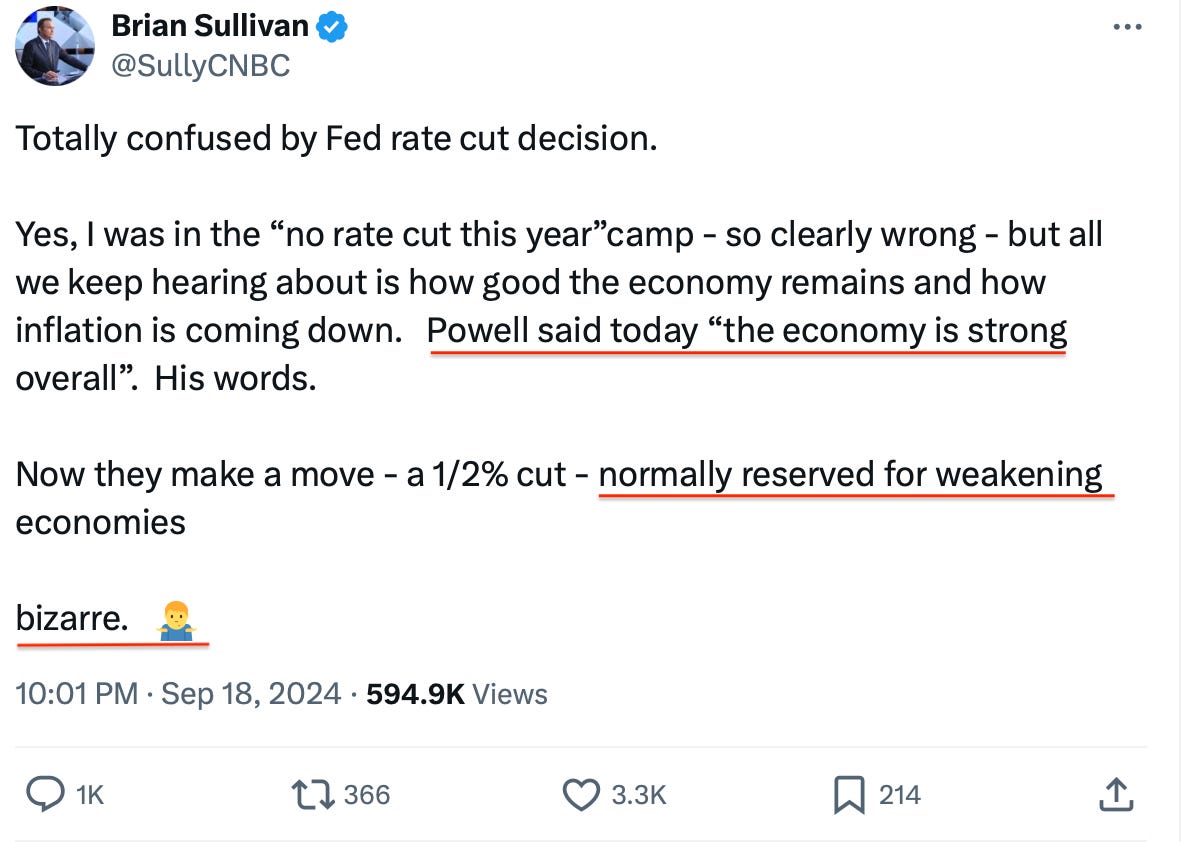

I saw this tweet last night, and I realised something…

I realised that people don’t have much understanding or even context for how central banks think… 👀 👀

Listen to this 2 minute Philo’s Thoughts on why the Fed is threading the needle, from May 2024. I explain the Fed’s predicament and the surgical balancing act it needs to execute to keep things together.

Fed Context

You remember how in the Covid era the Fed was late in hiking rates with the overall excuse of “transitory” inflation. Then they quickly threw in the towel and started hiking — with the objective of anchoring inflation expectations and not letting them get out of hand.. (Check Appendix Below1)

Well, a few quarters later and, together with the help of those crunching the numbers (LOL!), they managed to beat inflation. 😅

Ok they didn’t actually beat it, August Y/Y CPI All Items was at 3.2%, while the CPI LESS Food and Energy stood at 2.5%, down 0.4% from the last reading.

—> The stock markets rejoiced, yields tanked and the Fed got its chance to cut!

In this piece we will see where the Fed’s unofficial mandate of solving for real interest rates commenced, why they are doing it, and where/how this whole tactic can unravel in our faces!