This is a multi-layered market cycle, with high interconnectedness and a lot of moving parts. In the olden days things were easier and simpler: Banks, Oil & Gas, Construction etc.

I think I miss those times… 🥲

Now we have winner-takes-all narratives on the Mag 7 et al., with some serious AI sprinkled on top while the 10-year treasury is at a 15-year high due to the Fed’s rate hiking cycle.

Rates at >5% haven’t managed to slow down the economy much with unemployment still at 3.9% and stocks making all-time highs.

Today I want us to prepare for the second half of the year by assessing where we are in markets by unpacking all these layers.

In February I wrote “Is the Nasdaq in a Reflexive Bubble?” — consider this a follow up piece.

Here are the dynamics, trends and misconceptions shaping markets today.

I will end the piece with a gedanken (thought experiment) — WWGSD? and WWWBD?

What would George Soros do?

What would Warren Buffet do?

Should be fun! 🦉🫡

The Fed

The narrative the Fed wants to maintain is that a rate cut is always around the corner — they need this because if market expectations start to price in bad things, those bad things that people predict could be come reality à la self-fulfilling prophecy.

As I said early May, the Fed is forced to thread the needle to stay within its mandate while adjusting to a US Treasury spending like its 1999.

NEWSFLASH: It isn’t! Those days are long gone… In fact I think we overall peaked around 2008, but anyway back to our discussion.

In this 100 second voice clip I argued that the Fed is applying a managed-narrative monetary regime by saying one thing, but doing another. This is what happens when you have reached the limits of Keynesianism.. I elaborate below.

When you approach the limits of monetary policy, government debt, influencing the economy and your currency by setting interest rates and so forth — you are entering unchartered territory of what is accepted and expected in the dismal science of economics.

This is where Powell’s Fed finds itself today and the complication is further compounded by the reality that Powell is not only setting rates for his country and his currency, but of the whole world and the global reserve currency…

At the same time, the Fed is also trying to maintain ANOTHER narrative — that a rate hike is also just around the corner, in case inflation spikes again.

Inflation

How is inflation doing by the way? 👀

12-month April CPI stood at 3.4%!

Powell keeps promising that inflation will move back to 2% while at the same time signalling rate cuts while it’s steadily above 3% — what’s up with that? 🤦🏻♂️

A lot of things…

Well, the Fed knows the Treasury needs lowish real interest rates else the $34 trillion in government debt won’t be sustainable for much longer. This identity crisis the Fed is going through is an existential risk for the USA.

The Fed’s (official!) mandate is to promote maximum employment and stable prices. But if you were to ask me in reality what game they are playing I would say this.

To not allow inflation & inflation expectations to move to high enough levels that would crack the bond market, while at the same time not allow inflation to drop to the 2% inflation rate, by setting rates with the ultimate objective of keeping real interest rates low enough to make the monstrous US Federal Debt manageable while keeping inflation high enough to inflate the debt away a little bit every year.

The Real Economy

Americans are definitely hurting from this as money is expensive with the 30-year mortgage at 7%, Fed Funds at >5% while prices have gone through the roof.

Meanwhile, I hear people keep saying that “INFLATION IS FALLING”.

Is it really?

Looking at the 12-month CPI changes of the last 4 years gives us a compounded CPI inflation rate of 22.4% — but CPI isn’t really the actual inflation rate is it?

Coffee was removed from the CPI basket as of this March — maybe it just became too expensive and had to be cut? 😝

Derek Zoolander can’t take this anymore! 😤

The end of stimulus checks post-Covid layered on top of spiking interest rates is a double whammy for the real economy. But as we discussed, this isn’t your typical business cycle. ⭕️⭕️⭕️

A good chunk of the economy is no longer sensitive to interest rates — in fact I would argue some companies BENEFIT from higher interest rates!

Rate Sensitivity (or lack thereof)

Powell says he is trying to get inflation back to 2% — OK, but how?

The cycle isn’t being led by banks or construction companies, it’s being led by Big Tech companies that are in net CASH territory.

Apple, Amazon, Microsoft, Google and Meta hold almost $600bln in cash between themselves. Slap a ~5% on that and that’s $30bln a year in interest alone!

What am I trying to say? 🦉

This is a cycle like no other. The Fed is trying to control inflation, and it’s trying to do that by hiking rates — but the biggest players CAUSING the inflation are not sensitive to rates: namely Big Tech and the US Government.

The former is caught in a technological revolution that has sped up since the AI race kicked off, and they are spending massively trying to keep up. Again, refer to the Nasdaq Reflexive Bubble piece for more depth on this.

The latter has gone commando on spending with the deficit for 2024 expected at $1.6 trillion — we’ve crossed the Rubicon have we not??

This leaves everyone else hurting from rates affecting the real economy negatively while the equity indices are at all time-highs masking the reality on the ground.

Hey AI, whats up?

AI-stocks are up bigly and anyone who happened to be long these games is deep in the green — but is this sustainable? A few points from me:

Nvidia talks about their next generation of GPUs called Blackwell which are much more efficient in processing.

Language Models (LLMs) are being developed and trained en masse as we speak — meaning we can reasonably expect them to get better going forward.

