The Bessent Pipe Dream

What would Frédéric Bastiat do?

Is Scott Bessent a good or a bad economist?

The new Treasury Secretary is all the rage these days, with a diverse set of takes on him and what he can do for the US economy. I won’t introduce Scott again as I have already done it here and more recently here (in my two Trump trade pieces).

I briefly explained to Elon Musk why I thought Bessent was getting the nomination and why he was the best one to get it too, tweet.

In the tweet I explained that Scott “gets it” — in terms of the damage Bidenomics has caused and where the US is in terms of its life cycle: That is to say, massive uncontrollable deficits, unsustainable sovereign debt etc.

But is that enough?

Enter Frédéric Bastiat (1801 - 1850)

Bastiat was a free-market economist whose views and teachings influenced Mises, F.A. Hayek and the school of Austrian economics.

In early 2022 I wrote a thread reviewing his essay which talks about unintended consequences and higher-order effects in economics…

The Bessent Plan

The word is that Bessent was influenced by Shinzo Abe’s Three Arrows in designing his plan to solving the US’s problems.

He has advised Trump to pursue a policy he calls 3-3-3, inspired by former Japanese Prime Minister Shinzo Abe, who revitalized the Japanese economy in the 2010s with his “three-arrow” economic policy. Bessent’s “three arrows include cutting the budget deficit to 3% of gross domestic product by 2028, spurring GDP growth of 3% through deregulation and producing an additional 3 million barrels of oil or its equivalent a day.

—> I don’t see the analogy.

First, Abe’s Three Arrows (Abenomics) did not revitalise the Japanese economy — one could argue it did the opposite. Today Japan finds itself worse off both fiscally and economically.

(This may be a controversial take, but it is my take. Besides, operational success is what matters in the end and not the technicalities of theory or history.)

Second, Bessent’s 3-3-3 doesn’t compare to Abenomics in terms of policy.

For more context on Abenomics, read my presentation from 2015 on the matter here. 🦉🇯🇵

Ok, let’s review:

Abenomics

Fiscal Stimulus

Quantitative Easing

Structural Reforms

Bessent’s 3-3-3

Cutting the budget deficit to 3% of GDP by 2028

Boosting GDP growth to 3%

Increasing energy production in the US by 3mln BOE per day

Philo’s Take 🇯🇵 - 🇺🇸

Abenomics was something that could be executed, in principle.

You just deficit more, get the BOJ to do more of what it has always been doing (i.e. degenerate central banking) and lastly spitball “structural reforms” like everyone else.

In the conclusion of my presentation from 2015 (linked above) I clearly stated what I expected would be the outcome... 💅 it once more.

What about Bessent’s triple 3? Can it be done? What would be the outcome?

Let’s dive in…

1) Budget Deficit Target

The triple 3 target aims for a 3% budget deficit — word to the wise, it usually doesn’t work out!

How are you going to cut spending? Trump isn’t about to cut and risk overseeing the worst term since I don’t know when. The US is hooked on deficit spending — without it the machine don’t run. Actions speak louder than words — everyone preaches fiscal prudence but when it comes time to execute, they budge.

Yes, they will reverse some Biden era spending like EV credits from the IRA etc., but that doesn’t even get near to what they need.

