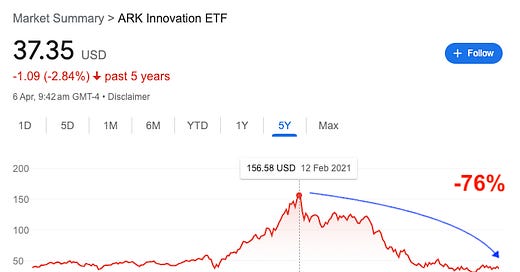

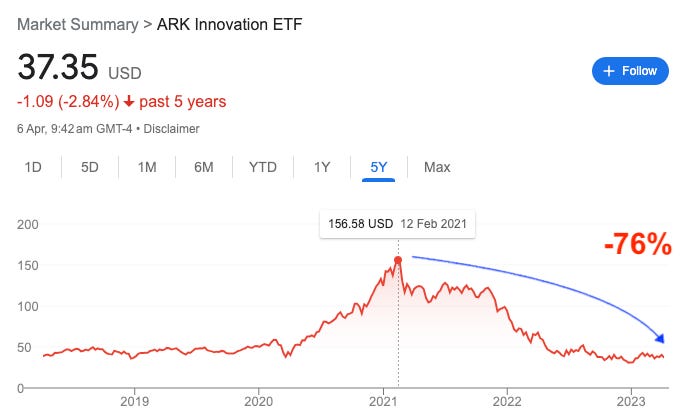

ARK Invest’s biggest ETF by far, ARK Innovation ETF ($ARKK) managed by the infamous Cathie Woods, has had abysmal performance since it peaked 2 years ago…

ARKK is great as a proxy to gauge what small tech or non-profitable tech/growth type companies are doing in terms of investor interest and capital flows — but as a fund it just sucks. ARKK and Cathie Woods made all the mistakes that they could.

Overly speculative companies with very high and rigid fixed cost structures and founders fleeing the company by selling at the top. Too much exposure to crypto, basically at the top. Companies that apparently won’t earn a profit even in 5+ years — if they stay alive that is.

The businesses that Cathie chose to invest in are just too speculative. Pie in the sky is not the same as disruptive innovation. The latter is overpromised while the former is what’s actually delivered… 🥧🪂

“The current cycle has been described by a large wave of investing in innovation, regardless of whether that innovation has shown that it can make money or not. I consider this a large risk. It could work, it could not.” 🦉

In March 2021, I started writing a Mindset essay around the subject of investing in innovation — and how that is effectively a misnomer. You don’t invest in innovation, you invest in business. Now if your business is innovative or not, that’s a different issue.

I never got round to finishing the essay but I wrote many others that you frankly cannot miss if you are serious about your investing. You can access a curation of all the pieces here: Education & Mindset

ARK’s strategy of investing in innovation without business considerations, can result in serious and permanent losses for the investor. But it seems most of them are committed to Cathie’s ARK simply because of psychological biases.

Anchoring is a heuristic in behavioral finance that describes the subconscious use of irrelevant information, such as the purchase price of a security, as a fixed reference point (or anchor) for making subsequent decisions about that security.⚓️

Anchoring must be the reason that ARKK has yet to unwind, because it surely isn’t due to investment considerations. The few good names in the portfolio aren’t enough to compensate for the names that are down 90% and will possibly never recover.

What does the portfolio look like now?

Almost all these names are either operating with serious losses with no chance of turning the tide, running with weak balance sheets after they have decimated their cash balances over the years, trading at very rich valuations (still!) and/or with considerable business model risk and competition.

Take Coinbase for example, COIN is in a world of hurt right now as the Crypto ecosystem unravels and scandals creep up all over the place. EXAMPLE.

Tesla, an ARKK top 5 position, is also suffering because of a myriad of reasons.

Better follow Tesla expert Motorhead for all things Tesla… 👇

Throwing in the towel?

Ark Invest still has a total of $14bln-ish in AuM as it added $400 million of inflows in March. It seems Ark investors (as well as Cathie et al.) are praying for a Fed pivot to lift all their boats rather than on good old business performance.

Sorry Cathie, but this is a massive red flag…. 🚩🚩🚩

I look forward to see how the Ark Invest saga unfolds and will seek to keep you posted on any worthwhile updates here on Philoinvestor. In my “In the Cards for 2023” I had ARK UNWINDS, amongst other things.