Most of the data from the real world will be used to train these LLMs, and most of the problems that humans ask AI chatbots to do for them will be done.

And so after the models are trained, how much more GPUs will be needed?

The semiconductor industry is cyclical, and this time around it will be more cyclical when the big buyers decide they bought enough for now — and push the brakes.

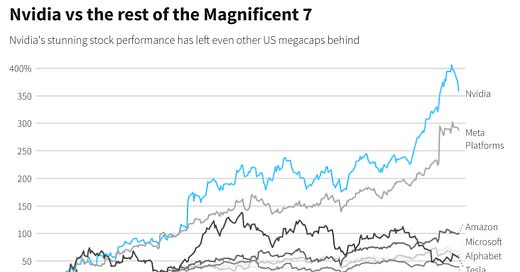

We can see from the chart below that Nvidia is leading the pack in the Mag 7 while Amazon, Microsoft and Alphabet are also benefitting from the AI race largely due to their Hyperscale offerings.

Note that Nvidia is leading the pack for now — as competition is coming swiftly from AMD etc. Nvidia’s CUDA bottleneck isn’t a lasting moat.

AI on the Cloud etc.

Companies are training their models on the Cloud, as well as using AI Cloud offerings from companies like Microsoft to “gain insights” into their business processes as part of their overall AI strategy…

OK, but here’s the facts.

94% of all companies worldwide use some kind of Cloud computing service, which makes me think that they’ve already been targeted to buy more services from the Cloud Big 3 (MSFT, AMZN, GOOG).

Most AI startups run their operations on one of the Cloud Big 3 already, so for revenue to grow much more from these levels means two things: 1) There will be a net GAIN in AI startups being launched and 2) AI startups currently on the Cloud will spend MORE per startup.

Considering that most AI startups are early-stage VC-backed and don’t make much money, I think many of them will shut down going forward and so the ecosystem will need more new ones opening up than the ones closing down for a net gain.

As for Cloud spend, the principles are the same as mentioned above under “Is AI worth it?” …In short, why are we so sure they will spend more?

Some are saying that AI is so powerful that it will 10X transform everything we do, and so there is no price high enough for Nvidia and ecosystem-associated companies.

A Facade?

I think we should take everything with a pinch of salt — META AI Chief basically says that AI in its current form is not what we think, and is highly problematic.

Considering this, couldn’t it be that we reach the limits of these models very quickly — and user engagement/conversion plateaus very quickly too?

What are the big GPU buyers supposed to do then? Keep ordering tens of billions of dollars worth of GPUS every years? LOL

So you see, this isn’t going to be a straight line going up, and we cannot linearly extrapolate any KPI we choose to oblivion — just because it suits our argument.

TIME FOR THE GEDANKEN

We could argue that GS and WB used completely opposing strategies. Soros was a top-down thinker, with a focus in macro and political developments while Buffet was a bottom-up thinker who was mostly agnostic to market movements and macro.

So, what would each of them do if they were in their prime today?

What would George Soros do?

I think Soros would recognise that the Dollar is the worst currency except of all the others, and use the rate differential between the US and Europe/Japan to be long USD bigly — while other trading blocs are starting their cutting cycles earlier than the Fed, giving the Dollar a strong push.

Soros would know this game isn’t a straight line up so he would position size accordingly, buying more on dips and taking profits on the runs. Soros liked to play technical formations too — helping him risk manage more effectively.

I think Soros would be bearish on Europe as it goes through this existential/identity crisis and would be short Euros in one form or another. At the same time he would observe developments in European politics extremely closely, trying to look for the light at the end of the tunnel.

There’s a chance Soros would try to extract as much profit from the AI/Semi boom as possible, but at the same time knowing the flaw in the whole process. Soros used to say that he would get anxious and scared if he didn’t see the flaw in a market theme/process/bubble, but would calm down when he found it.

We discussed all this extensively in the Nasdaq Reflexive Bubble piece.

I don’t think Soros would be long US treasurys right now, even though the yield seems lucrative. He didn’t really play bonds for the yield but actually traded them directionally.

Maybe he would look for a stronger hand from the Fed before going long Treasurys.

I think Soros would also have a position in Gold as: 1) It’s the ultimate hedge against US monetary/fiscal folly and 2) receives all the inflows from foreign countries exiting the US Dollar as their reserve currency and looking for other places to park their money.

What would Warren Buffet do?

Circle of competence, right?

If Warren didn’t know semiconductors, he wouldn’t bother investing in them. What he would do however would be to study and understand AI and the effects this technology could have on the global economy and individual business sectors.

Warren would stick to companies with slow change and strong moats, but he would keep studying them and learning more about them, getting ready for the time to invest in them.

He would sit back and understand that the conditions for massive undervaluations in companies are still here, and that one day the opportunities would be BIG — therefore he would keep cash aside for when these times come.

One more thing he would have in the back of his mind, especially at these times, would be that the “Dollar will be worth less over time” and that money siting around for too long, especially at times of high inflation — is detrimental for one’s pocket.

Warren’s long-term bias, patience, and focus in only high-quality real assets would protect him from current market conditions and give him staying power from whatever happens in AI, tech or the economy more broadly.

Sincerely,

Philo 🦉