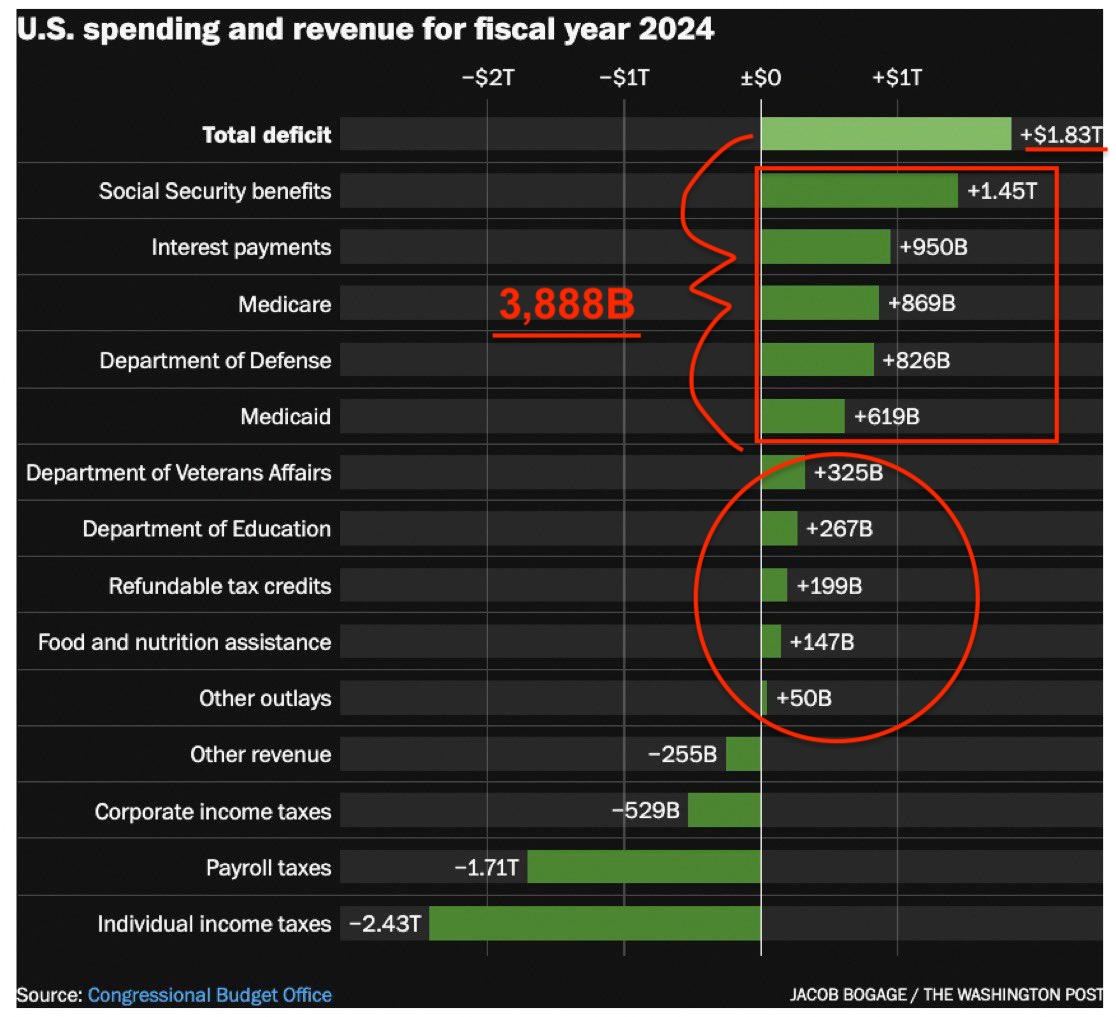

The thing is, the US Budget has very, veeery little room for cutting costs.

Most expenses are in lines that cannot be adjusted easily — like health insurance, social security and defence.

On top, Bessent has mentioned that he doesn’t want to fiddle with military expenditure too much as he believes a strong military is a strong dollar.

Another major misconception —> Dollar Maximalism 👇👇👇

It’s not the strong military that keeps the dollar strong. It’s the strong dollar that allows the US to maintain that military… This is a great misconception. -Philo

If you really want to cut spending, you need to slash from everywhere — remember Greece? How did they do it? They were forced to.

Conclusion: The risks are to the downside, or should I say the upside? 😅 What I mean is, it will be very hard to achieve the 3% budget deficit target the 3-3-3 plan is trying to achieve.

But the budget deficit is also a function of tax revenues, which are a function of GDP.. Which brings us to the next pillar of the triple 3.

2) Boosting GDP Growth

This is the only one of Bessent’s “Triple 3” that I find as credible. Why?

Well, Bidenomics is/was a massive burden to the US economy. Too much intervention, weird subsidies and programs and over-regulation which distort production, cause inflation and make the economy to underperform.

Relieving these anchors would have positive effects — but we don’t know to what extent. And we don’t understand the timing either. Unwinding subsidies could have immediately negative effects before creating positive ones going forward.

But a material distinction is that the BOJ kept rates ate zero-ish since Abenomics was launched — while the FFR is now at 4.75% (upper range) at the moment. The two are unrelated monetarily speaking.

I talked about the bifurcation this is causing in the economy in Biden’s Techno-Imperial Cycle here.

All this while the US’s global technological hegemony & the AI hype since late-2022 is definitely a positive influence to economic growth..

What happens when that slows down a bit? Which sector of the economy will take the baton and start running ahead? Let's see.

3) Boosting Energy Production

So when Bessent was designing the grand plan to save the US from disaster in his Moleskin notebook ✍️ — he thought oil production in the US should be boosted.

What could have been the idea behind that? Increase tax revenues for the Treasury? Lower the price of oil to fight inflation further, allowing for a further reduction in interest rates? Maybe both.

But this is near impossible to accomplish.

First, oil producers couldn’t care less about what Bessent wants. After deep oil cycles both up and down — and a lot of uncertainty, they are just trying to stay afloat while giving a fair return to their shareholders.

Uncertainty from the global geopolitical picture, military conflicts and the economic environment means oil producers cannot overextend themselves, and they don’t even want to.

IT’S JUST NOT THAT KIND OF MARKET.

(Excerpt from “A State of Offshore” on market structure in Oil markets right now)

Balance sheet discipline, super important. Because Anton says this isn’t a macro concern/reason, but it seems like a macro thing to me. Why? Because this is the current state of the market. We just aren’t in a super cycle for oil — producers are trying to keep what they have and only extend themselves slowly. This is affecting the Offshore sector materially.

There’s a piece in the Journal this morning on this, they seem to agree with my idea that Bessent won’t be able to influence oil production.

ON TARIFFS

Earlier this year, Bessent thought about tariffs as a negotiating tool, telling investors in a letter that the "tariff gun will always be loaded and on the table but rarely discharged." He has since argued for them more forcefully, especially as a source of tax.

Read more on my views on Trump tariffs and their effects here:

Conclusion

This was a short piece on my views on Bessent’s Triple 3 and the use of tariffs as a means to control the budget.

I think the Americans are still making decisions from the POV of their “everything supremacy” on the global stage — and still behaving as if there are not/will not be any alternatives to them. Competition is actually ramping up…

The use of tariffs to increase tax revenues and balance the budget, I think is myopic at best and ignores higher-order effects.

This is why I mentioned Bastiat in the introduction, because his essays focused on second-order effects and unintended consequences in economics and politics.

Read “That which is seen and that which is not seen”. LINK.

Sincerely,

Philo 🦉

Excellent piece, Philo!

Down to earth and well-articulated.