Last on Philoinvestor

Why I don't like Transocean. Link.

Downside at MRNA. Link.

When ARKK unwind. Link.

Apple's Microsoft moment. Link.

AAPL Vs The 10-Year Treasury

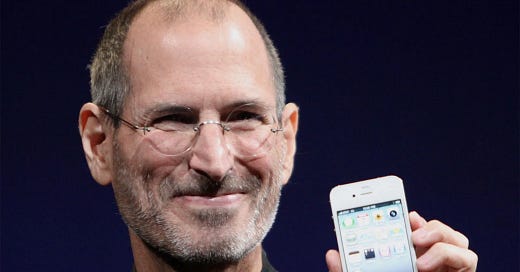

In this essay I will compare the 10-year treasury with a very strong cash-flow generative company. I’ll go for the most profitable company in the history of capitalism, Apple Inc.

At the moment of writing, the US 10-year treasury yields 3.4%. Apple’s P/E is at ~27x and inverting that gets you an earnings yield of 3.7% — for simplicity though let’s assume Apple also yields 3.4%.

Investors often like to compare yields on sovereign bonds with the earnings yield of an index, the S&P500, the Nasdaq 100, whatever. They then go on to reason - If I can get 3.4% risk-free, why risk it in stocks to get the same 3.4%??!!

But are those two things the same?

Let me explain

The treasury’s cash flows are pre-agreed contractually. You will receive these set coupon payments and on maturity you will receive your principal back — that is, in fixed dollars.

And this is why people talk about the *real* interest rate. That’s the nominal interest rate, minus the rate of inflation. I personally believe that inflation will stay higher than expected for a long time, and therefore I believe the real interest rate is ~0%.

This simply means I don’t really make interest by buying a bond that won’t even beat inflation, and my principal gets eroded by inflation too. This is a financial tragedy for savers.

However…

The payoff profile of real assets is different from fixed assets (like bonds). Real assets (like businesses), have cash flows that move with inflation. A simpler way of thinking is that bonds pay in currency, but businesses pay in units of goods or services. What does this mean? Well, a Starbucks coffee today doesn’t have the same price it had 10 years ago, and so the margin from that unit of coffee is higher too. But one dollar is still one dollar. The principal and coupon payments you will get from a bond investment will not go up with inflation!

Let me illustrate with iPhones, instead of coffees.

In 2007 Apple sold 1.4mln iPhones, in 2017 they sold 217mln and in 2022 they sold 232mln. Not only can a business increase its sales, they an also adjust their prices as their input costs change, and still make a healthy margin.

The idea is that dollars get debased and inflated away, losing their purchasing power — while good businesses continue to create value regardless.

So why do you keep comparing Apples to 10-Year Treasury Oranges? 🍎🍊

You say that you think in opportunity costs, and that’s why you refer to the 10-year. Ok, but what’s the *real* opportunity cost? It’s negative. Investors feel that the Fed and the powers that be in the US will continue to erode their dollars, so they need to hide somewhere.

Why not hide in a place which can beat inflation simply by raising prices to adjust to it? Why not hide in a place which can also increase value by increased sales or product lines?

Fluctuat Nec Mergitur

You say that Apple is at peak earnings, and paying a ~30x multiple on that is double the risk. Well, maybe. But cyclicality isn’t what it used to be — why is Apple at peak earnings? It can literally grow all its business lines, even in the face of adversity and headwinds.

But even if it doesn’t grow anytime soon, or even stays here for the next 5 years, it still beats treasurys at a 0% real interest rate! Apple shares may fluctuate, but they won’t sink.

What about business risk?

Forget about business risk for now, investors trying to park money safely hold a very diversified portfolio consisting of real assets (equities, property) and so don’t bother too much with Apple’s future business risks.

These are the flows driving valuations in the highest-quality parts of the market today, but if you aren’t happy with these prices just don’t buy.

Why did I write this piece?

This was instigated by a short conversation I had on Twitter the other day about treasurys and the Nasdaq. The other party was arguing that the yield on the Nasdaq is “hypothetical” while the treasury yield was guaranteed — and that both of these payoffs suffer the same vis-á-vis inflation.

I hope that I covered the reasons why this is not true in this post.

P.S. It’s funny that we consider sovereign bonds to be “risk-free” — because there is no such thing.. Consider that too the next time you allocate capital to US treasurys to earn a 0% real interest rate.

Sincerely,

Philo 🦉

few get this