in 2022, to stand at 75.8M units and 82.6M units, respectively. For 2023 we have reduced the forecast by 1.05M units or 1.1% to 92.0M units; this is a front-loaded adjustment and from the second quarter we expect output levels will be able to accelerate as supply chains return to normal. If this is the case then strong pent-up demand and the pressure to rebuild stock levels is expected to support elevated levels of production in 2024 and 2025, with 2024 now forecast to hit 97.3M units, up 3.2% compared to the previous forecast and 2025 forecast at 98.9M units an increase of 2.4%.”

It seems that reality keeps getting worse and worse for Tenneco, but business is never easy. Opportunity is always mixed with difficulty.

Now what?

The company is in the process of restructuring to cut costs, rationalize production, invest in targeted growth, lengthen debt maturities and reduce debt as a means to get back on track.

The not-so-great operating and balance sheet conditions are not Tenneco’s only problem. The automotive sector is going through transformational trends like electrification and autonomous driving, disrupting every legacy trend in existence.

Tenneco is a levered company running a levered business model. The high debt-load it burdened itself with, together with their relatively thin gross margins and high fixed cost base means the company is skating on thin ice.

Why so serious?

Tenneco is trading at a debt-focused valuation, assigning very little value to the company’s equity. At the time of writing Tenneco shares trade at $13.18 each (market cap of $1.08 billion). Net debt as of Q2 2021 is $4.5 billion, giving Tenneco an EV (enterprise value) of ~$5.6 billion.

The market values Tenneco as a turnaround play, setting up the opportunity for big gains going forward.

The Bear Case

J.P Morgan’s take on Tenneco, August 9th 2021.

“Tenneco, following its combination with Federal Mogul, is a leading provider of full-scale emissions controls technologies and other motor parts products, as well as ride control products, for light and commercial vehicle manufacturers and aftermarket customers. The global trend toward stronger regulation of vehicle tailpipe emissions benefits Tenneco’s emissions controls business, and the growing number of vehicles in population in China — and potentially the growing number of miles driven in developed markets such as the United States and Europe upon potential proliferation of autonomous ride-share services — benefits Tenneco’s ride performance aftermarket business. Execution is improving and leverage declining, although the later remains elevated. The growth of battery electric vehicles not necessitating a portion of Tenneco’s product offerings (e.g., catalytic converters and gasoline and diesel particulate filters), combined with high balance sheet leverage, however, cause us to remain on the sidelines for now.”

What is the market thinking? What are they afraid of? 😱

Electrification trends will hurt the company’s ICE (internal combustion engine) related segment, resulting in lower revenues in the future.

Supply-chain disruptions and the chip-crunch will hurt the auto business, making the company’s debt load unsustainable.

If the economy turns south, the company will go bankrupt.

Even in a good auto sales climate, the company won’t make enough to pay down its debt to more sustainable levels.

Annual auto sales could continue in their downward trajectory.

The company has a bullet debt payment in 2023 and it won’t be able to pay it, resulting in default and bankruptcy.

It’s going to take long for the company to restructure its operations, and pay down its debt.

Where will the upside come from? 📈

Tenneco has a lot of operating leverage to benefit from as auto sales come back.

As debt starts to get paid down and business stabilizes, the market will assign much more value to the equity resulting in share price gains going forward.

Electrification won’t happen in a day, and is much further out.

Tenneco currently has 64% of its revenues coming from non-Light Vehicle ICE related business, and plans to take that to 80% by the end of the decade.

The company is restructuring operations and reducing costs.

The company is reducing annual capex, by focusing on increasing capital efficiency.

The company has lengthened its debt maturities resulting in a stronger balance sheet.

It may take time for a turnaround, but rewards can be big. I…WAIT!

Asset sales could accelerate debt reduction faster than expected.

Autos are already in low cycle, and pent up demand is increasing.

Tenneco is gaining a lot of HEV (Hybrid Electric Vehicles) and BEV (Battery Electric Vehicles) related business, showing that it is competitive even in electrification.

When the environment gets better Tenneco could proceed with its planned spinoff, creating shareholder value.

What did Tenneco do wrong?

When you are a cyclical business you never buyback shares at peak cycle and peak prices. You try to buy them back at low cycle and low prices.

If Tenneco was flush with cash they could have either retained it for deployment at better conditions, or pay it out to shareholders.

Tenneco levered up excessively to acquire Federal Mogul, making it super sensitive to cyclical changes. If leverage was less, Tenneco would have been in a much better position.

What Tenneco needs now.

It needs a major shareholder which backs a management that makes decisions for the long term. At this stage there is not much to be done as management is already doing it (i.e. cost cutting, paying down debt etc).

However, the company risks finding itself in the same situation if the capital allocation strategy doesn’t change. You can never forget that this is a cyclical business. Change is a constant in business.

1) Robustify the balance sheet. Reduce leverage ratio to a max of 1X, no excuses. Opportunistic acquisitions should never be an excuse to steer off prudent risk management.

2) Seek to allocate excess cash to share repurchases at low prices only. Carl Icahn was issued 29.45 million shares @ $42 each for the F.M deal. Maybe this is an opportunity to slowly buy them back ~70% cheaper.

3) Focus on operating efficiency by restructurings and capital efficiency campaigns. There is always a better way to run 300 facilities around the world.

Further Reading: