Where are the Safe Havens?

Ideas, Trades, Shifts.

“The world is getting more and more fat tailed..” —Philo

“I play it close to the West.” —George Soros

Historically, you could count safe havens on the fingers of one hand — these days you’d be lucky to count them on one finger.

What do I mean?

Well, the world ain’t what it used to be…. Traditional safe havens are losing their lustre while modern ones are creeping up.

What are safe havens?

Safe havens are assets that carry (or perceived to carry) one or more of the following functions: 1) preservation of wealth (+income) 2) safety from inflationary spikes/demise of currency and 3) safety from political turbulence, military conflicts, regime changes etc.

Today we will look into the following categories of safe havens:

Precious Metals

Real Assets

Government Bonds

1. PRECIOUS METALS

“Gold is money, everything else is credit.” —J.P. Morgan

Well, gold used to be money until the US pulled a Kansas City shuffle on the rest of the world. Today, all currencies are fiat currencies — that is to say, not backed by gold. In this world of naive Keynesianism and endless budget deficits, money is anything BUT sound.

This keeps people up at night, and makes them look for safe places to park their wealth. The absolute classic of safe havens is of course, GOLD.

Chart below shows the biggest holders of gold. But it’s not just countries that like to seek solace in the yellow metal — private individuals love gold too.

Indian households own 24,000 tonnes of gold (11% of global supply). It’s a way to not only store wealth during their lifetimes, but pass it down to the next generations.

The recent spike in gold prices was mostly due to Japanese and Chinese retail buyers worried about more problems in their currencies. Safe havens have many dimensions — and one of them is definitely perspective.

Let’s see how gold has performed in currencies other than the US Dollar.

Gold/Yuan 🇨🇳

Gold/Yuan is up 110% since 2018 where there was an acceleration in the price increase indicated by the red arrow. Recent price movements have been underpinned by Yuan devaluation fears spurring buying into gold.

Gold/Yen 🇯🇵

Gold/JPY is up 190% since Abenomics was launched in late 2012. Nikkei up 300%.

Arguably holders of either Gold or a broad basket of stocks have protected themselves from Yen debasement — while Yen holders got destroyed.

The point is: Gold can protect savers from currencies that are getting eroded — Hint: every. single. one!

Silver

There’s layers to this game…

Store of value is NOT linear, the whole point is this:

FLUCTUAT NEC MERGITUR

This latin phrase is the motto of the city of Paris, and it means “It may fluctuate but it will not sink.”

Precious metals may be a store of value, but it matters where you buy them. If you buy them wrong, you could still lose a huge chunk of your principal.

Silver is up 1000% in the past ~24 years. In 2011 prices spiked to $52 and then bottomed at $12 in 2020, after a prolonged bear market…

Yes, in episodes of inflationary spikes, silver will still benefit by moving up — but can you hold through that bear market? Will the sovereign fund or investment firm have the staying power to wait it out?…

Parking value in safe havens isn’t free — it can be a double-edged sword.

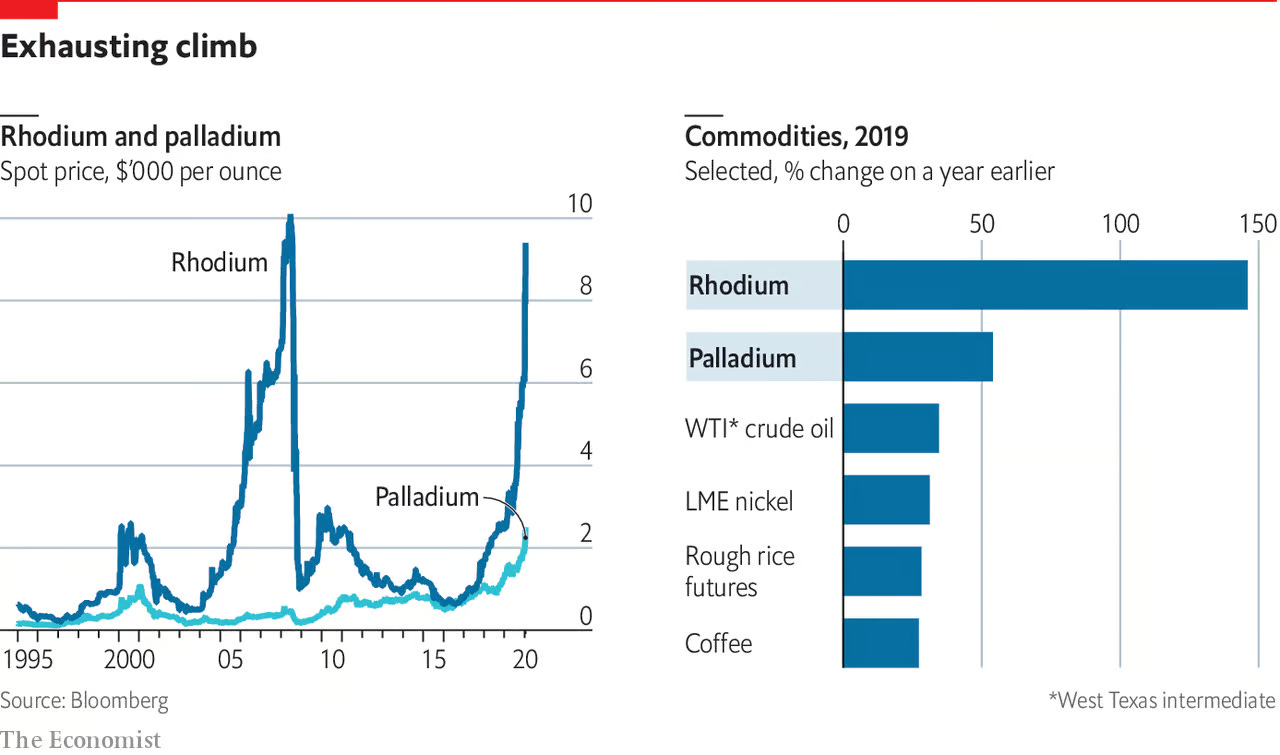

Rhodium & Palladium

On the broader metals front, rhodium and palladium received some interest a few years back. Their industrial uses and lack of supply meant one thing for speculators… FUNDAMENTALS! 🤑

I am sure the bull market attracted greater fools that tried to benefit from the “fundamentals” — but what did they achieve?

Rhodium boom/bust cycles have been SHARP. The chart above ends in January of 2020, it seemed like all the way was UP for Rhodium…

It went to $27,000 per oz and now back under $5,000. OUCH!

From 2016 to peak 2021, Palladium rose 5X and is now down ~70%.

The thought here is that they may be metals, and metals with industrial uses — but are they safe havens? Not for me.

2. REAL ASSETS

“The dollar will be worth less over time.” —Warren Buffet

And he was right, the dollar’s value erodes year by year. So how can you protect yourself from that? Real assets of course.

Assets that derive their intrinsic value from the value they generate in the real economy, rather than from a fixed-currency instrument. (More on this here, and here on Apple -Vs- the 10-year treasury.)

The former is businesses and real estate, the later is cash, cash deposits and bonds.

Equities

Yes, companies with some sort of competitive advantage that allows them to continue generating returns for decades; are strong assets that not only maintain their value but also generate a return for the owner.

Having said that, time has sharp teeth and it destroys everything, and so the stronger the event the more the chances of a business going under.

Historically, investors always knew that — and never used stocks as safe havens. But I think recently with the emergence of Big Tech and a handful of companies that “cannot be competed away” investors decided to park money in their shares.

Think Microsoft, Google, Apple etc.

I think the reason is two pronged: 1) These companies are dominant, and they only seem to go up and up, making it easier psychologically to allocate more capital to them. 2) Their dominance means they can adjust prices of their products as inflation appears, making them a solid protection from further debasement.

BUT, that’s only true as long as they are dominant and profitable, not to mention that valuation only matters (Remember Rhodium??)

I’ve written thought pieces about all three of these companies which can be found at Downside by Philo here.

Real Estate

The ultimate asset…

Fortunes have been created (and lost) on this asset class, since forever. The wealthiest people are probably property owners 8 out of 10 times — and it has been proven to be the most robust asset to maintain and grow wealth over generations.

Why?..

Many years ago I started capturing data (anecdotally, in my head) of people around me whose families managed maintained or lost generational wealth. The ones who lost their wealth were the ones who had it mostly in some sort of business — trading, financials, general business..

The ones who kept it usually owned the same businesses too, but owned a lot of property on the side. The robustness of property is that it hasn’t been disrupted.

Residential 200 years ago is residential today. An empty plot of land today has value, 100 years ago it could have been something else. The point is, real estate has a number of uses, and the value of those uses tend to go up over time.

Risks & Leverage

The risks with parking generational wealth in real estate is 1) leverage resulting in eventual loss of said property 2) confiscation/destruction/mismanagement and 3) some business goes south and one is forced to sell his property to recover.

If you are buying property for wealth preservation, make sure you aren’t using any leverage to fund the purchase. The more you layer leverage on top of the asset purchase, the more the payoff changes — yes, it will be do better as the asset does better, but you run the risk of ruin if it doesn’t.

And that defies the point of a safe haven doesn’t it?

3. GOVERNMENT BONDS

“Gentlemen prefer bonds.” —Andrew Mellon

Former US Treasury Secretary Andrew Mellon said this in the late 1920s when asked what he thought about investing in equities.

Well, Mr. Mellon, most sovereigns are bankrupt today. Which means your principal isn’t safe, either because of the direct risk of default (recently in the case of Greece) or indirectly because the (bankrupt) issuer needs to debase the issuing currency to make the debt sustainable. Think USA, Japan, Europe etc.

Therefore, government bonds do not comply as safe havens simply because they do not have any of the three functions a safe haven should have mentioned in the introduction above.

Sometimes it feels like they are a safe haven, usually in times of general market crisis like 2008 — where a “flight to quality” means everyone buys government bonds and their value shoots up while everything else is tanking… but that’s just a trade, if you KEEP money in these assets, you will get fleeced over time.

I have made my views on the US, Europe and Japan very well known to Philoinvestors — and more recently with the two macro-thematic pieces on the future of the EMU and Japan.

Where the world and financial markets are — is the perfect setup for money’d people to lose a lot of their wealth.

Stagflation or Zero Inflation…?

Meanwhile, I think we are finally going to enter stagflation some point soon, as the AI spell weakens and excessive fiscal expansion from the US is forced to taper soon.

That would get us the STAG, at the moment we have some FLATION — and that would give us STAGFLATION.

If it actually results in crashing inflation, we will get near-zero interest rates. The case for zero interest rates is another thought piece I am working in, coming soon on Philoinvestor!

If you have any more questions on this, let’s discuss more in the community. Paid subscribers can now start their own threads! 👇

Sincerely,

Philo 🦉